TripAdvisor 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTE 10: COMMITMENTS AND CONTINGENCIES

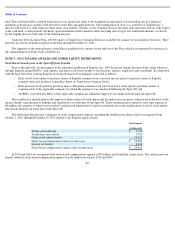

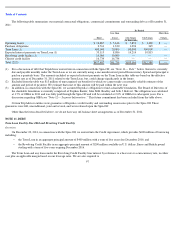

Term Loan Facility Due 2016 and Revolving Credit Facility

On December 20, 2011, in connection with the Spin-

Off, we entered into the Credit Agreement, which provides $600 million of borrowing

facilities including:

Refer to “Note 11— Debt, ” below for further information on the Credit Agreement.

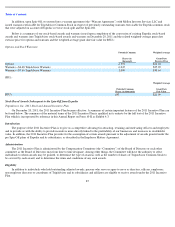

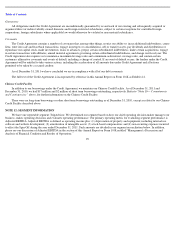

Chinese Credit Facility

In August 2010, certain of our Chinese subsidiaries entered into a RMB 67,000,000 (approximately $10 million), one-

year revolving credit

facility (the “Chinese Credit Facility”) with Bank of America. In June 2011, the Chinese Credit Facility was amended to extend the facility to

March 2012 and increase the borrowing capacity to RMB 130,000,000 (approximately $20 million). In December 2011 the Chinese Credit

Facility was amended to extend the facility to September 2012. The Chinese Credit Facility was unconditionally guaranteed by Expedia prior to

the Spin-Off. This guarantee was subsequently released in connection with the Spin-Off. As of December 31, 2011 and December 31, 2010, we

had $17 million and $2 million of borrowings outstanding, under the Chinese Credit Facility, respectively. The Chinese Credit Facility bears

interest based on the People’s Bank of China’s base rate, which was 6.56% and 5.81% as of December 31, 2011 and December 31, 2010,

respectively.

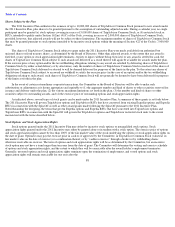

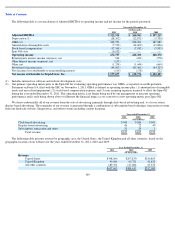

Office Lease Commitments

We have contractual obligations in the form of operating leases for office space and related office equipment for which we record the

related expense on a monthly basis. Certain leases contain periodic rent escalation adjustments and renewal options. Rent expense related to such

leases is recorded on a straight-line basis. Operating lease obligations expire at various dates with the latest maturity in December 2015. For the

years ended December 31, 2011, 2010 and 2009, we recorded rental expense of $6 million, $6 million and $4 million, respectively.

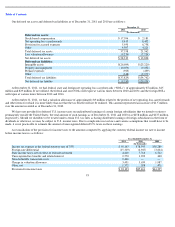

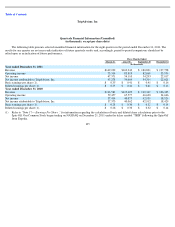

The following table presents our estimated future minimum rental payments under operating leases with non-cancelable lease terms that

expire after December 31, 2011, in thousands:

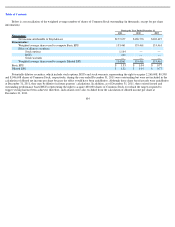

Purchase Commitments

As of December 31, 2011, we had minimum non-

cancelable purchase obligations with certain of our vendors, which we expect to utilize in

the ordinary course of business.

96

•

the Term Loan in an aggregate principal amount of $400 million with a term of five years due December 2016; and

•

the Revolving Credit Facility in an aggregate principal amount of $200 million available in U.S. dollars, Euros and British pound

sterling with a term of five years expiring December 2016.

2012

$

5,616

2013

4,619

2014

3,232

2015

1,420

Total

$

14,887