TripAdvisor 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

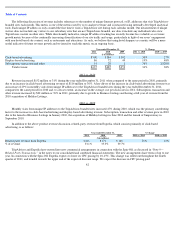

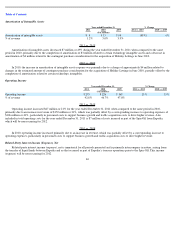

Click-Based Advertising Revenue. In recent years, the majority of our revenue growth resulted from higher click-based advertising revenue

due to increased traffic on our websites, an increase in the volume of clicks on advertisers’ placements, and, in 2011, an increase in the average

CPC price. Although click-based advertising revenue growth has generally been driven by traffic volume, we remain focused on the various

factors that could impact revenue growth, including, but not limited to, the growth in hotel shoppers, CPC pricing fluctuations, the overall

economy, the ability of advertisers to monetize our traffic, the quality and mix of traffic to our websites, and the quality and mix of traffic from

our advertising placements to advertisers, as well as advertisers’ evolving approach to transaction attribution models and return on investment

targets.

Global Economic Conditions. In late 2008 and throughout 2009, weak global economic conditions created uncertainty for travelers and

suppliers, and put pressure on discretionary spending on travel and advertising. As a result, our revenue growth slowed in 2009, with a

corresponding pull back in sales and marketing and a reduction in general and administrative expenses. Throughout 2010 and into 2011, the

travel industry has been gradually improving. With the improved economic conditions, we reaccelerated sales and marketing spending and

increased other operating costs to support expansion and have experienced increased click volumes and revenue growth during these periods.

Global economic conditions remain uncertain and, as such, our near-term visibility remains limited.

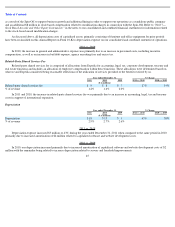

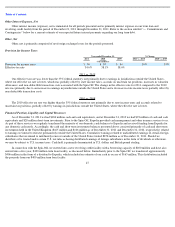

Spin

-Off

On April 7, 2011, Expedia announced its plan to separate into two independent public companies in order to better achieve certain strategic

objectives of its various businesses. We refer to this transaction as the “Spin-Off” in this Annual Report on Form 10-K. Non-recurring expenses

incurred to affect the Spin-Off during the year ended December 31, 2011 has been included within Spin-Off costs in the accompanying

consolidated and combined statements of operations.

In connection with the Spin-Off, we were incorporated as a Delaware corporation in July 2011. On November 1, 2011, the Securities and

Exchange Commission, or the SEC, declared effective the Form S-4 with information pertaining to the Spin-Off, which included a preliminary

proxy statement for Expedia and prospectus for us and Expedia. On December 6, 2011, at Expedia’s annual meeting of stockholders, Expedia’s

stockholders approved the Spin-Off, and the related proposals. The Spin-Off was also approved by Expedia’

s Board of Directors on December 6,

2011 and, also in December 2011, Expedia received a favorable private letter ruling from the Internal Revenue Service, or the IRS, on the tax-

free nature of the Spin-Off.

On December 20, 2011, following the close of trading on the NASDAQ Global Select Market, the Spin-Off was completed, and we began

trading as an independent public company on December 21, 2011. Expedia effected the Spin-Off by means of a reclassification of its capital

stock that resulted in the holders of Expedia capital stock immediately prior to the time of effectiveness of the reclassification having the right to

receive a proportionate amount of our capital stock. A one-for-two reverse stock split of outstanding Expedia capital stock occurred immediately

prior to the Spin-Off, with cash paid in lieu of fractional shares. Upon completion of the Spin-Off, Expedia ceased to have any ownership

interest in us, and all of our shares of Common Stock were held by the stockholders of Expedia immediately prior to Spin-Off.

In connection with the Spin-Off, Expedia contributed or transferred all of the subsidiaries and assets it held relating to the TripAdvisor

Media Group, which are comprised of the TripAdvisor Holdings, LLC combined financial statements, to us and we or one of our subsidiaries

assumed of all of the liabilities relating to Expedia’s TripAdvisor Media Group. We now trade on NASDAQ, under the symbol “TRIP.”

In connection with the Spin-Off, and as provided for in the separation agreement between us and Expedia, or the Separation Agreement,

we secured financing under a $400 million term loan at the time of our separation from Expedia. Immediately prior to the completion of the

Spin-Off, we distributed approximately $406 million in cash to Expedia in the form of a dividend, which was funded from the net proceeds of

the financing and any cash on hand in excess of $165 million as of the Spin-Off. The Separation Agreement also provided for a subsequent

37