Spirit Airlines 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

86

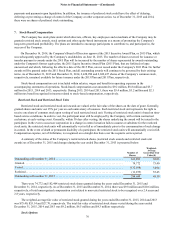

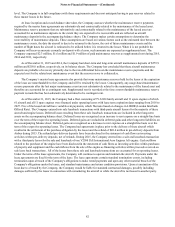

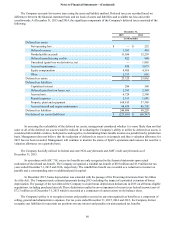

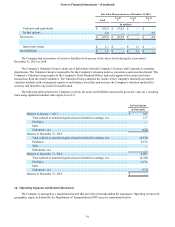

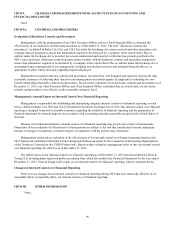

The Company accounts for income taxes using the asset and liability method. Deferred taxes are recorded based on

differences between the financial statement basis and tax basis of assets and liabilities and available tax loss and credit

carryforwards. At December 31, 2015 and 2014, the significant components of the Company's deferred taxes consisted of the

following:

December 31,

2015 2014

(in thousands)

Deferred tax assets:

Net operating loss. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ 252

Deferred revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,381 410

Nondeductible accruals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,056 12,239

Deferred manufacturing credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 822 848

Unrealized (gain) loss on derivatives, net . . . . . . . . . . . . . . . . . . . . . . . — 1,865

Accrued maintenance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 830 3,073

Equity compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,485 4,514

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,751 661

Deferred tax assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23,325 23,862

Deferred tax liabilities:

Capitalized interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 286 568

Deferred gain (loss) on leases, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,393 2,349

Accrued rent. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,724 2,560

Prepaid expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,151 1,681

Property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 168,813 37,369

Accrued aircraft and engine maintenance . . . . . . . . . . . . . . . . . . . . . . . 64,439 45,702

Deferred tax liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 244,806 90,229

Net deferred tax assets (liabilities) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (221,481) $ (66,367)

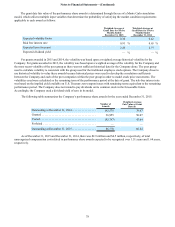

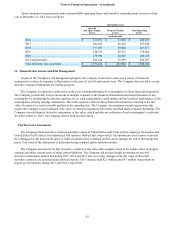

In assessing the realizability of the deferred tax assets, management considered whether it is more likely than not that

some or all of the deferred tax assets would be realized. In evaluating the Company’s ability to utilize its deferred tax assets, it

considered all available evidence, both positive and negative, in determining future taxable income on a jurisdiction by jurisdiction

basis. Management does not believe that the realization of deferred tax assets is in jeopardy and thus a valuation allowance for

2015 has not been recorded. Management will continue to monitor the status of Spirit’s operations and reassess the need for a

valuation allowance on a quarterly basis.

The Company has fully utilized its federal and state NOL carryforwards and AMT credit carryforwards as of

December 31, 2015.

In accordance with ASC 718, excess tax benefits are only recognized in the financial statements upon actual

realization of the related tax benefit. The Company recognized a windfall tax benefit of $8.9 million and $1.9 million for tax

years ended December 31, 2015 and 2014, respectively. The windfall tax benefit was recorded as a reduction to income tax

payable and a corresponding entry to additional paid in capital.

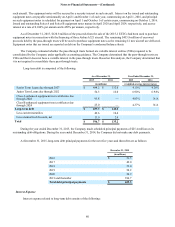

In December 2015, bonus depreciation was extended with the passage of the Protecting Americans from Tax Hikes

Act (the Act). The Company made estimated payments during 2015 excluding the impact of a potential extension of bonus

depreciation. The passage of the Act allowed the Company to claim bonus depreciation deductions in 2015 on all bonus eligible

acquisitions, including purchased aircraft. These deductions resulted in an overpayment of current year federal income taxes of

$72.3 million as of December 31, 2015 which is recorded as a component of current assets on the balance sheet.

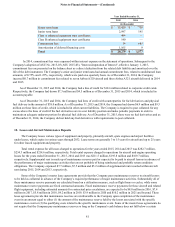

The Company's policy is to recognize interest and penalties accrued on any unrecognized tax benefits as a component of

selling, general and administrative expenses. For tax years ended December 31, 2015, 2014 and 2013, the Company did not

recognize any liabilities for uncertain tax positions nor any interest and penalties on unrecognized tax benefits.