TripAdvisor 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

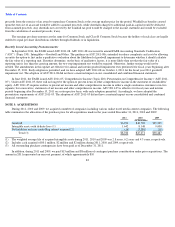

development costs. For the years ended December 31, 2011, 2010 and 2009, we recorded amortization of capitalized software and website

development costs of $12 million, $8 million and $6 million, respectively, which is included in depreciation expense on our consolidated and

combined statement of operations.

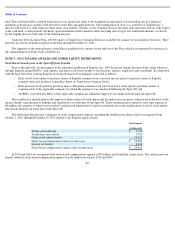

NOTE 5: GOODWILL AND INTANGIBLE ASSETS, NET

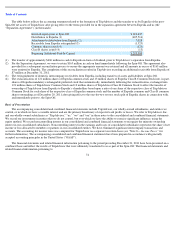

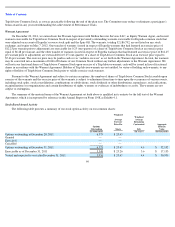

The following table presents the changes in goodwill for the years ended December 31:

In 2011 and 2010, the additions to goodwill relate to our acquisitions. See “Note 3— Acquisitions ,” above for further information.

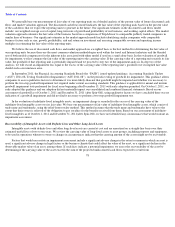

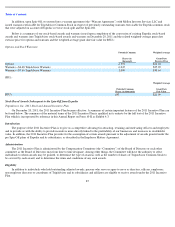

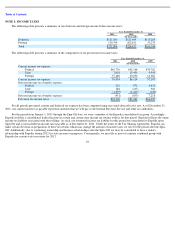

Intangible assets, which were acquired in business combinations and recorded at fair value on the date of purchase, consist of the following

as of December 31:

Amortization expense was $8 million, $15 million, and $14 million, respectively, for the years ended December 31, 2011, 2010 and 2009.

Included within amortization expense for 2010 was a charge of approximately $4 million related to changes in the estimated amount of

contingent purchase consideration. In 2011 this amount was not material.

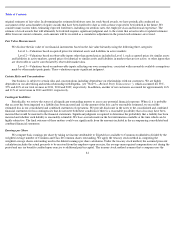

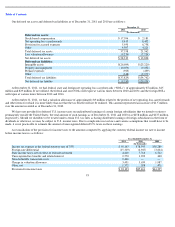

Our indefinite-lived assets relate to trade names and trademarks acquired in various acquisitions. The following table presents the

components of our intangible assets with definite lives as of December 31, 2011 and 2010:

84

2011

2010

(In thousands)

Beginning balance as of January 1

$

460,610

$

418,170

Additions

6,390

40,703

Foreign exchange translation adjustment

(108

)

1,737

Ending balance as of December 31

$

466,892

$

460,610

2011

2010

(In thousands)

Intangible assets with definite lives

$

89,323

$

87,582

Less: accumulated amortization

(75,593

)

(67,788

)

Intangible assets with definite lives, net

13,730

19,794

Intangible assets with indefinite lives

30,300

30,300

$

44,030

$

50,094

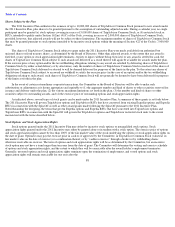

December 31, 2011

December 31, 2010

Weighted Ave

Remaining Life

(in years)

Cost

Accumulated

Amortization

Net

Cost

Accumulated

Amortization

Net

(In thousands)

(In thousands)

Trade names

4.4

$

17,030

$

(9,104

)

$

7,926

$

16,721

$

(5,952

)

$

10,769

Subscriber relationships

1.9

19,290

(14,470

)

4,820

18,836

(11,748

)

7,088

Technology and other

1.9

53,003

(52,019

)

984

52,025

(50,088

)

1,937

Total

3.4

$

89,323

$

(75,593

)

$

13,730

$

87,582

$

(67,788

)

$

19,794