TripAdvisor 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

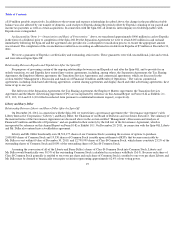

Guarantees

All obligations under the Credit Agreement are unconditionally guaranteed by us and each of our existing and subsequently acquired or

organized direct or indirect wholly-owned domestic and foreign restricted subsidiaries, subject to certain exceptions for controlled foreign

corporations, foreign subsidiaries where applicable law would otherwise be violated or non-material subsidiaries.

Covenants

The Credit Agreement contains a number of covenants that, among other things, restrict our ability to: incur additional indebtedness, create

liens, enter into sale and leaseback transactions, engage in mergers or consolidations, sell or transfer assets, pay dividends and distributions or

repurchase our capital stock, make investments, loans or advances, prepay certain subordinated indebtedness, make certain acquisitions, engage

in certain transactions with affiliates, amend material agreements governing certain subordinated indebtedness, and change our fiscal year. The

Credit Agreement also requires us to maintain a maximum leverage ratio and a minimum cash interest coverage ratio, and contain certain

customary affirmative covenants and events of default, including a change of control. If an event of default occurs, the lenders under the Credit

Agreement will be entitled to take various actions, including the acceleration of all amounts due under Credit Agreement and all actions

permitted to be taken by a secured creditor.

As of December 31, 2011 we have concluded we are in compliance with all of our debt covenants.

The full text of the Credit Agreement is incorporated by reference in this Annual Report on Form 10-K as Exhibit 4.2.

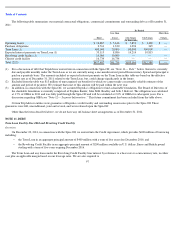

Chinese Credit Facility

In addition to our borrowings under the Credit Agreement, we maintain our Chinese Credit Facility. As of December 31, 2011 and

December 31, 2010, we had $17 million and $2 million of short term borrowings outstanding, respectively. Refer to “Note 10— Commitments

and Contingencies ” above, for further information on the Chinese Credit Facility.

There were no long-

term borrowings or other short term borrowings outstanding as of December 31, 2010, except as related to our Chinese

Credit Facility described above.

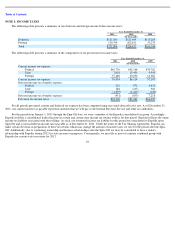

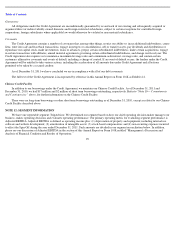

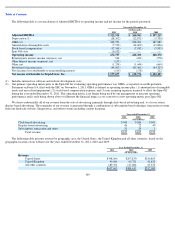

NOTE 12: SEGMENT INFORMATION

We have one reportable segment: TripAdvisor. We determined our segment based on how our chief operating decision maker manages our

business, makes operating decisions and evaluates operating performance. Our primary operating metric for evaluating segment performance is

Adjusted EBITDA. Adjusted EBITDA is defined as operating income plus: (1) depreciation of property and equipment, including internal use

software and website development; (2) amortization of intangible assets; (3) stock-based compensation; and (4) non-recurring expenses incurred

to effect the Spin-Off during the year ended December 31, 2011. Such amounts are detailed in our segment reconciliation below. In addition,

please see our discussion of Adjusted EBITDA in the section of this Annual Report on Form 10-K entitled “Management’s Discussion and

Analysis of Financial Condition and Results of Operations.”

99