Spirit Airlines 2015 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.5

launched a new brand campaign, which we continued in 2015, to educate the public on how Spirit's unbundled pricing model

works and how that gives them choice and saves them money compared to other airlines.

Our Strengths

We believe we compete successfully in the airline industry by leveraging the following demonstrated business strengths:

Ultra-Low Cost Structure. Our unit operating costs are among the lowest of all airlines operating in the United States.

We believe this unit cost advantage helps protect our market position and enables us to offer some of the lowest base fares in

our markets, sustain among the highest operating margins in our industry and support continued growth. Our operating costs

per available seat mile (CASM) of 7.68 cents in 2015 were significantly lower than those of the major domestic network

carriers and among the lowest of the domestic low-cost carriers. We achieve these low unit operating costs in large part due to:

• high aircraft utilization;

• high-density seating configurations on our aircraft, which is part of our Plane Simple TM strategy along with simplified

onboard product designed to lower costs;

• no hub-and-spoke network inefficiencies;

• highly productive workforce;

• opportunistic outsourcing of operating functions;

• operating our Fit Fleet TM, a single-fleet type of Airbus A320-family aircraft that is the youngest fleet of any major

U.S. airline and operated by common flight crews;

• reduced sales, marketing and distribution costs through direct-to-consumer marketing;

• efficient flight scheduling, including minimal ground times between flights; and

• a company-wide business culture that is keenly focused on driving costs lower.

Innovative Revenue Generation. We execute our innovative, unbundled pricing strategy to generate significant non-

ticket revenue, which allows us to lower base fares and enables our passengers to identify, select and pay for only the products

and services they want to use. In implementing our unbundled strategy, we have grown average non-ticket revenue per

passenger flight segment from approximately $5 in 2006 to $54 in 2015 by:

• charging for checked and carry-on baggage;

• passing through all distribution-related expenses;

• charging for premium seats and advance seat selection;

• maintaining consistent ticketing policies, including service charges for changes and cancellations;

• generating subscription revenue from our $9 Fare Club low-fare subscription service;

• deriving brand-based revenues from proprietary services, such as our FREE SPIRIT affinity credit card program;

• offering third-party travel products (travel packages), such as hotel rooms, ground transportation (rental and hotel

shuttle products) and attractions (show or theme park tickets) packaged with air travel on our website;

• selling third-party travel insurance through our website; and

• selling onboard advertising.

Resilient Business Model and Customer Base. By focusing on price-sensitive travelers, we have maintained profitability

during volatile economic periods because we are not highly dependent on premium-fare business traffic. We believe our

growing customer base is more resilient than the customer bases of most other airlines because our low fares and unbundled

service offering appeal to price-sensitive travelers. In 2015, low oil prices coupled with increased competition in the U.S. drove

lower unit revenues, but lower costs produced margins that remain higher than most of our domestic network peers.

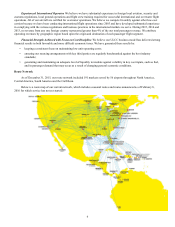

Well Positioned for Growth. We have developed a substantial network of destinations in profitable U.S. domestic niche

markets, targeted growth markets in the Caribbean and Latin America and high-volume routes flown by price-sensitive

travelers. In the United States, we also have grown into large markets that, due to higher fares, have priced out those more

price-sensitive travelers. We seek to balance growth between large domestic markets, niche markets and opportunities in the

Caribbean and Latin America according to current economic and industry conditions.