TripAdvisor 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

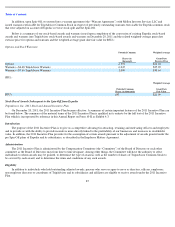

In addition, upon Spin-Off, we entered into a warrant agreement (the “Warrant Agreement”) with Mellon Investor Services LLC and

issued warrants exercisable for TripAdvisor Common Stock in respect of previously outstanding warrants exercisable for Expedia common stock

that were adjusted on account of Expedia’s reverse stock split and the Spin-Off.

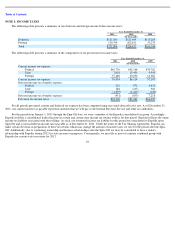

Below is a summary of our stock-based awards and warrants issued upon completion of the conversion of existing Expedia stock-based

awards and warrants into TripAdvisor stock-based awards and warrants on December 20, 2011 and the related weighted-average grant date

exercise price for options and warrants and the weighted-average grant date fair value for RSUs:

Options and Stock Warrants:

RSUs:

Stock Based Awards Subsequent to the Spin

-Off from Expedia

TripAdvisor, Inc. 2011 Stock and Annual Incentive Plan

On December 20, 2011, the 2011 Incentive Plan became effective. A summary of certain important features of the 2011 Incentive Plan can

be found below. The summary of the material terms of the 2011 Incentive Plan is qualified in its entirety by the full text of the 2011 Incentive

Plan which is incorporated by reference in this Annual Report on Form 10-K as Exhibit 4.3.

Introduction

The purpose of the 2011 Incentive Plan is to give us a competitive advantage in attracting, retaining and motivating officers and employees

and to provide us with the ability to provide incentives more directly linked to the profitability of our businesses and increases in stockholder

value. In addition, the 2011 Incentive Plan provides for the assumption of certain awards pursuant to the adjustment of awards granted under the

pre Spin-Off plans of Expedia and its subsidiaries, as described in the Employee Matters Agreement.

Administration

The 2011 Incentive Plan is administered by the Compensation Committee (the “Committee”) of the Board of Directors or such other

committee as the Board of Directors may from time to time designate. Among other things, the Committee will have the authority to select

individuals to whom awards may be granted, to determine the type of award as well as the number of shares of TripAdvisor Common Stock to

be covered by each award, and to determine the terms and conditions of any such awards.

Eligibility

In addition to individuals who hold outstanding adjusted awards, persons who serve or agree to serve as directors, officers, employees,

non-employee directors or consultants of TripAdvisor and its subsidiaries and affiliates are eligible to receive awards under the 2011 Incentive

Plan.

87

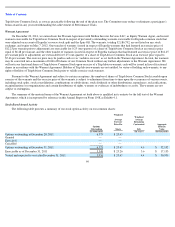

Potential Common

Shares (in

thousands)

Weighted Average

Grant Date

Exercise Price

Options

6,575

$23.65

Warrants

—

$

6.48 TripAdvisor Warrants

6,047

$25.92

Warrants

—

$

7.66 TripAdvisor Warrants

2,000

$30.64

Potential Common

Shares (in thousands)

Weighted Average

Grant Date

Fair Value

RSUs

893

$21.09