Toyota 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110 TOYOTA •Annual Report 2008 •

Financial Section

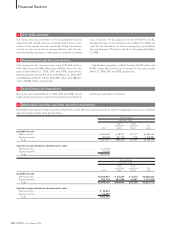

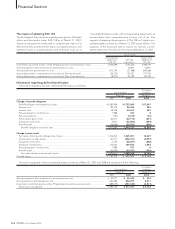

The provision for income taxes consists of the following:

U.S. dollars

Yen in millions in millions

For the year ended

For the years ended March 31, March 31,

2006 2007 2008 2008

Current income tax expense:

Parent company and domestic subsidiaries ................................................. ¥451,593 ¥591,840 ¥491,185 $4,903

Foreign subsidiaries ........................................................................................ 310,298 174,164 338,852 3,382

Total current................................................................................................. 761,891 766,004 830,037 8,285

Deferred income tax expense (benefit):

Parent company and domestic subsidiaries ................................................. 76,503 51,740 119,333 1,191

Foreign subsidiaries ........................................................................................ (43,241) 80,568 (37,875) (378)

Total deferred.............................................................................................. 33,262 132,308 81,458 813

Total provision............................................................................................. ¥795,153 ¥898,312 ¥911,495 $9,098

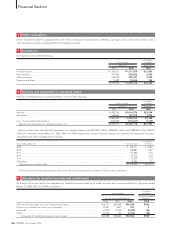

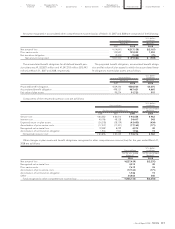

For the years ended March 31,

2006 2007 2008

Statutory tax rate ................................................................................................................................. 40.2% 40.2% 40.2%

Increase (reduction) in taxes resulting from:

Non-deductible expenses .............................................................................................................. 0.4 0.5 0.6

Increase in deferred tax liabilities on undistributed earnings of foreign

subsidiaries and affiliates accounted for by the equity method................................................ 2.8 3.1 4.0

Valuation allowance......................................................................................................................... (0.4) 0.1 (0.5)

Tax credits ........................................................................................................................................ (4.1) (3.9) (4.4)

Other................................................................................................................................................. (0.8) (2.3) (2.5)

Effective income tax rate..................................................................................................................... 38.1% 37.7% 37.4%

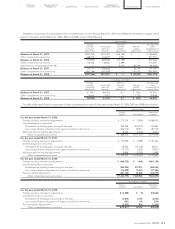

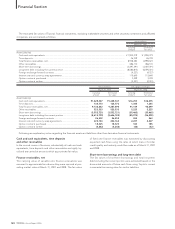

Significant components of deferred tax assets and liabilities are as follows:

U.S. dollars

Yen in millions in millions

March 31, March 31,

2007 2008 2008

Deferred tax assets

Accrued pension and severance costs ..................................................................................... ¥ 104,470 ¥ 156,924 $ 1,566

Warranty reserves and accrued expenses................................................................................ 218,125 205,564 2,052

Other accrued employees’ compensation............................................................................... 120,004 129,472 1,292

Operating loss carryforwards for tax purposes........................................................................ 35,629 54,368 543

Inventory adjustments................................................................................................................ 57,698 67,904 678

Property, plant and equipment and other assets.................................................................... 168,535 180,922 1,806

Other ........................................................................................................................................... 349,933 332,779 3,321

Gross deferred tax assets ...................................................................................................... 1,054,394 1,127,933 11,258

Less—Valuation allowance ........................................................................................................(95,225) (82,191) (820)

Total deferred tax assets .......................................................................................................959,169 1,045,742 10,438

Deferred tax liabilities

Unrealized gains on securities................................................................................................... (465,280) (279,795) (2,793)

Undistributed earnings of foreign subsidiaries and affiliates accounted

for by the equity method......................................................................................................... (559,591) (607,510) (6,064)

Basis difference of acquired assets........................................................................................... (37,778) (37,919) (378)

Lease transactions ...................................................................................................................... (419,259) (405,028) (4,042)

Gain on securities contribution to employee retirement benefit trust.................................. (66,523) (66,523) (664)

Other ........................................................................................................................................... (80,380) (80,230) (801)

Gross deferred tax liabilities..................................................................................................(1,628,811) (1,477,005) (14,742)

Net deferred tax liability........................................................................................................ ¥ (669,642) ¥ (431,263) $ (4,304)

Toyota is subject to a number of different income taxes

which, in the aggregate, indicate a statutory rate in Japan of

approximately 40.2% for the years ended March 31, 2006, 2007,

and 2008. Such rate was also used to calculate the tax effects of

temporary differences, which are expected to be realized in the

future years. Reconciliation of the differences between the

statutory tax rate and the effective income tax rate is as follows: