Toyota 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

■

75

•Annual Report 2008 • TOYOTA

Performance Messages from the Management &

•Overview •Management •Special Feature •Business Overview •Corporate Information •Financial Section •Investor Information •

“—Legislation Regarding End-of-Life Vehicles”, “Information

on the Company—Business Overview—Governmental

Regulation, Environmental and Safety Standards” and note 23

to the consolidated financial statements for a more detailed

discussion of these laws, regulations and policies.

Many governments also regulate local content, impose tariffs

and other trade barriers, and enact price or exchange controls

that can limit an automaker’s operations and can make the repa-

triation of profits unpredictable. Changes in these laws, regula-

tions, policies and other governmental actions may affect the

production, licensing, distribution or sale of Toyota’s products,

cost of products or applicable tax rates. Toyota is currently one of

the defendants in purported national class actions alleging vio-

lations of the U.S. Sherman Antitrust Act. Toyota believes that

its actions have been lawful. In the interest of quickly resolving

these legal actions, however, Toyota entered into a settlement

agreement with the plaintiffs at the end of February 2006. The

settlement agreement is pending the approval of the federal

district court, and immediately upon approval the plaintiffs will,

in accordance with the terms of the settlement agreement,

withdraw all pending actions against Toyota in the federal dis-

trict court as well as all state courts and all related actions will

be closed. For a more detailed description of these proceed-

ings, see note 23 to the consolidated financial statements.

The worldwide automotive industry is in a period of global-

ization, which may continue for the foreseeable future, and in

general the competitive environment in which Toyota operates

is likely to intensify. Toyota believes it has the resources, strate-

gies and technologies in place to compete effectively in the

industry as an independent company for the foreseeable future.

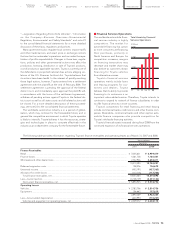

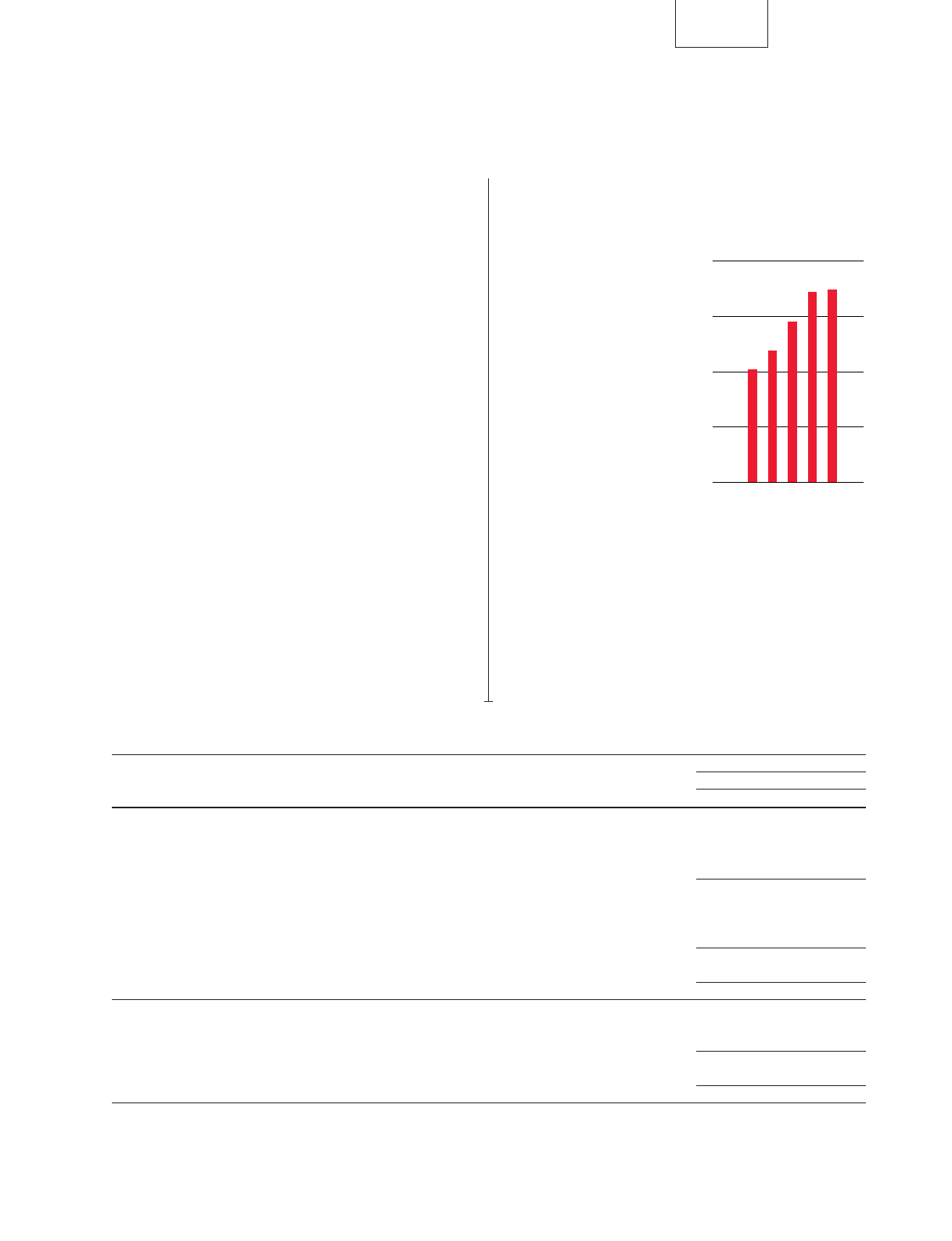

■Financial Services Operations

The worldwide automobile finan-

cial services industry is highly

competitive. The market for

automobile financing has grown

as more consumers are financing

their purchases, primarily in

North America and Europe. As

competition increases, margins

on financing transactions may

decrease and market share may

also decline as customers obtain

financing for Toyota vehicles

from alternative sources.

Toyota’s financial services

operations mainly include loans

and leasing programs for cus-

tomers and dealers. Toyota

believes that its ability to provide

financing to its customers is an

important value added service. Therefore, Toyota intends to

continue to expand its network of finance subsidiaries in order

to offer financial services in more countries.

Toyota’s competitors for retail financing and retail leasing

include commercial banks, credit unions and other finance com-

panies. Meanwhile, commercial banks and other captive auto-

mobile finance companies also provide competition for

Toyota’s wholesale financing activities.

Toyota’s financial assets increased during fiscal 2008 from the

continued expansion of its financial services operations.

’04FY ’05 ’06 ’07 ’08

0

8,000

16,000

4,000

12,000

(¥ Billion)

Total Assets by Financial

Services Operations

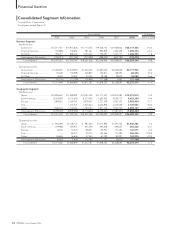

The following table provides information regarding Toyota’s finance receivables and operating leases as of March 31, 2007 and 2008.

Yen in millions

March 31,

2007 2008

Finance Receivables

Retail .............................................................................................................................................................................. ¥ 7,005,631 ¥6,959,479

Finance leases............................................................................................................................................................... 1,061,738 1,160,401

Wholesale and other dealer loans .............................................................................................................................. 2,342,926 2,604,411

10,410,295 10,724,291

Deferred origination costs ........................................................................................................................................... 108,076 106,678

Unearned income ......................................................................................................................................................... (403,191) (437,365)

Allowance for credit losses .......................................................................................................................................... (112,116) (117,706)

Total finance receivables, net.................................................................................................................................. 10,003,064 10,275,898

Less—Current portion.................................................................................................................................................. (4,108,139) (4,301,142)

Noncurrent finance receivables, net ....................................................................................................................... ¥ 5,894,925 ¥5,974,756

Operating Leases

Vehicles.......................................................................................................................................................................... ¥ 2,783,706 ¥2,814,706

Equipment..................................................................................................................................................................... 106,663 107,619

2,890,369 2,922,325

Less—Accumulated depreciation ............................................................................................................................... (640,997) (718,207)

Vehicles and equipment on operating leases, net ................................................................................................ ¥ 2,249,372 ¥2,204,118