TripAdvisor 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Other Interest Expense, Net

Other interest income (expense), net is immaterial for all periods presented and is primarily interest expense on our term loan and

revolving credit facility from the period of December 21, 2011 through December 31, 2011. Refer to the section entitled “— Commitments and

Contingencies” below for a current estimate of our expected future interest payments regarding our long term debt.

Other, Net

Other, net is primarily comprised of net foreign exchange losses for the periods presented.

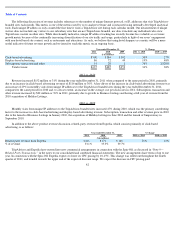

Provision for Income Taxes

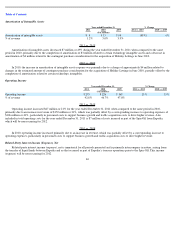

2011 vs. 2010

Our effective tax rate was lower than the 35% federal statutory rate primarily due to earnings in jurisdictions outside the United States,

where our effective tax rate is lower, which was partially offset by state income taxes, accruals on uncertain tax positions, increases in valuation

allowances, and non-deductible transaction costs associated with the Spin-Off. The change in the effective rate for 2011 compared to the 2010

rate was primarily due to an increase in earnings in jurisdictions outside the United States and a decrease in state income taxes partially offset by

non-deductible transaction costs.

2010 vs. 2009

The 2010 effective tax rate was higher than the 35% federal statutory rate primarily due to state income taxes and accruals related to

uncertain tax positions, partially offset by earnings in jurisdictions outside the United States, where the effective rate is lower.

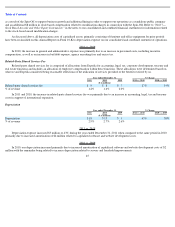

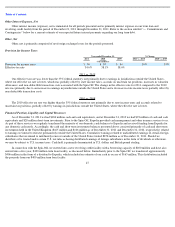

Financial Position, Liquidity and Capital Resources

As of December 31, 2011 we had $184 million cash and cash equivalents, and at December 31, 2010 we had $93 million of cash and cash

equivalents and $20 million short-term investments. Prior to the Spin-Off, Expedia provided cash management and other treasury services to us.

As part of these services we regularly transferred the majority of our domestic cash balances to Expedia and received funding from Expedia for

any domestic cash needs. Accordingly, the cash and short-term investment balances presented above consisted primarily of cash and short term

investments held in the United Kingdom ($165 million and $106 million as of December 31, 2011 and December 31, 2010, respectively) related

to earnings we intend to reinvest permanently outside the United States. Cumulative earnings related to undistributed earnings of certain foreign

subsidiaries that we intend to indefinitely reinvest outside of the United States totaled $258 million as of December 31, 2011. Should we

distribute or be treated under certain U.S. tax rules as having distributed earnings of foreign subsidiaries in the form of dividends or otherwise,

we may be subject to U.S. income taxes. Cash held is primarily denominated in U.S. dollars and British pound sterling.

In connection with the Spin-Off, we entered into a new revolving credit facility with a borrowing capacity of $200 million and have also

entered into a five-year, $400 million term loan facility, as discussed below. Immediately prior to the Spin-Off, we transferred approximately

$406 million in the form of a dividend to Expedia, which included an estimate of our cash in excess of $165 million. This distribution included

the proceeds from our $400 million term loan facility.

47

Year ended December 31,

% Change

2011

2010

2009

2011 vs. 2010

2010 vs. 2009

($ in millions)

Provision for income taxes

$

94

$

85

$

64

10

%

33

%

Effective tax rate

34.6

%

38.1

%

38.6

%