Toyota 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82 TOYOTA •Annual Report 2008 •

Financial Section

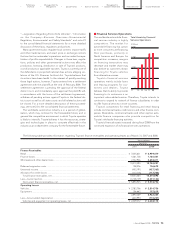

During fiscal 2007, operating income (before the elimination

of intersegment profits) by significant geographies resulted in

an increase of ¥381.3 billion, or 35.4%, in Japan, a decrease of

¥46.0 billion, or 9.3%, in North America, an increase of ¥43.4 bil-

lion, or 46.2% in Europe, a decrease of ¥27.9 billion, or 19.2%, in

Asia, and an increase of ¥16.3 billion, or 24.3% in Other com-

pared with the prior year. The increase in Japan relates primari-

ly to the vehicle unit sales growth in the export markets partially

offset by changes in sales mix, continued cost reduction efforts

and the favorable impact of fluctuations in foreign currency

translation rates. The increase was partially offset by increases

in research and development expenses. The decrease in North

America is attributed primarily to the impact of start-up costs

relating to the Texas plant, and the impact of losses due to

changes in the fair value of derivative financial instruments such

as interest rate swaps, partially offset by the increase in vehicle

unit sales, the impact of cost reduction efforts in the manufac-

turing operations and the favorable impact of fluctuations in

foreign currency translation rates. The increase in Europe

relates mainly to the impact of an increase in production vol-

ume and vehicle unit sales, cost reduction efforts in the manu-

facturing operations and the favorable impact of fluctuations in

foreign currency translation rates. The decrease in Asia relates

primarily to the decrease in production volume and vehicle unit

sales. The increase in Other relates primarily to the impact of

the increase in production volume and vehicle unit sales mainly

attributed to the IMV series.

The following is a discussion of operating income for each of

Toyota’s business segments. The operating income amounts

discussed are before the elimination of intersegment profits.

• Automotive Operations Segment

Operating income from Toyota’s automotive operations

increased by ¥344.8 billion, or 20.4%, to ¥2,038.8 billion during

fiscal 2007 compared with the prior year. This increase is primar-

ily attributed to the increase in vehicle unit sales, the increase in

parts sales, the impact of continued cost reduction efforts and

the favorable impact of fluctuations in foreign currency transla-

tion rates. This increase was partially offset by, the increase in

research and development expenses and the increase in

expenses corresponding to business expansion.

• Financial Services Operations Segment

Operating income from Toyota’s financial services operations

increased by ¥2.7 billion, or 1.7%, to ¥158.5 billion during fiscal

2007 compared with the prior year. This increase is primarily

attributed to the impact of a higher volume of financing activi-

ties mainly in North America and the favorable impact of fluctu-

ations in foreign currency translation rates, which was partially

offset by the impact of losses due to changes in the fair value of

derivative financial instruments such as interest rate swaps.

• All Other Operations Segment

Operating income from Toyota’s other businesses remained

consistent to ¥39.6 billion during fiscal 2007 compared with the

prior year.

■Other Income and Expenses

Interest and dividend income increased by ¥38.0 billion, or

40.4%, to ¥132.0 billion during fiscal 2007 compared with the

prior year mainly due to an increase in investment securities

held by the United States subsidiaries.

Interest expense increased by ¥27.7 billion, or 2.3 times to

¥49.3 billion during fiscal 2007 compared with the prior year

due to an increase in interest expense in the automotive opera-

tions segment.

Foreign exchange gains, net increased by ¥22.2 billion, or 3.1

times, to ¥33.0 billion during fiscal 2007 compared with the

prior year. Foreign exchange gains and losses include the dif-

ferences between the value of foreign currency denominated

sales translated at prevailing exchange rates and the value of

the sales amounts settled during the year, including those set-

tled using forward foreign currency exchange contracts.

Other income, net decreased by ¥97.6 billion, or 77.6%, to

¥28.2 billion during fiscal 2007 compared with the prior year.

This decrease primarily relates to the gain of ¥143.3 billion for a

nonmonetary exchange of marketable equity securities recorded

during fiscal 2006. The gain was calculated in accordance with

Emerging Issues Task Force (“EITF”) No. 91-5 “Nonmonetary

Exchange of Cost-Method Investments”, which was determined

as the difference between acquisition costs of pre-merger UFJ

Holdings, Inc. shares that Toyota had held and the fair market

value of post-merger Mitsubishi UFJ Financial Group, Inc.

shares that Toyota received in exchange for shares of UFJ

Holdings, Inc. following the merger between Mitsubishi Tokyo

Financial Group, Inc. and UFJ Holdings, Inc.

■Income Taxes

The provision for income taxes increased by ¥103.2 billion, or

13.0%, to ¥898.3 billion during fiscal 2007 compared with the

prior year primarily due to the increase in income before

income taxes. The effective tax rate for fiscal 2007 remained rel-

atively unchanged compared to the rate for fiscal 2006.

■Minority Interest in Consolidated Subsidiaries

and Equity in Earnings of Affiliated Companies

Minority interest in consolidated subsidiaries decreased by

¥34.7 billion, or 41.1%, to ¥49.7 billion during fiscal 2007 com-

pared with the prior year. This decrease was mainly due to the

decrease of a gain calculated in accordance with EITF 91-5 from

the nonmonetary exchange of marketable equity investments

related shares of UFJ Holdings, Inc. held by a domestic consoli-

dated subsidiary prior to the merger with Mitsubishi Tokyo

Financial Group, Inc. resulting in the receipt of new shares in

the post-merger entity.

Equity in earnings of affiliated companies during fiscal 2007

increased by ¥45.2 billion, or 27.5%, to ¥209.5 billion compared

with the prior year due to an increase in net income attributable

to favorable operations at the affiliated companies.

■

■