Toyota 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 TOYOTA •Annual Report 2008 •

Financial Section

Toyota maintains a program to sell retail and lease finance

receivables. Under the program, Toyota’s securitization transac-

tions are generally structured as qualifying SPEs (“QSPE”s), thus

Toyota achieves sale accounting treatment under the provisions

of FAS 140. Toyota recognizes a gain or loss on the sale of the

finance receivables upon the transfer of the receivables to the

securitization trusts structured as a QSPE. Toyota retains servic-

ing rights and earns a contractual servicing fee of 1% per

annum on the total monthly outstanding principal balance of

the related securitized receivables. In a subordinated capacity,

Toyota retains interest-only strips, subordinated securities, and

cash reserve funds in these securitizations, and these retained

interests are held as restricted assets subject to limited recourse

provisions and provide credit enhancement to the senior

securities in Toyota’s securitization transactions. The retained

interests are not available to satisfy any obligations of Toyota.

Investors in the securitizations have no recourse to Toyota

beyond the contractual cash flows of the securitized receiv-

ables, retained subordinated interests, any cash reserve funds

and any amounts available or funded under the revolving liq-

uidity notes. Toyota’s exposure to these retained interests

exists until the associated securities are paid in full. Investors do

not have recourse to other assets held by Toyota for failure of

obligors on the receivables to pay when due or otherwise.

Toyota sold finance receivables under the program and rec-

ognized pretax gains resulting from these sales of ¥837 million,

¥1,589 million and ¥1,688 million ($17 million) for the years

ended March 31, 2006, 2007 and 2008, respectively, after pro-

viding an allowance for estimated credit losses. The gain on

sale recorded depends on the carrying amount of the assets at

the time of the sale. The carrying amount is allocated between

the assets sold and the retained interests based on their relative

During the year ended March 31, 2008, Toyota sold mortgage loan receivables, while no other retail and finance lease receivables

were securitized.

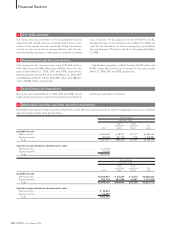

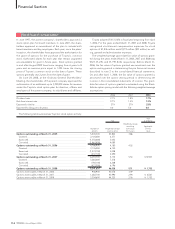

The following table summarizes certain cash flows received from and paid to the securitization trusts for the years ended March 31,

2006, 2007 and 2008.

U.S. dollars

Yen in millions in millions

For the year ended

For the years ended March 31, March 31,

2006 2007 2008 2008

Proceeds from new securitizations, net of purchased and retained securities..... ¥ 88,698 ¥69,018 ¥91,385 $912

Servicing fees received.............................................................................................. 2,297 1,881 1,682 17

Excess interest received from interest only strips ................................................... 4,219 2,818 1,865 19

Repurchases of receivables....................................................................................... (50,086) — (4,681) (47)

Servicing advances..................................................................................................... (453) (234) (114) (1)

Reimbursement of servicing and maturity advances .............................................. 793 234 114 1

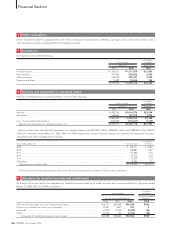

The contractual maturities of retail receivables, the future minimum lease payments on finance leases and wholesale and other dealer

loans at March 31, 2008 are summarized as follows:

Yen in millions U.S. dollars in millions

Wholesale Wholesale

Finance and other Finance and other

Years ending March 31, Retail lease dealer loans Retail lease dealer loans

2009 ..................................................................... ¥1,992,899 ¥272,261 ¥2,109,716 $19,891 $2,718 $21,057

2010 ..................................................................... 1,744,911 195,266 143,833 17,416 1,949 1,436

2011 ..................................................................... 1,442,464 173,664 104,150 14,398 1,733 1,040

2012 ..................................................................... 965,618 74,552 75,085 9,638 744 749

2013 ..................................................................... 530,228 21,607 72,583 5,292 216 724

Thereafter............................................................ 283,359 1,436 99,044 2,828 14 989

¥6,959,479 ¥738,786 ¥2,604,411 $69,463 $7,374 $25,995

Finance leases consist of the following:

U.S. dollars

Yen in millions in millions

March 31, March 31,

2007 2008 2008

Minimum lease payments ................................................................................................................. ¥ 679,311 ¥738,786 $ 7,374

Estimated unguaranteed residual values......................................................................................... 382,427 421,615 4,208

1,061,738 1,160,401 11,582

Deferred origination costs ................................................................................................................ 3,348 4,414 44

Less—Unearned income ................................................................................................................... (100,035) (118,831) (1,186)

Less—Allowance for credit losses .................................................................................................... (4,999) (4,592) (46)

Finance leases, net ........................................................................................................................ ¥ 960,052 ¥1,041,392 $10,394