TripAdvisor 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

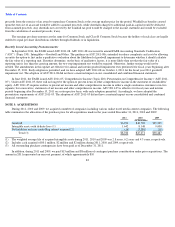

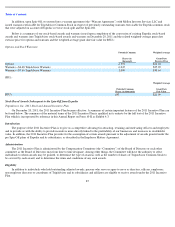

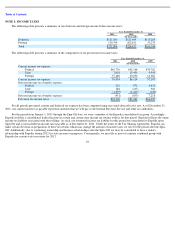

The estimated future amortization expense related to intangible assets with definite lives as of December 31, 2011, assuming no subsequent

impairment of the underlying assets, is as follows, in thousands:

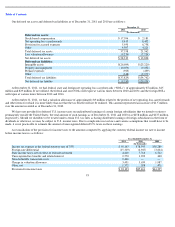

NOTE 6: EMPLOYEE BENEFIT PLANS

Prior to the Spin

-Off from Expedia

Our U.S. employees were generally eligible to participate in Expedia’s retirement and savings plan (the “Expedia 401(k) Plan”) that

qualified under Section 401(k) of the Internal Revenue Code until October 31, 2011. Our employees ceased to participate in this plan upon the

creation of our new retirement and savings plan on November 1, 2011 described below. Within the Expedia 401(k) Plan, participating employees

could contribute up to 50% of their pretax salary, but not more than statutory limits. We matched 50% of the first 6% of employee contributions

to the plan for a maximum employer contribution of 3% of a participant’s eligible earnings. Our contributions vested with the employees after

they completed two years of service. Participating employees had the option to invest in Expedia’s common stock, but there was no requirement

for participating employees to invest their contribution or our matching contribution in Expedia’s common stock. Expedia also had various

defined contribution plans for our international employees. Contributions to these benefit plans for our employees were $2 million for the year

ended December 31, 2011 and $1 million for each of the years ended December 31, 2010 and 2009.

Subsequent to Spin

-Off from Expedia

TripAdvisor Retirement Savings Plan

Effective November 1, 2011, our U.S. employees are generally eligible to participate in a new retirement and savings plan, the TripAdvisor

Retirement Savings Plan (the “401(k) Plan”),

that qualifies under Section 401(k) of the Internal Revenue Code. This 401(k) Plan is similar to and

has replaced the Expedia 401(k) Plan, allowing all employees to make contributions of a specified percentage of their compensation.

Participating employees may contribute up to 50% of their pretax salary, but not more than statutory limits. We match 50% of the first 6% of

employee contributions to the plan for a maximum employer contribution of 3% of a participant’

s eligible earnings. The 401(k) Plan additionally

allows certain employees to contribute amounts above the specified percentage, which are not subject to any employer match. Our contributions

vest with the employee after the employee completes two years of service. We also have various defined contribution plans for our international

employees. Our employee’s interests were rolled into the 401(k) Plan from the Expedia 401(k) Plan in connection with the creation of our new

plan on November 1, 2011. Our contributions to the 401(k) Plan were not material for the period from November 1, 2011 through December 31,

2011.

TripAdvisor, Inc. Deferred Compensation Plan for Non-Employee Directors

On December 20, 2011, the TripAdvisor, Inc. Deferred Compensation Plan for Non-Employee Directors (the “Plan”) became effective.

Under the Plan, eligible directors who defer their directors’ fees may elect to have such deferred fees (i) applied to the purchase of share units,

representing the number of shares of our Common Stock that could have been purchased on the date such fees would otherwise be payable, or

(ii) credited to a cash

85

2012

$

6,055

2013

3,918

2014

2,122

2015

297

2016

273

2017 and thereafter

1,065

Total

$

13,730