TripAdvisor 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Historically, the cash we generate has been sufficient to fund our working capital and capital expenditure requirements. Subsequent to the

Spin-Off, management believes that our cash and cash equivalents, combined with expected cash flows generated by operating activities and the

new revolving credit facility, will be sufficient to fund our ongoing working capital needs, capital expenditure requirements and business growth

initiatives, meet our long term debt obligations and commitments, and fund acquisitions for at least the next 12 months.

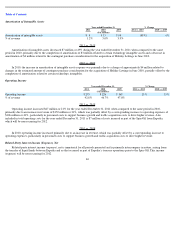

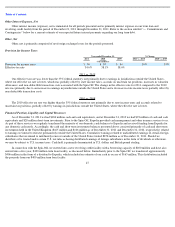

Our cash flows are as follows (in millions):

2011 vs. 2010

Operating Activities

For the year ended December 31, 2011, net cash provided by operating activities increased by $21 million or 11% when compared to the

same period in 2010, primarily due to higher operating income after adjusting for the impacts of depreciation and amortization, and cash inflows

from the Business Listing product, partially offset by an increase in income tax payments and the payment of a contingent purchase

consideration of which $3 million affected operating cash and working capital adjustments related to the Spin-Off.

Investing Activities

For the year ended December 31, 2011, net cash used in investing activities increased by $399 million or 286% when compared to the

same period in 2010 primarily due to a distribution of approximately $406 million paid to Expedia immediately prior to the Spin-Off, higher net

cash transfers to Expedia related to business operations between us and Expedia prior to Spin-Off of $30 million and, in October 2011, an

acquisition of a common control subsidiary in China from Expedia for $28 million, net of cash acquired, partially offset by a decrease of $27

million in cash paid for business acquisitions and a maturity of a short term investment of $20 million.

Financing Activities

For the year ended December 31, 2011, net cash provided by financing activities increased $408 million when compared to the same

period in 2010, primarily due to our term loan facility borrowing in conjunction with the Spin-Off of $400 million and additional short-term

borrowings of $16 million, consisting of $10 million from our new revolving credit facility related to the Spin-Off and an additional $6 million

related to our existing revolving credit facility in China. This was partially offset by a payment of a contingent purchase consideration of which

$10 million affected cash used in financing activities.

2010 vs. 2009

Operating Activities

For the year ended December 31, 2010, net cash provided by operating activities increased by $71 million, primarily due to higher

operating income after adjusting for the impacts of depreciation and amortization, and cash inflows from the Business Listing product, partially

offset by an increase in income tax payments.

48

Year ended December 31,

2011

2010

2009

Net cash provided by (used in):

Operating activities

$

218

$

197

$

126

Investing activities

$

(539

)

$

(140

)

$

(149

)

Financing activities

$

412

$

4

$

46