Spirit Airlines 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

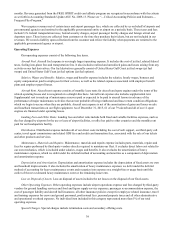

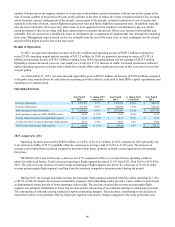

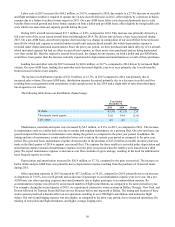

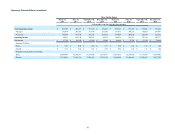

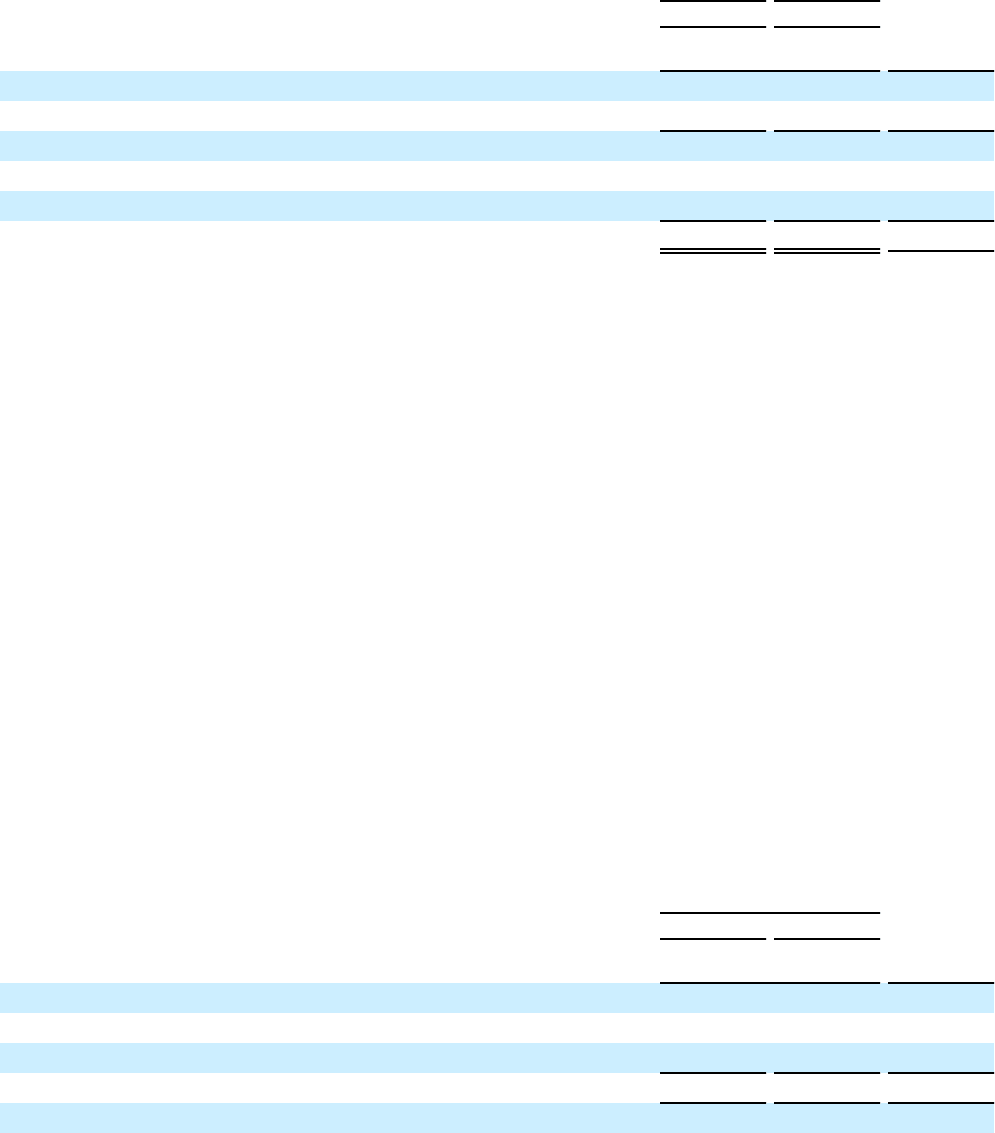

The elements of the changes in aircraft fuel expense are illustrated in the following table:

Year Ended December 31,

2015 2014

(in thousands, except per

gallon amounts) Percent

Change

Fuel gallons consumed 255,008 200,498 27.2 %

Into-plane fuel cost per gallon $ 1.78 $ 3.03 (41.3 )%

Into-plane fuel expense $ 454,747 $ 608,033 (25.2 )%

Realized losses (gains) related to fuel derivative contracts, net 10,580 995 NM

Unrealized losses (gains) related to fuel derivative contracts, net (3,880) 3,881 NM

Aircraft fuel expense (per statement of operations) $ 461,447 $ 612,909 (24.7)%

Gulf Coast Jet indexed fuel is the basis for a substantial majority of our fuel consumption and is impacted by both the

price of crude oil as well as increases or decreases in refining margins associated with the conversion of crude oil to jet fuel.

The into-plane fuel cost per gallon decrease of 41.3% was primarily a result of a decrease in jet fuel prices.

In 2015, we recognized $10.6 million of realized loss related to fuel derivatives consisting of $11.2 million of premiums

paid for fuel options that expired during the twelve months ended December 31, 2015 offset by $0.6 million of cash received

from fuel options that settled during the period. In 2014, total realized loss related to fuel derivatives was $1.0 million which

represents premiums paid for fuel options that expired during the twelve months ended December 31, 2014. There was no cash

received from fuel options that settled during 2014. During the twelve months ended December 31, 2015 and December 31,

2014, we paid $2.5 million and $9.7 million, respectively, in premiums to acquire fuel options. We had unrealized gains of $3.9

million and unrealized losses of $3.9 million related to mark to market adjustments in the fair value of our outstanding fuel

derivatives during the twelve months ended December 31, 2015 and December 31, 2014, respectively.

We track economic fuel expense, which we believe is the best measure of the effect fuel prices are currently having on

our business, because it most closely approximates the net cash outflow associated with purchasing fuel used for our operations

during the period. We define economic fuel expense as into-plane fuel expense and realized gains or losses on derivative

contracts. The key difference between aircraft fuel expense, as recorded in our statement of operations, and economic fuel

expense is unrealized mark-to-market changes in the value of aircraft fuel derivatives outstanding. In addition, in our

calculation for economic fuel price for the prior year, we are excluding the out of period additional jet fuel FET amount of $9.3

million expensed in the third quarter of 2014. Many industry analysts evaluate airline results using economic fuel expense and

it is used in our internal management reporting.

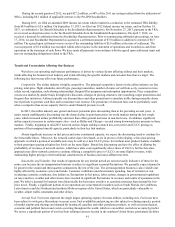

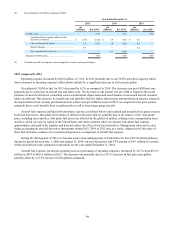

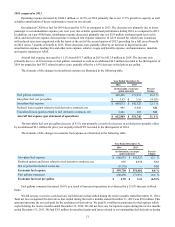

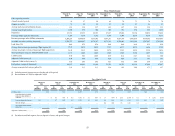

The elements of the changes in economic fuel expense are illustrated in the following table:

Year Ended December 31,

2015 2014

(in thousands, except per

gallon amounts) Percent

Change

Into-plane fuel expense $ 454,747 $ 608,033 (25.2 )%

Realized (gains) and losses related to fuel derivative contracts, net 10,580 995 NM

Out of period fuel federal excise tax —(9,278) NM

Economic fuel expense $ 465,327 $ 599,750 (22.4)%

Fuel gallons consumed 255,008 200,498 27.2 %

Economic fuel cost per gallon $ 1.82 $ 2.99 (39.1)%

Fuel gallons consumed increased 27.2% as a result of increased operations, as evidenced by a 26.4% increase in block

hours.