TripAdvisor 2011 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

fund. The cash fund will be credited with interest at an annual rate equal to the weighted average prime or base lending rate of a financial

institution selected in accordance with the terms of the Plan and applicable law. Upon termination of service as a director of TripAdvisor, a

director will receive (i) with respect to share units, such number of shares of our Common Stock as the share units represent, and (ii) with respect

to the cash fund, a cash payment. Payments upon termination will be made in either one lump sum or up to five annual installments, as elected

by the eligible director at the time of the deferral election.

Under the 2011 Incentive Plan, 100,000 shares of TripAdvisor Common Stock are available for issuance to non-employee directors. There

has been no activity from the inception of the Plan through December 31, 2011.

The summary of the material terms of the Plan is qualified in its entirety by the full text of the Plan, which is incorporated by reference in

this Annual Report on Form 10-K as Exhibit 4.4.

NOTE 7: STOCK BASED AWARDS AND OTHER EQUITY INSTRUMENTS

Stock Based Awards prior to the Spin

-Off from Expedia

Prior to the Spin-Off, we participated in the Amended and Restated Expedia, Inc. 2005 Stock and Annual Incentive Plan, under which we,

through Expedia, granted RSUs, stock options, and other stock-based awards to our directors, officers, employees and consultants. In connection

with the Spin-Off, these existing Expedia stock-based awards were primarily converted as follows:

This resulted in a modification to the number of shares subject to each option and the option exercise prices, which were both based on the

relative market capitalization of Expedia and TripAdvisor as of the date of the Spin-Off. These modifications resulted in a one-time expense of

$8 million, the majority of which was recorded to general and administrative expense, primarily due to the modification of vested stock options

that remain unexercised at the date of the Spin-Off.

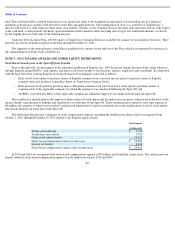

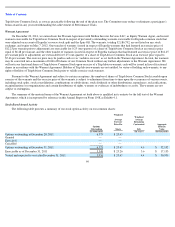

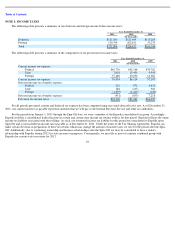

The following table presents a summary of stock compensation expense, including the modification charge, that we recognized from

January 1, 2011 through December 20, 2011 related to the Expedia equity awards:

In 2010 and 2009, we recognized total stock-based compensation expense of $7 million and $6 million, respectively. The total income tax

benefit related to stock-based compensation expense was $2 million for each of 2010 and 2009.

86

•

Each vested stock option to purchase shares of Expedia common stock converted into an option to purchase shares of Expedia

common stock and an option to purchase shares of TripAdvisor Common Stock;

•

Each unvested stock option to purchase shares of Expedia common stock converted into a stock option to purchase shares of

common stock of the applicable company for which the employee was employed following the Spin

-

Off; and

•

All RSUs converted into RSUs of the applicable company for which the employee was employed following the Spin

-

Off.

Total Expense

(in thousands)

Selling and marketing

$

3,104

Technology and content

3,783

General and administrative

10,013

Stock

-

based compensation before income taxes

$

16,900

Income tax benefit

6,338

Stock

-

based compensation expense after income taxes

$

10,562