TripAdvisor 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

million and $3 million are recorded to financing activities and operating activities, respectively, in the consolidated and combined statement of

cash flows. All previous contingent consideration accrued and paid was calculated based on the financial performance of the acquired entities to

which it relates.

The purchase price allocation of the 2011 acquisitions are preliminary and subject to revision as more information becomes available, but

in any case will not be revised beyond 12 months after the acquisition date and any change to the fair value of net assets acquired will lead to a

corresponding change to the purchase price allocable to goodwill on a retroactive basis. The results of operations of each of the acquired

businesses have been included in our consolidated and combined results from each transaction closing date forward. We did not have any

material acquisitions during the years 2011, 2010 and 2009; therefore no pro-forma results have been provided.

One of our acquisitions made during 2008 includes noncontrolling interests with certain rights whereby we may acquire, and the minority

shareholders may sell to us, the additional shares of the subsidiary, at fair value or at adjusted fair values at our discretion, beginning in the

fourth quarter of 2012. Changes in fair value of the shares for which the minority holders may sell to us are recorded to the redeemable

noncontrolling interest with charges or credits to additional paid in capital. Fair value determinations are based on various valuation techniques,

including market comparables and discounted cash flow projections. Our redeemable noncontrolling interest is not material for all periods

presented and has been included in other long-term liabilities at December 31, 2010 and is included in other current liabilities at December 31,

2011, as we expect the noncontrolling interest to be redeemed in 2012.

In addition to the acquisitions listed in the above table, in October 2011, we purchased a subsidiary in China from Expedia for $37 million,

or $28 million net of acquired cash. This acquisition was accounted for as a common control transaction, with net liabilities recorded at a

carrying value of $4 million, including an additional $7 million of short term borrowings from the Chinese Credit Facility (refer to “Note 10—

Commitments and Contingencies” below for further information on the Chinese Credit Facility). No goodwill or other intangibles were recorded

as a result of this acquisition and no further contingent payments are outstanding. The difference between the purchase price and the carrying

value of the net liabilities was recorded to additional paid in capital. The results of operations from this business are included in our consolidated

and combined results from the transaction closing date through December 31, 2011.

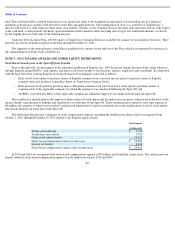

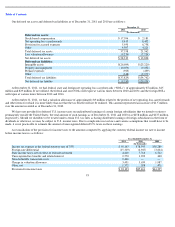

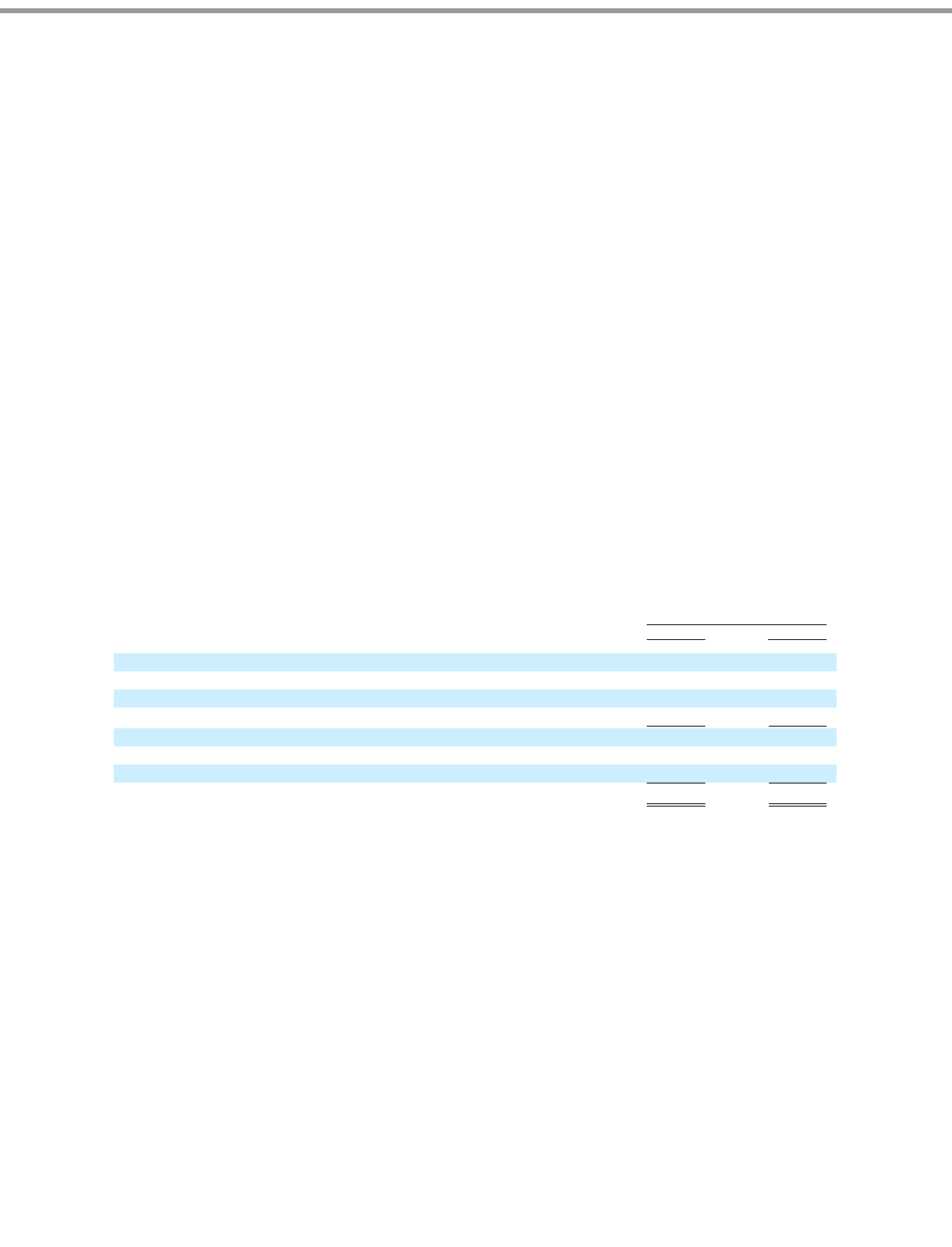

NOTE 4: PROPERTY AND EQUIPMENT, NET

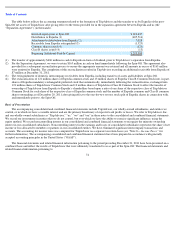

Property and equipment consists of the following:

As of December 31, 2011 and 2010, our recorded capitalized software and website development costs, net of accumulated amortization,

were $21 million and $17 million, respectively. For the years ended December 31, 2011 and 2010, we capitalized $16 million and $12 million,

respectively, related to software and website

83

December 31,

2011

2010

(In thousands)

Capitalized software and website development

$

46,878

$

31,778

Leasehold improvements

12,924

11,461

Computer equipment

11,638

8,863

Furniture and other equipment

5,267

3,480

76,707

55,582

Less: accumulated depreciation

(43,391

)

(25,075

)

Projects in progress

1,438

237

Property and equipment, net

$

34,754

$

30,744