Spirit Airlines 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

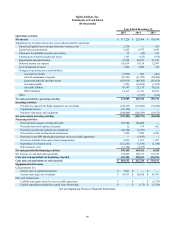

payments. We spent $15.2 million in debt issuance costs to secure the financing on 14 aircraft purchases, spent $112.3 million

to repurchase common stock and made $26.4 million in debt and capital lease payments.

During 2014, financing activities provided $144.0 million. We received $7.2 million in proceeds from the sale of one

spare engine as part of a sale and leaseback transaction, $148.0 million in connection with the debt financing of four aircraft,

retained $1.9 million as a result of excess tax benefits related to share-based payments and received cash as a result of

exercised stock options. We spent $4.7 million in debt issuance costs to secure the financing on 4 aircraft delivered in 2014 and

11 aircraft delivered in 2015.

During 2013, financing activities provided $8.5 million. We received $6.9 million in proceeds from the sale of one

spare engine as part of sale and leaseback transactions, retained $1.9 million as a result of excess tax benefits related to share-

based payments and received cash as a result of exercised stock options.

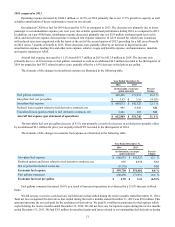

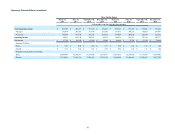

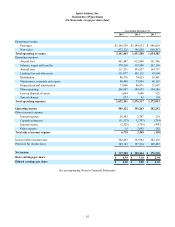

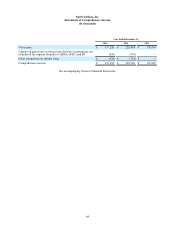

Commitments and Contractual Obligations

We have contractual obligations and commitments primarily with regard to future purchases of aircraft and engines,

payment of debt, and lease arrangements. The following table discloses aggregate information about our contractual obligations

as of December 31, 2015 and the periods in which payments are due (in millions):

2016 2017 - 2018 2019 - 2020 2021 and

beyond Total

Long-term debt (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 52 $ 102 $ 109 $ 396 $ 659

Interest commitments (2) . . . . . . . . . . . . . . . . . . . . . . . . . . 27 50 39 63 179

Operating lease obligations . . . . . . . . . . . . . . . . . . . . . . . . 241 435 340 564 1,580

Flight equipment purchase obligations . . . . . . . . . . . . . . . 593 1,388 1,409 812 4,202

Other (3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 8 — — 28

Total future payments on contractual obligations . . . . . . . $ 933 $ 1,983 $ 1,897 $ 1,835 $ 6,648

(1) Includes principal only associated with senior term loans due through 2027, junior term loans due through 2022 and

Class A and Class B enhanced equipment trust certificates due through 2028 and 2024, respectively. See “Notes to the

Financial Statements—9. Debt and Other Obligations.”

(2) Related to senior and junior term loans and Class A and Class B enhanced equipment trust certificates only.

(3) Primarily related to the reconfiguration of seating in 40 of our A320ceos from 178 to 182 seats.

Some of our master lease agreements provide that we pay maintenance reserves to aircraft lessors to be held as collateral

in advance of our required performance of major maintenance activities. Some maintenance reserve payments are fixed

contractual amounts, while others are based on utilization. In addition to the contractual obligations disclosed in the table

above, we have fixed maintenance reserve payments for these aircraft and related flight equipment, including estimated

amounts for contractual price escalations, which are approximately $8.0 million in 2016, $7.4 million in 2017, $5.8 million in

2018, $4.2 million in 2019, $3.9 million in 2020 and $10.2 million in 2021 and beyond.

In August 2015, we created two separate pass-through trusts which issued $576.6 million aggregate face amount of Series

2015-1 Class A and Class B EETCs in connection with the financing of 15 aircraft to be delivered between October 2015 and

December 2016. The proceeds from the issuance of EETCs were initially held in escrow by a depositary and, upon satisfaction

of certain terms and conditions, will be released and used to purchase secured equipment notes to be issued as the new aircraft

are delivered. As of December 31, 2015 we have taken delivery of three aircraft and the remaining twelve aircraft are scheduled

to be delivered throughout 2016. Interest on the issued and outstanding equipment notes are payable semiannually on April 1

and October 1 of each year, commencing on April 1, 2016 and principal on such equipment notes is scheduled for payment on

April 1 and October 1 of certain years, commencing on October 1, 2016. Interest on the issued and outstanding equipment

notes accrue at a blended rate of 4.15% per annum. Issued and outstanding Series A and Series B equipment notes mature in

April 2028 and April 2024, respectively.

We evaluated whether the pass-through trusts formed are variable interest entities (VIEs) required to be consolidated by

the Company under applicable accounting guidance. We determined that the pass-through trusts are VIEs and that we do not

have a variable interest in the pass-through trusts. As such, we are not required to consolidate these pass-through trusts.