TripAdvisor 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

TripAdvisor Common Stock, as soon as practicable following the end of the plan year. The Committee may reduce or eliminate a participant’s

bonus award in any year notwithstanding the achievement of Performance Goals.

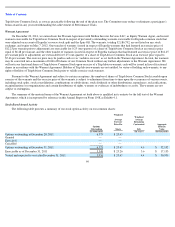

Warrant Agreement

On December 20, 2011, we entered into the Warrant Agreement with Mellon Investor Services LLC, as Equity Warrant Agent, and issued

warrants exercisable for TripAdvisor Common Stock in respect of previously outstanding warrants exercisable for Expedia common stock that

were adjusted on account of Expedia’s reverse stock split and the Spin-Off. The warrants, totaling 32,186,792, are not listed on any stock

exchange, and expire on May 7, 2012. One tranche of warrants (issued in respect of Expedia warrants that had featured an exercise price of

$12.23 per warrant prior to adjustment) are exercisable for 0.25 (one-quarter) of a share of TripAdvisor Common Stock at an exercise price

equal to $6.48 per warrant, and the other tranche of warrants (issued in respect of Expedia warrants that had featured an exercise price of $14.45

per warrant prior to adjustment) are exercisable for 0.25 (one-quarter) of a share of TripAdvisor Common Stock at an exercise price equal to

$7.66 per warrant. The exercise price may be paid in cash or via “cashless exercise” as set forth in the Warrant Agreement. In total, the warrants

may be converted into a maximum of 8,046,698 shares of our Common Stock without any further adjustments to the Warrant Agreement. We

will not issue fractional shares of TripAdvisor Common Stock upon exercise of a TripAdvisor warrant; cash will be issued in lieu of fractional

shares in accordance with the Warrant Agreement. Holders of TripAdvisor warrants are not entitled, by virtue of holding such warrants, to any

rights of holders of TripAdvisor Common Stock prior to validly exercise such warrants.

Pursuant to the Warrant Agreement and subject to certain exceptions, the number of shares of TripAdvisor Common Stock issuable upon

exercise of the warrants and the exercise price of the warrants is subject to adjustment from time to time upon the occurrence of various events,

including stock splits, stock consolidations, combinations or subdivisions; stock dividends or other distributions, repurchases, reclassifications,

recapitalizations or reorganizations and certain distributions of rights, warrants or evidences of indebtedness or assets. The warrants are not

subject to redemption.

The summary of the material terms of the Warrant Agreement set forth above is qualified in its entirety by the full text of the Warrant

Agreement, which is incorporated by reference in this Annual Report on Form 10-K as Exhibit 4.1.

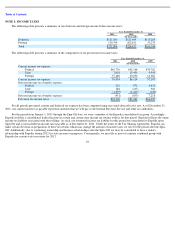

Stock

-Based Award Activity

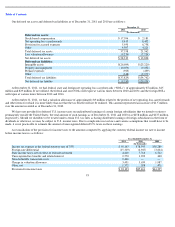

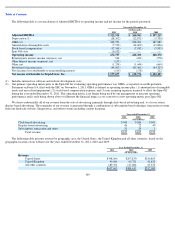

The following table presents a summary of our stock option activity on our common shares:

90

Options

Outstanding

Weighted

Average

Exercise

Price Per

Share

Weighted

Average

Remaining

Contractual

Life

Aggregate

Intrinsic

Value

(In thousands)

(In years)

(In thousands)

Options outstanding at December 20, 2011

6,575

$

23.65

Granted

—

—

Exercised

—

—

Cancelled

—

—

Options outstanding at December 31, 2011

6,575

$

23.65

4.6

$

32,192

Exercisable as of December 31, 2011

3,548

$

25.26

3.6

$

17,133

Vested and expected to vest after December 31, 2011

5,976

$

23.45

4.4

$

30,930