Toyota 2008 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2008 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

•Annual Report 2008 • TOYOTA

Performance Messages from the Management &

•Overview •Management •Special Feature •Business Overview •Corporate Information •Financial Section •Investor Information •

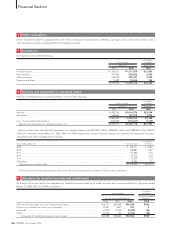

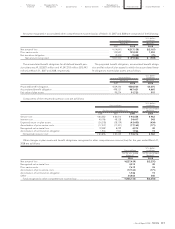

Detailed components of accumulated other comprehensive income (loss) at March 31, 2007 and 2008 and the related changes, net of

taxes for the years ended March 31, 2006, 2007 and 2008 consist of the following:

Yen in millions

Foreign Minimum Accumulated

currency Unrealized pension Pension other

translation gains on liability liability comprehensive

adjustments securities adjustments adjustments income (loss)

Balances at March 31, 2005 ......................................................... ¥(439,333) ¥375,379 ¥(16,706) ¥ — ¥ (80,660)

Other comprehensive income ........................................................ 268,410 244,629 4,937 — 517,976

Balances at March 31, 2006 ......................................................... (170,923) 620,008 (11,769) — 437,316

Other comprehensive income ........................................................ 130,746 38,800 3,499 — 173,045

Adjustment to initially apply FAS 158............................................. — — 8,270 82,759 91,029

Balances at March 31, 2007 ......................................................... (40,177) 658,808 — 82,759 701,390

Other comprehensive income (loss)............................................... (461,189) (347,829) — (133,577) (942,595)

Balances at March 31, 2008 .........................................................

¥(501,366) ¥310,979 ¥ — ¥ (50,818) ¥(241,205)

U.S. dollars in millions

Foreign Minimum Accumulated

currency Unrealized pension Pension other

translation gains on liability liability comprehensive

adjustments securities adjustments adjustments income (loss)

Balances at March 31, 2007 ......................................................... $ (401) $ 6,576 $— $ 826 $ 7,001

Other comprehensive income (loss)............................................... (4,603) (3,472) — (1,333) (9,408)

Balances at March 31, 2008 .........................................................

$(5,004) $ 3,104 $— $ (507) $(2,407)

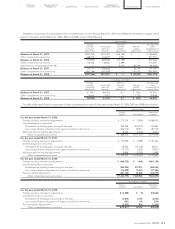

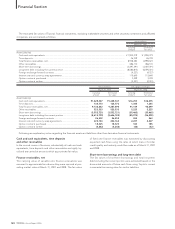

Tax effects allocated to each component of other comprehensive income for the years ended March 31, 2006, 2007 and 2008 are as follows:

Yen in millions

Pre-tax Net-of-tax

amount Tax amount amount

For the year ended March 31, 2006

Foreign currency translation adjustments......................................................................................... ¥ 272,214 ¥ (3,804) ¥ 268,410

Unrealized gains on securities:

Unrealized net holding gains arising for the year......................................................................... 555,789 (223,427) 332,362

Less: reclassification adjustments for gains included in net income........................................... (146,710) 58,977 (87,733)

Minimum pension liability adjustments............................................................................................. 8,260 (3,323) 4,937

Other comprehensive income.................................................................................................... ¥ 689,553 ¥(171,577) ¥ 517,976

For the year ended March 31, 2007

Foreign currency translation adjustments......................................................................................... ¥ 133,835 ¥ (3,089) ¥ 130,746

Unrealized gains on securities:

Unrealized net holding gains arising for the year......................................................................... 78,055(31,378) 46,677

Less: reclassification adjustments for gains included in net income........................................... (13,172) 5,295 (7,877)

Minimum pension liability adjustments............................................................................................. 5,854 (2,355) 3,499

Other comprehensive income.................................................................................................... ¥ 204,572 ¥ (31,527) ¥ 173,045

For the year ended March 31, 2008

Foreign currency translation adjustments.........................................................................................

¥(460,723) ¥ (466) ¥(461,189)

Unrealized losses on securities:

Unrealized net holding losses arising for the year........................................................................

(545,555) 219,313 (326,242)

Less: reclassification adjustments for gains included in net income...........................................

(36,099) 14,512 (21,587)

Pension liability adjustments ..............................................................................................................

(221,142) 87,565 (133,577)

Other comprehensive income (loss) ..........................................................................................

¥(1,263,519) ¥ 320,924 ¥(942,595)

U.S. dollars in millions

Pre-tax Net-of-tax

amount Tax amount amount

For the year ended March 31, 2008

Foreign currency translation adjustments.........................................................................................

$(4,598) $ (5) $(4,603)

Unrealized losses on securities:

Unrealized net holding losses arising for the year........................................................................

(5,445) 2,189 (3,256)

Less: reclassification adjustments for gains included in net income...........................................

(361) 145 (216)

Pension liability adjustments ..............................................................................................................

(2,207) 874 (1,333)

Other comprehensive income (loss) ..........................................................................................

$(12,611) $3,203 $(9,408)