TripAdvisor 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

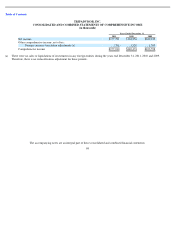

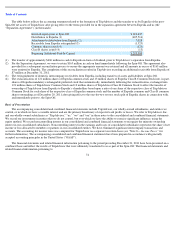

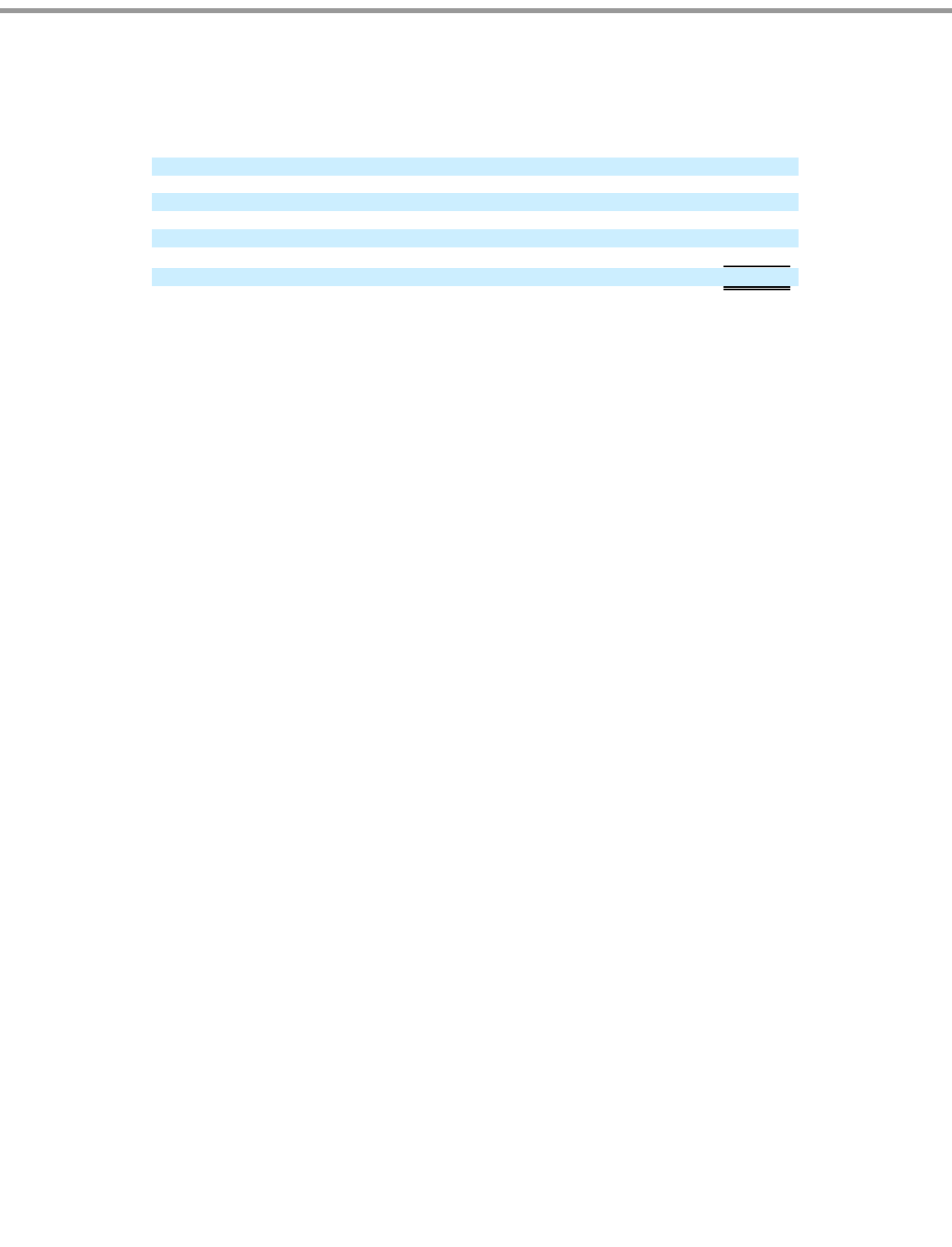

The table below reflects the accounting treatment related to the formation of TripAdvisor and the transfer to us by Expedia of the post-

Spin-Off net assets of TripAdvisor after giving effect to the terms provided for in the separation agreement between Expedia and us (the

“Separation Agreement”) (in thousands).

Basis of Presentation

The accompanying consolidated and combined financial statements include TripAdvisor, our wholly-owned subsidiaries, and entities we

control, or in which we have a variable interest and are the primary beneficiary of expected cash profits or losses. We refer to TripAdvisor, Inc.

and our wholly-owned subsidiaries as “TripAdvisor,” “us,” “we” and “our”

in these notes to the consolidated and combined financial statements.

We record our investments in entities that we do not control, but over which we have the ability to exercise significant influence, using the

equity method. We record noncontrolling interest in our consolidated and combined financial statements to recognize the minority ownership

interest in our consolidated subsidiaries. Noncontrolling interest in the earnings and losses of consolidated subsidiaries represents the share of net

income or loss allocated to members or partners in our consolidated entities. We have eliminated significant intercompany transactions and

accounts. The accounting for income taxes was computed for TripAdvisor on a separate tax return basis (see “Note 8— Income Taxes ” for

further information). The accompanying consolidated and combined financial statements have been prepared in accordance with generally

accepted accounting principles in the United States (“GAAP”).

The financial statements and related financial information pertaining to the period preceding December 21, 2011 have been presented on a

combined basis and reflect the results of TripAdvisor that were ultimately transferred to us as part of the Spin-Off. The financial statements and

related financial information pertaining to

74

Invested equity prior to Spin

-

Off

$

693,447

Distribution to Expedia (1)

(405,516

)

Adjustment to distribution from Expedia (2)

7,028

Receivable from Expedia extinguished (3)

(1,525

)

Common shares issued (4)

(121

)

Class B shares issued (4)

(13

)

Beginning Additional

-

Paid

-

In

-

Capital

$

293,300

(1)

The transfer of approximately $406 million in cash to Expedia in form of dividend, prior to TripAdvisor

’

s separation from Expedia.

(2) Per the Separation Agreement, we were to retain $165 million in cash on hand immediately following the Spin-Off. The agreement also

provided for a subsequent reconciliation process to ensure the appropriate amount was retained and all amounts in excess of $165 million

were remitted to Expedia. The completion of this reconciliation resulted in TripAdvisor recording an additional receivable from Expedia of

$7 million at December 31, 2011.

(3)

The extinguishment of domestic intercompany receivables from Expedia, including transfers of assets and liabilities at Spin

-

Off.

(4)

The reclassification of 121 million shares of Expedia common stock and 13 million shares of Expedia Class B Common Stock into, in part,

shares of Expedia mandatory exchangeable preferred stock that automatically, immediately following the reclassification, exchanged into

121 million shares of TripAdvisor Common Stock and 13 million shares of TripAdvisor Class B Common Stock to effect the transfer of

ownership of TripAdvisor from Expedia to Expedia’s shareholders based upon a ratio of one share of the respective class of TripAdvisor

Common Stock for each share of the respective class of Expedia common stock and the number of Expedia common and Class B common

shares outstanding as of December 20, 2011 after giving effect to the one-for-two reverse stock split of Expedia shares in connection with,

and immediately prior to, the Spin

-

Off.