Toyota 2008 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2008 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130 TOYOTA •Annual Report 2008 •

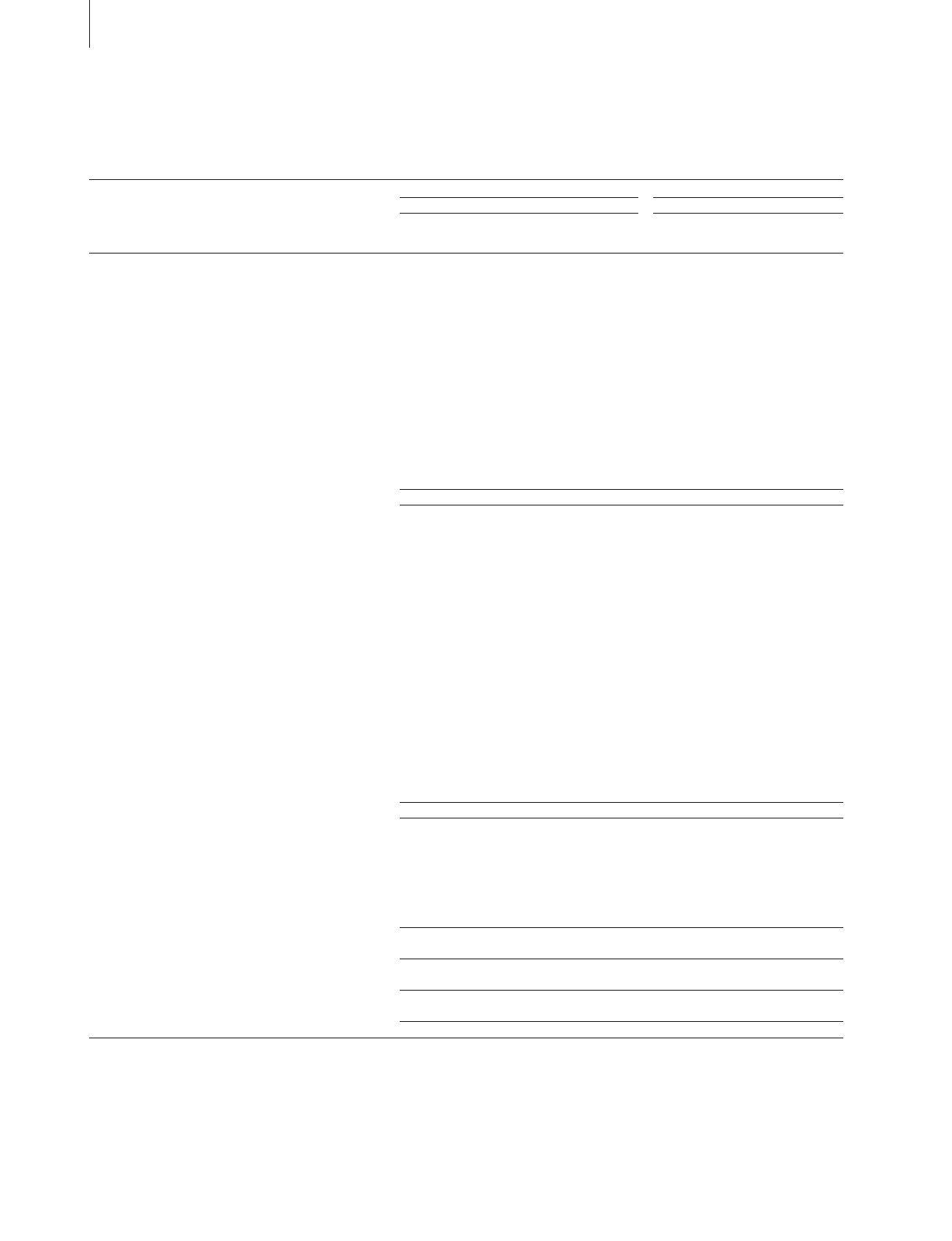

Financial Section

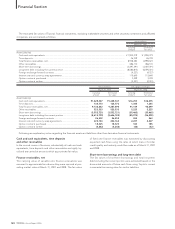

Yen in millions U.S. dollars in millions

For the year ended March 31, 2008 For the year ended March 31, 2008

Non-Financial Financial Non-Financial Financial

Services Services Services Services

Businesses Businesses Consolidated Businesses Businesses Consolidated

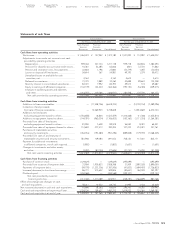

Cash flows from operating activities

Net income........................................................................ ¥ 1,671,859 ¥ 45,995 ¥ 1,717,879 $ 16,687 $ 459 $ 17,146

Adjustments to reconcile net income to net cash

provided by operating activities

Depreciation.................................................................. 1,081,410 409,725 1,491,135 10,793 4,090 14,883

Provision for doubtful accounts and credit losses ..... 357 122,433 122,790 4 1,222 1,226

Pension and severance costs, less payments ............. (54,868) 527 (54,341) (547) 5 (542)

Losses on disposal of fixed assets............................... 44,993 444 45,437 449 5 454

Unrealized losses on available-for-sale

securities, net .............................................................. 11,346 — 11,346 113 — 113

Deferred income taxes................................................. 80,027 1,500 81,458 798 15 813

Minority interest in consolidated subsidiaries............ 73,543 4,419 77,962 734 44 778

Equity in earnings of affiliated companies.................. (268,025) (2,089) (270,114) (2,675) (21) (2,696)

Changes in operating assets and liabilities,

and other ..................................................................... (220,217) 215,218 (241,928) (2,198) 2,148 (2,415)

Net cash provided by operating activities.............. 2,420,425 798,172 2,981,624 24,158 7,967 29,760

Cash flows from investing activities

Additions to finance receivables ..................................... — (16,644,139) (8,647,717) — (166,126) (86,313)

Collection of and proceeds

from sale of finance receivables .................................... —15,095,380 7,332,697 — 150,667 73,188

Additions to fixed assets

excluding equipment leased to others......................... (1,472,422) (8,148) (1,480,570) (14,697) (81) (14,778)

Additions to equipment leased to others ...................... (137,711) (1,141,694) (1,279,405) (1,375) (11,395) (12,770)

Proceeds from sales of fixed assets

excluding equipment leased to others......................... 56,603 10,948 67,551 565 109 674

Proceeds from sales of equipment leased to others..... 80,944 294,937 375,881 808 2,944 3,752

Purchases of marketable securities

and security investments................................................ (936,324) (215,316) (1,151,640) (9,346) (2,149) (11,495)

Proceeds from sales of and maturity of

marketable securities and security investments........... 789,366 198,044 987,410 7,879 1,977 9,856

Payment for additional investments

in affiliated companies, net of cash acquired............... (4,406) — (4,406) (44) — (44)

Changes in investments and other assets,

and other ......................................................................... (44,891) 23,024 (74,687) (447) 230 (745)

Net cash used in investing activities ....................... (1,668,841) (2,386,964) (3,874,886) (16,657) (23,824) (38,675)

Cash flows from financing activities

Purchase of common stock.............................................. (311,667) — (311,667) (3,111) — (3,111)

Proceeds from issuance of long-term debt.................... 17,162 3,364,351 3,349,812 171 33,579 33,434

Payments of long-term debt............................................ (226,561) (2,156,709) (2,310,008) (2,261) (21,526) (23,056)

Increase in short-term borrowings .................................. 24,126 370,293 408,912 241 3,696 4,081

Dividends paid .................................................................. (430,860) — (430,860) (4,300) — (4,300)

Net cash provided by (used in)

financing activities................................................... (927,800) 1,577,935 706,189 (9,260) 15,749 7,048

Effect of exchange rate changes on cash

and cash equivalents .......................................................... (65,405) (19,354) (84,759) (653) (193) (846)

Net decrease in cash and cash equivalents........................ (241,621) (30,211) (271,832) (2,412) (301) (2,713)

Cash and cash equivalents at beginning of year ............... 1,714,722 185,657 1,900,379 17,115 1,853 18,968

Cash and cash equivalents at end of year .......................... ¥ 1,473,101 ¥ 155,446 ¥ 1,628,547 $ 14,703 $ 1,552 $ 16,255