Toyota 2008 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2008 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

•Annual Report 2008 • TOYOTA

please refer to the “Message from the Executive Vice President Responsible

for Accounting” on page 16.)

Q.What are Toyota’s policies with respect to return of profits

to shareholders?

A.We will meet our shareholders’ expectations through medium-

to-long term growth and the aggressive pursuit of returns

to shareholders.

We consider the return of profits to shareholders to be one of our key

management priorities and will continue to enhance and reinforce our

corporate structure toward this goal. Aiming for the early realization of a

consolidated dividend payout ratio of 30% in the medium-to-long term, we

will make every effort to continuously increase the annual dividend per share.

In fiscal 2008, we paid an annual dividend of ¥140 per share, up ¥20 per share

from the previous fiscal year, and achieved a consolidated payout ratio for

the fiscal year of 25.9%.

We also continue to acquire shares to improve our capital efficiency.

Following the Ordinary General Shareholders’ Meeting last year, we received

authorization to acquire approximately 30 million shares of Toyota stock,

at a total cost of ¥200 billion.

At the end of fiscal 2008, we canceled 162 million treasury stocks. We

will continue to retain the remaining treasury stock of approximately 300

million shares to secure management flexibility. In principle, we plan to

cancel any treasury stocks acquired in the future.

We intend to aggressively invest in research and development to

improve our corporate value and to expand our production facilities and

sales network while consistently returning profits to shareholders. We will

also build a strong yet flexible corporate structure that will enable us to

continue providing products that meet the needs of customers worldwide.

Moving forward, I would like to request our shareholders and investors

to view Toyota from a medium-to-long term standpoint, and ask for your

continued trust, support and understanding.

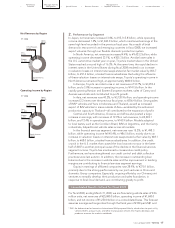

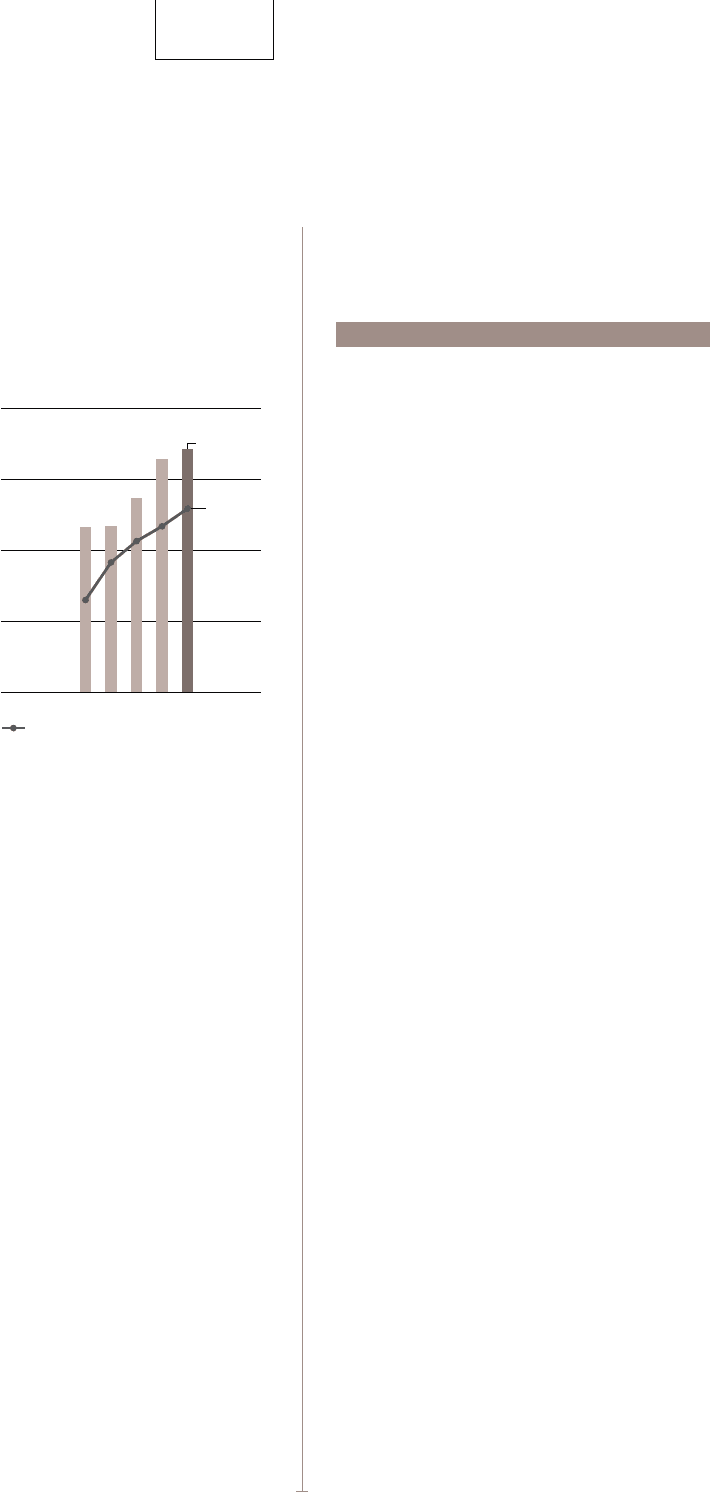

Policies for Returns to Shareholders

Performance Messages from the Management &

•Overview •Management •Special Feature •Business Overview •Corporate Information •Financial Section •Investor Information •

’04 ’05 ’06 ’07 ’08

0

1,000

500

1,500

2,000

0

10

20

40

30

(¥ Billion) (%)

Consolidated dividend payout ratio

(Right scale)

FY

1,717.8

25.9%

Net Income and Consolidated

Dividend Payout Ratio

Note: Fiscal years ended March 31