Toyota 2008 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2008 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

•Annual Report 2008 • TOYOTA

development even under such conditions as rises in raw material costs and

drastic changes in foreign exchange rates, and underpins the high credit

ratings that enable access to stable, low-cost financing even during the credit

crunch. In view of anticipated medium-to-long term growth in automotive

markets worldwide, we believe that maintaining adequate liquidity is essential

for the implementation of forward-looking investment to improve products

and develop next-generation technology, as well as establish production and

sales operations for the expansion of businesses worldwide.

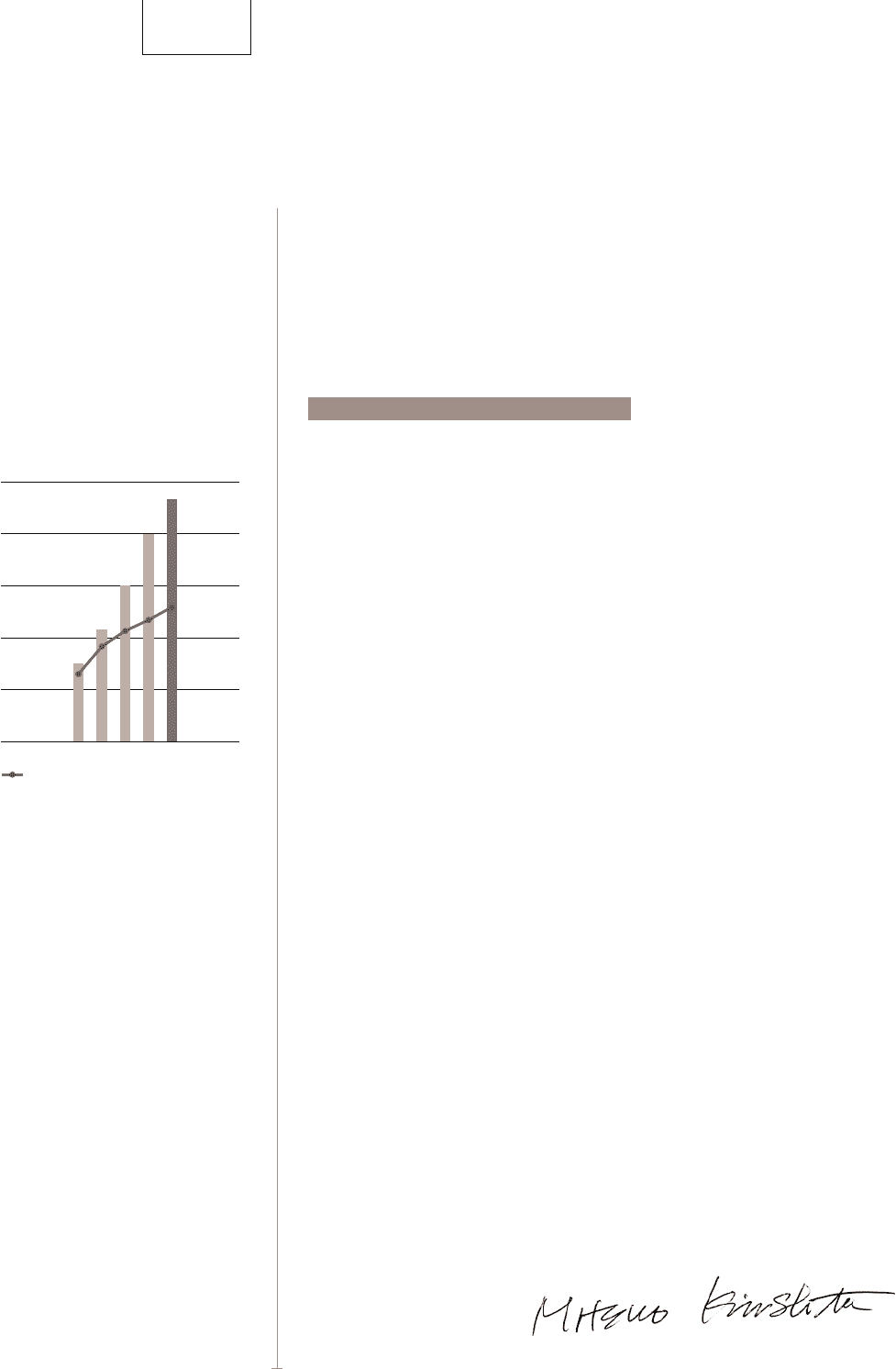

Toyota considers the returning of profits to its shareholders as one of its

priority management policies and continuously strives to increase per-share

earnings through aggressively promoting its business while improving and

strengthening its corporate foundations. With respect to the payment of

dividends, Toyota declared an annual dividend payment of ¥140 per share at

the end of fiscal 2008, which is an increase of ¥20 from the previous fiscal year.

This marks the ninth consecutive term of dividend increase—a record high for

Toyota. The consolidated dividend payout ratio increased from 23.4% in fiscal

2007 to 25.9% in fiscal 2008. Going forward, Toyota aims to achieve a

consolidated dividend payout ratio of 30% at an early stage, as well as strives

for continuous growth of dividend per share, giving due consideration to such

factors as business results for each term and new investment plans.

With respect to the repurchase of our own shares, all shares authorized at

the Ordinary General Shareholders’ Meeting held in June 2007, which were

the lesser of 30 million shares or the number of shares equivalent to ¥250

billion in cost of repurchase, were repurchased. Furthermore, in February 2008

the Board of Directors authorized an additional share repurchase of the lesser

of 12 million shares or the number of shares equivalent to ¥60 billion in cost

of repurchase, and as of March 31, 2008, 9.52 million shares at a total cost of

¥59.9 billion were repurchased. In fiscal 2008, Toyota repurchased 49 million

shares at a total cost of ¥317 billion. Since Toyota began repurchasing shares

in fiscal 1997, the cumulative number of shares repurchased as of the end of

June 2008 was approximately 722.04 million shares at a total cost of

approximately ¥2,796.0 billion.

To define improvement of capital efficiency, Toyota canceled 162 million

shares of its treasury stock at the end of fiscal 2008. Toyota will continue to

retain the remaining treasury stock of approximately 300 million shares to

achieve flexibility in management, but as a principle, plans to cancel all shares

it repurchases in the future. At the Ordinary General Shareholders’ Meeting

held in June 2008, a resolution was passed to authorize the repurchase of

30 million shares at a total cost of ¥200 billion. Toyota aims to continue

repurchasing shares to effectively respond to changes in the management

environment and to improve capital efficiency.

Going forward, Toyota hopes to continue meeting shareholders’

expectations through medium-to-long term growth and the active return

of profits to shareholders.

July 2008

Mitsuo Kinoshita, Executive Vice President

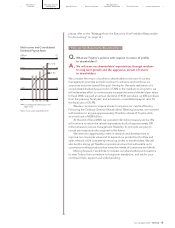

Dividends and Share Acquisitions

Performance Messages from the Management &

•Overview •Management •Special Feature •Business Overview •Corporate Information •Financial Section •Investor Information •

’04

+9

45

’05

+20

65

’06

+25

90

’07

+30

120

’08

+20

140

0

60

30

90

150

120

0

20

10

30

50

40

(¥) (%)

FY

Consolidated dividend payout ratio

(Right scale)

Dividends per Share

Note: Fiscal years ended March 31