Toyota 2008 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2008 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

•Annual Report 2008 • TOYOTA

Performance Messages from the Management &

•Overview •Management •Special Feature •Business Overview •Corporate Information •Financial Section •Investor Information •

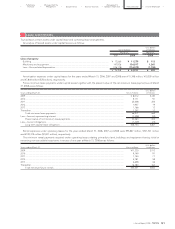

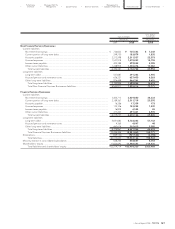

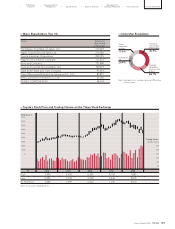

Reconciliations of the differences between basic and diluted net income per share for the years ended March 31, 2006, 2007 and 2008

are as follows:

Thousands

Yen in millions of shares Yen U.S. dollars

Weighted- Net income Net income

Net income average shares per share per share

For the year ended March 31, 2006

Basic net income per common share................................................................................ ¥1,372,180 3,253,450 ¥421.76

Effect of dilutive securities

Assumed exercise of dilutive stock options ............................................................. (5) 1,049

Diluted net income per common share............................................................................ ¥1,372,175 3,254,499 ¥421.62

For the year ended March 31, 2007

Basic net income per common share................................................................................ ¥1,644,032 3,210,422 ¥512.09

Effect of dilutive securities

Assumed exercise of dilutive stock options ............................................................. (2) 1,812

Diluted net income per common share............................................................................ ¥1,644,030 3,212,234 ¥511.80

For the year ended March 31, 2008

Basic net income per common share................................................................................

¥1,717,879 3,177,445 ¥540.65 $5.40

Effect of dilutive securities

Assumed exercise of dilutive stock options .............................................................

(1)

1,217

Diluted net income per common share............................................................................

¥1,717,878 3,178,662 ¥540.44 $5.39

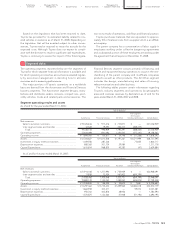

Thousands

Yen in millions of shares Yen U.S. dollars

Shares issued and

outstanding at the Net assets Net assets

Net assets end of the year per share per share

March 31, 2007 .................................................................................................................... ¥11,836,092 3,197,936 ¥3,701.17

March 31, 2008..................................................................................................................

11,869,527 3,149,279 3,768.97 $37.62

Per share amounts:

25

.

Certain stock options were not included in the computation

of diluted net income per share for the years ended March 31,

2008 because the options’ exercise prices were greater than the

average market price per common share during the period.

The following table shows Toyota’s net assets per share as

of March 31, 2007 and 2008. Net assets per share amounts are

calculated as dividing net assets’ amount at the end of each

period by the number of shares issued and outstanding at the

end of corresponding period. In addition to the disclosure

requirements under FAS No. 128,

Earnings per Share

, Toyota

discloses this information in order to provide financial state-

ment users with valuable information.