Toyota 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

•Annual Report 2008 • TOYOTA

Performance Messages from the Management &

•Overview •Management •Special Feature •Business Overview •Corporate Information •Financial Section •Investor Information •

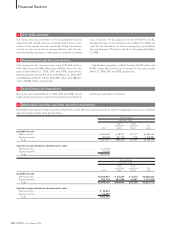

In June 2006, FASB issued FASB Interpretation No. 48,

Accounting for Uncertainty in Income Taxes—an interpretation

of FASB Statement No. 109

(“FIN 48”). FIN 48 clarifies the

accounting for uncertainty in tax positions and requires a com-

pany to recognize in its financial statements, the impact of a tax

position, if that position is more likely than not to be sustained

on audit, based on the technical merits of the position. Toyota

adopted FIN 48 from the fiscal year begun after December 15,

2006. See note 16 to the consolidated financial statements for

the impact of the adoption of the interpretation on Toyota’s

consolidated financial statements.

Recent pronouncements to be adopted

in future periods

In September 2006, FASB issued FAS No. 157,

Fair Value

Measurements

(“FAS 157”), which defines fair value, establishes

a framework for measuring fair value and expands disclosures

about fair value measurements. FAS 157 is effective for financial

statements issued for fiscal year beginning after November 15,

2007. Management does not expect this Statement to have a

material impact on Toyota’s consolidated financial statements.

In September 2006, FASB issued FAS 158. FAS 158 requires

employers to measure the funded status of their defined bene-

fit postretirement plans as of the date of their year-end state-

ment of financial position. This provision in FAS 158 regarding a

measurement date is effective for fiscal year ending after

December 15, 2008. Management does not expect this provi-

sion to have a material impact on Toyota’s consolidated finan-

cial statements.

In February 2007, FASB issued FAS No. 159,

The Fair Value

Option for Financial Assets and Financial Liabilities—Including

an amendment of FASB Statement No. 115

(“FAS 159”). FAS

159 permits entities to measure many financial instruments and

certain other assets and liabilities at fair value on an instrument-

by-instrument basis and subsequent change in fair value must

be recorded in earnings at each reporting date. FAS 159 is

effective for fiscal year beginning after November 15, 2007.

Management is evaluating the impact of adopting FAS 159 on

Toyota’s consolidated financial statements.

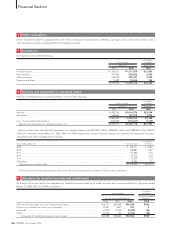

In December 2007, FASB issued FAS No. 141(R),

Business

Combinations

(“FAS 141(R)”). FAS 141(R) establishes principles

and requirements for how the acquirer recognizes and mea-

sures the identifiable assets acquired, the liabilities assumed,

any noncontrolling interest, and the goodwill acquired in a busi-

ness combination or a gain from a bargain purchase. Also, FAS

141(R) provides several new disclosure requirements that

enable users of the financial statements to evaluate the nature

and financial effects of the business combination. FAS 141(R) is

effective to business combinations on and after the beginning

of fiscal year beginning on or after December 15, 2008. The

impact of adopting FAS 141(R) on Toyota’s consolidated finan-

cial statements will depend on the nature and significance of

any acquisitions in the future period.

In December 2007, FASB issued FAS No. 160,

Noncontrolling

Interests in Consolidated Financial Statements—an amendment

of ARB No. 51

(“FAS 160”). FAS 160 amends the guidance in

Accounting Research Bulletin (“ARB”) No. 51,

Consolidated

Financial Statements

(“ARB 51”), to establish accounting and

reporting standards for the noncontrolling interest in a sub-

sidiary and for the deconsolidation of a subsidiary. FAS 160 is

effective for fiscal year beginning on or after December 15,

2008. The presentation and disclosure requirements shall be

applied retrospectively for all periods presented in the consoli-

dated financial statements in which FAS 160 is initially applied.

Management is evaluating the impact of adopting FAS 160 on

Toyota’s consolidated financial statements.

In March 2008, FASB issued FAS No. 161,

Disclosures about

Derivative Instruments and Hedging Activities—an amendment

of FASB Statement No. 133

(“FAS 161”). FAS 161 changes and

enhances the current disclosure requirements for derivative

instruments and hedging activities under FAS 133. FAS 161 is

effective for financial statements for fiscal years beginning after

November 15, 2008. Management does not expect this

Statement to have a material impact on Toyota’s consolidated

financial statements.

Reclassifications

During the year ended March 31, 2008, certain leases that his-

torically have been accounted for as operating leases, were cor-

rected to be accounted for as finance leases. This resulted in

the recognition of current and noncurrent finance receivables

and revenue from financing operations related to finance leas-

es, and the derecognition of vehicles and equipment on oper-

ating leases, accumulated depreciation, revenue from financing

operations related to operating leases, cost of financing opera-

tions including depreciation expense, cash provided by operat-

ing activities and cash used in investing activities, as of and for

the year ended March 31, 2008. Certain prior year amounts

have been reclassified to conform to the presentations as of

and for the year ended March 31, 2008. At March 31, 2007, the

adjustments resulted in an increase in current assets and a

decrease in noncurrent assets. For the years ended March 31,

2006 and 2007, the adjustments resulted in decreases to both

additions to equipment leased to others and proceeds from

sales of equipment leased to others, and increases to both

additions to finance receivables and collection of finance

receivables. These adjustments are immaterial to Toyota’s con-

solidated financial statements for all periods presented.