Spirit Airlines 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

92

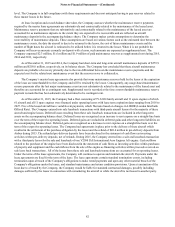

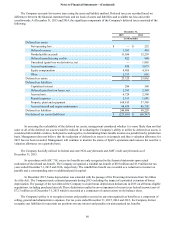

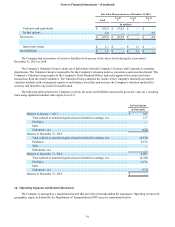

2015 2014 2013

(in millions)

DOT—Domestic . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,940.2 $ 1,728.8 $ 1,467.5

DOT—Latin America . . . . . . . . . . . . . . . . . . . . . 201.3 202.8 186.9

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,141.5 $ 1,931.6 $ 1,654.4

During 2015, 2014 and 2013, no revenue from any one foreign country represented greater than 4% of the Company’s

total passenger revenue. The Company attributes operating revenues by geographic region based upon the origin and

destination of each passenger flight segment. The Company’s tangible assets consist primarily of flight equipment, which are

mobile across geographic markets and, therefore, have not been allocated.

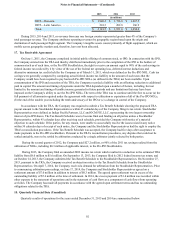

17. Tax Receivable Agreement

On June 1, 2011, the Company completed its initial public offering of common stock, or IPO. In connection with the IPO,

the Company entered into the TRA and thereby distributed immediately prior to the completion of the IPO to the holders of

common stock as of such time, or the Pre-IPO Stockholders, the right to receive an amount equal to 90% of the cash savings in

federal income tax realized by it by virtue of the use of the federal net operating loss, deferred interest deductions and

alternative minimum tax credits held by the Company as of March 31, 2011, which was defined as the Pre-IPO NOL. Cash tax

savings were generally computed by comparing actual federal income tax liability to the amount of such taxes that the

Company would have been required to pay had such Pre-IPO NOLs (as defined in the TRA) not been available. Upon

consummation of the IPO and execution of the TRA, the Company recorded a liability with an offsetting reduction to additional

paid in capital. The amount and timing of payments under the TRA depended upon a number of factors, including, but not

limited to, the amount and timing of taxable income generated in future periods and any limitations that may have been

imposed on the Company's ability to use the Pre-IPO NOLs. The term of the TRA was to continue until the first to occur (a) the

full payment of all amounts required under the agreement with respect to utilization or expiration of all of the Pre-IPO NOLs,

(b) the end of the taxable year including the tenth anniversary of the IPO or (c) a change in control of the Company.

In accordance with the TRA, the Company was required to submit a Tax Benefit Schedule showing the proposed TRA

payout amount to the Stockholder Representatives within 45 calendar days of the Company filing its tax return. Stockholder

Representatives were defined as Indigo Pacific Partners, LLC and OCM FIE, LLC, representing the two largest ownership

interest of pre-IPO shares. The Tax Benefit Schedule was to become final and binding on all parties unless a Stockholder

Representative, within 45 calendar days after receiving such schedule, provided the Company with notice of a material

objection to such schedule. If the parties, for any reason, were unable to successfully resolve the issues raised in any notice

within 30 calendar days of receipt of such notice, the Company and the Stockholder Representatives had the right to employ the

TRA's reconciliation procedures. If the Tax Benefit Schedule was accepted, the Company had five days after acceptance to

make payments to the Pre-IPO stockholders. Pursuant to the TRA's reconciliation procedures, any disputes that could not be

settled amicably, were to be settled by arbitration conducted by a single arbitrator jointly selected by both parties.

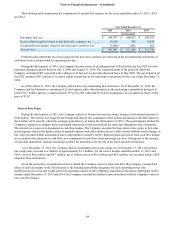

During the second quarter of 2012, the Company paid $27.2 million, or 90% of the 2011 tax savings realized from the

utilization of NOLs, including $0.3 million of applicable interest, to the Pre-IPO Stockholders.

During 2013, the Company filed an amended 2009 income tax return which resulted in a reduction to the estimated TRA

liability from $8.0 million to $5.6 million. On September 13, 2013, the Company filed its 2012 federal income tax return, and

on October 14, 2013, the Company submitted the Tax Benefit Schedule to the Stockholder Representatives. On November 27,

2013, pursuant to the TRA, the Company received an objection notice to the Tax Benefit Schedule from the Stockholder

Representatives. On April 7, 2014, the Company received a demand for arbitration from the Stockholder Representatives. Prior

to commencing arbitration proceedings, on June 17, 2014, the Company and Stockholder Representatives agreed on a

settlement amount of $7.0 million in addition to interest of $0.3 million. The agreed upon settlement was in excess of the

outstanding liability of $5.6 million at the time of settlement. In 2014, the excess payment of $1.4 million was recorded within

other expense in the statement of operations and in the statement of cash flows as a component of cash flows from operating

activities. The Company has made all payments in accordance with the agreed upon settlement terms and has no outstanding

obligations related to the TRA.

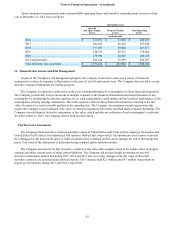

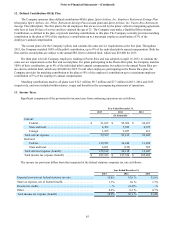

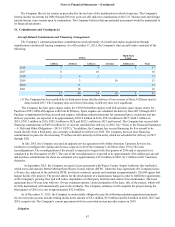

18. Quarterly Financial Data (Unaudited)

Quarterly results of operations for the years ended December 31, 2015 and 2014 are summarized below: