TripAdvisor 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Shares Subject to the Plan

The 2011 Incentive Plan authorizes the issuance of up to 10,000,000 shares of TripAdvisor Common Stock pursuant to new awards under

the 2011 Incentive Plan, plus shares to be granted pursuant to the assumption of outstanding adjusted awards. During a calendar year, no single

participant may be granted (a) stock options covering in excess of 3,000,000 shares of TripAdvisor Common Stock, or (b) restricted stock or

RSUs, intended to qualify under Section 162(m) (4)(C) of the Code, covering in excess of 2,000,000 shares of TripAdvisor Common Stock;

provided, however, that adjusted awards will not be subject to these limitations. The maximum number of shares of TripAdvisor Common Stock

that may be granted pursuant to stock options intended to be incentive stock options within the meaning of Section 422 of the Code is 7,000,000

shares.

The shares of TripAdvisor Common Stock subject to grant under the 2011 Incentive Plan were made available from authorized but

unissued shares or from treasury shares, as determined by the Board of Directors. Other than adjusted awards, to the extent that any award is

forfeited, or any option or stock appreciation right terminates, expires or lapses without being exercised, or any award is settled for cash, the

shares of TripAdvisor Common Stock subject to such awards not delivered as a result thereof will again be available for awards under the plan.

If the exercise price of any option and/or the tax withholding obligations relating to any award are satisfied by delivering shares of TripAdvisor

Common Stock (by either actual delivery or by attestation), only the number of shares of TripAdvisor Common Stock issued net of the shares of

TripAdvisor Common Stock delivered or attested to will be deemed delivered for purposes of the limits in the plan. To the extent any shares of

TripAdvisor Common Stock subject to an award are withheld to satisfy the exercise price (in the case of an option) and/or the tax withholding

obligations relating to such award, such shares of TripAdvisor Common Stock will not generally be deemed to have been delivered for purposes

of the limits set forth in the plan.

In the event of certain extraordinary corporate transactions, the Committee or the Board of Directors will be able to make such

substitutions or adjustments as it deems appropriate and equitable to (1) the aggregate number and kind of shares or other securities reserved for

issuance and delivery under the plan, (2) the various maximum limitations set forth in the plan, (3) the number and kind of shares or other

securities subject to outstanding awards, and (4) the exercise price of outstanding options and stock appreciation rights.

As indicated above, several types of stock grants can be made under the 2011 Incentive Plan. A summary of these grants is set forth below.

The 2011 Incentive Plan will govern TripAdvisor options and TripAdvisor RSUs that have converted from existing Expedia options and Expedia

RSUs in connection with the Spin-Off as well as other award grants made following the Spin-Off pursuant to the 2011 Incentive Plan.

Notwithstanding the foregoing, the terms that govern Expedia options and Expedia RSUs that have converted into TripAdvisor options and

TripAdvisor RSUs in connection with the Spin-Off will govern the TripAdvisor options and TripAdvisor restricted stock units to the extent

inconsistent with the terms described below.

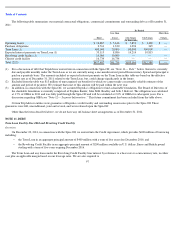

Stock Options and Stock Appreciation Rights

Stock options granted under the 2011 Incentive Plan may either be incentive stock options or nonqualified stock options. Stock

appreciation rights granted under the 2011 Incentive may either be granted alone or in tandem with a stock option. The exercise price of options

and stock appreciation rights cannot be less than 100% of the fair market value of the stock underlying the options or stock appreciation rights on

the date of grant. Optionees may pay the exercise price in cash or, if approved by the Committee, in TripAdvisor Common Stock (valued at its

fair market value on the date of exercise) or a combination thereof, or by “cashless exercise” through a broker or by withholding shares

otherwise receivable on exercise. The term of options and stock appreciation rights will be as determined by the Committee, but an incentive

stock option may not have a term longer than ten years from the date of grant. The Committee will determine the vesting and exercise schedule

of options and stock appreciation rights, and the extent to which they will be exercisable after the award holder’s employment terminates.

Generally, unvested options and stock appreciation rights terminate upon the termination of employment, and vested options and stock

appreciation rights will remain exercisable for one year after the

88