TripAdvisor 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

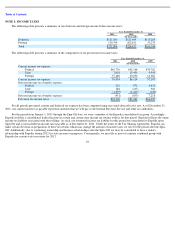

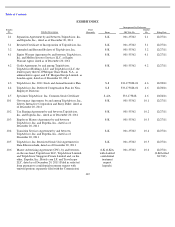

NOTE 14: CASH, CASH EQUIVALENTS AND SHORT TERM INVESTMENTS

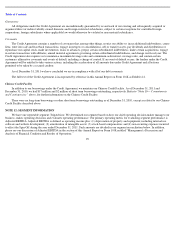

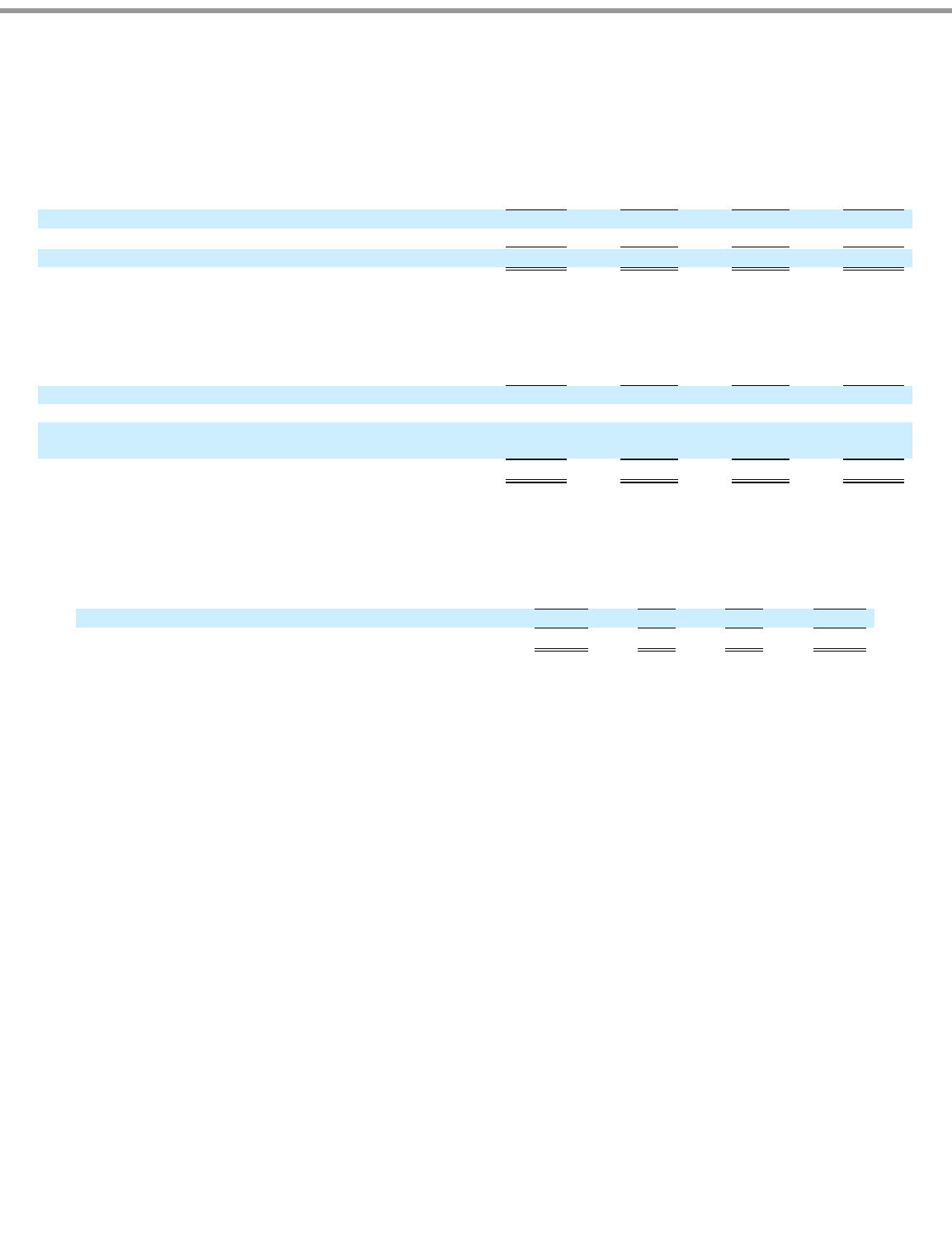

Cash and cash equivalents by security type at December 31, 2011 were as follows (in thousands):

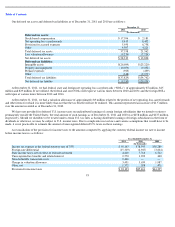

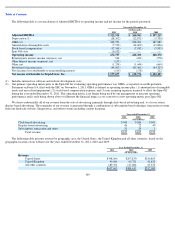

Cash, cash equivalents and short term investments by security type at December 31, 2010 were as follows (in thousands):

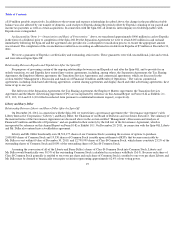

NOTE 15: FAIR VALUE MEASUREMENTS

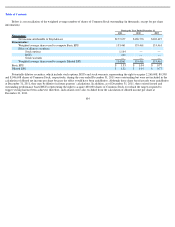

The following tables provide a summary of the fair value measurements of our assets as of December 31, 2011 (in thousands):

We did not have any Level 3 assets for the year ended December 31, 2011.

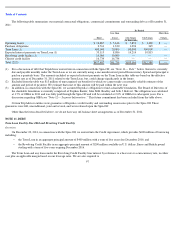

As discussed in “Note 3— Acquisitions ”, we have a redeemable noncontrolling interest related to a 2008 acquisition, which fair value

determinations are based on various internal valuation techniques, including market comparables and discounted cash flow projections and is

considered a Level 3 liability at December 31, 2011. Certain assumptions are used in determining fair value, including revenue growth rates and

discount rates. Changes in these assumptions would impact the fair value. Changes in the fair value of the shares for which the minority holders

may sell to us are recorded to the redeemable noncontrolling interest with charges or credits to additional paid in capital. Our redeemable

noncontrolling interest is not material for all periods presented and is included in other long-term liabilities at December 31, 2010 and in other

current liabilities at December 31, 2011, as we expect the noncontrolling interest to be redeemed in 2012.

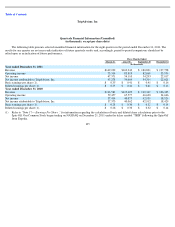

We currently invest excess cash balances primarily in cash deposits and money market investment accounts at major banks. The carrying

amount of cash deposits, accounts receivable, related party receivables, accounts payable, and accrued and other current liabilities, as reported on

the consolidated and combined balance sheet as of December 31, 2011, approximate their fair value because of the short maturity of those

instruments. The carrying value of the borrowings outstanding on our new Credit Agreement bear interest at a variable rate and are considered to

approximate fair value.

102

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

Cash

$

114,532

$

—

$

—

$

114,532

Money market funds

-

cash equivalent

69,000

—

—

69,000

Total

$

183,532

$

—

$

—

$

183,532

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

Cash

$

53,133

$

—

$

—

$

53,133

Money market funds

—

cash equivalent

40,000

—

—

40,000

Time deposits with financial institutions—short term

investment

20,297

—

—

20,297

Total

$

113,430

$

—

$

—

$

113,430

Level 1

Level 2

Level 3

Assets at

Fair

Value

Money market funds

—

cash equivalent (1)

$

69,000

$

—

$

—

$

69,000

Total

$

69,000

$

—

$

—

$

69,000

(1)

Cash equivalents include money market investment accounts that hold excess liquid funds. The fair value measurement of these assets is

based on quoted market prices in active markets and, therefore, is recorded at fair value on a recurring basis and classified as Level 1

assets.