TripAdvisor 2011 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

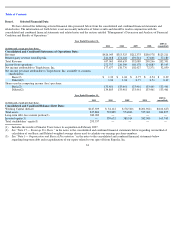

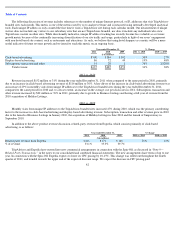

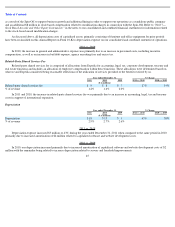

The following table is a reconciliation of Adjusted EBITDA to operating income for the periods presented:

Reclassifications

Certain reclassifications have been made to conform the prior period’s data to the current format.

Our management has changed the non-GAAP financial measure that we use to measure our operating performance from OIBA to

Adjusted EBITDA. Consequently we have reclassified depreciation expense, which previously had resided in technology and content expense

and general and administrative expense, and have presented it as a separate line item on the consolidated and combined statement of operations.

This reclassification had no net effect on either total operating expenses or total operating income for any period. The table below provides a

reconciliation of that reclassification for the periods presented.

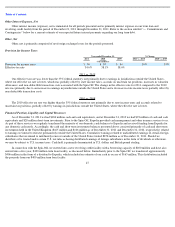

Revenue

We derive substantially all of our revenue through the sale of advertising, primarily through click-based advertising and, to a lesser extent,

display-based advertising. In addition, we earn revenue through a combination of subscription-based offerings, transaction revenue from our

flash sale website, SniqueAway, and other revenue including content licensing.

41

Year ended December 31,

(in thousands)

2011

2010

2009

Adjusted EBITDA

$

322,918

$

260,963

$

197,219

Depreciation (1)

(18,362

)

(12,871

)

(9,330

)

OIBA (2)

304,556

248,092

187,889

Amortization of intangible assets

(7,523

)

(14,609

)

(13,806

)

Stock

-

based compensation

(17,344

)

(7,183

)

(5,905

)

Spin

-

Off costs

(6,932

)

—

—

Operating income

272,757

226,300

168,178

(1)

Includes internal use software and website development costs.

(2) Our primary operating metric prior to the Spin-Off for evaluating operating performance was Operating Income Before Amortization, or

OIBA, as reported on our Form S-4, filed with the SEC on November 1, 2011. OIBA is defined as operating income plus: (1) amortization

of intangible assets and any related impairment; (2) stock-based compensation expense; and (3) non-recurring expenses incurred to effect

the Spin-Off during the year ended December 31, 2011. This operating metric is no longer being used by our management to measure

operating performance and is only being shown above to illustrate the financial impact as we convert to a new operating metric post Spin-

Off.

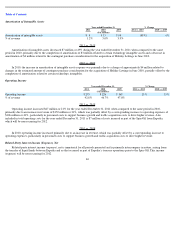

Year ended December 31,

(in thousands)

2010

2009

Depreciation (1)

$

12,871

$

9,330

Technology and content

(10,351

)

(7,743

)

General and administrative

(2,520

)

(1,587

)

$

—

$

—

(1) Reflects total depreciation expense as reported on our Form S-4, filed with the SEC on November 1, 2011 in our consolidated and

combined statement of cash flows.