Spirit Airlines 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

74

as an asset. Once adopted, entities are required to apply the new guidance retrospectively to all prior periods presented. ASU

2015-03 is effective for annual periods ending after December 15, 2015, and interim periods within those fiscal years. Early

application is permitted. The Company elected to early adopt the standard effective January 1, 2015.

In November 2015, the FASB issued ASU No. 2015-17 (ASU 2015-17), "Income Taxes." The standard requires deferred

tax liabilities and assets to be classified as noncurrent on the balance sheet. The new guidance is effective for annual reporting

periods (including interim periods within those periods) beginning after December 15, 2016 for public companies with early

adoption permitted. Entities have the option of applying the guidance either prospectively to all deferred tax liabilities and

assets or retrospectively to all periods presented. The Company has elected to retrospectively adopt the standard effective

January 1, 2015. As such, certain prior period amounts have been reclassified to conform to the current presentation. In the

Balance Sheets as of December 31, 2014, the Company has reclassified $9.6 million from deferred income taxes in current

assets to long-term deferred income taxes within non-current liabilities.

3. Letters of Credit

As of December 31, 2015, the Company had a $25.1 million unsecured standby letter of credit facility, of which $13.0

million had been drawn upon for issued letters of credit.

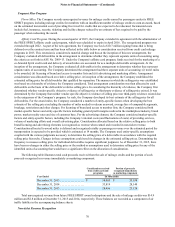

4. Credit Card Processing Arrangements

The Company has agreements with organizations that process credit card transactions arising from the purchase of air

travel, baggage charges and other ancillary services by customers. As it is standard in the airline industry, the Company's

contractual arrangements with credit card processors permit them, under certain circumstances, to retain a holdback or other

collateral, which the Company records as restricted cash, when future air travel and other future services are purchased via

credit card transactions. The required holdback is the percentage of the Company's overall credit card sales that its credit card

processors hold to cover refunds to customers if the Company fails to fulfill its flight obligations.

The Company's credit card processors do not require the Company to maintain cash collateral provided that the Company

continues to satisfy certain liquidity and other financial covenants. Failure to meet these covenants would provide the

processors the right to place a holdback, resulting in a commensurate reduction of unrestricted cash. As of December 31, 2015

and 2014, the Company continued to be in compliance with its credit card processing agreements, and the processors were

holding back no remittances.

The maximum potential exposure to cash holdbacks by the Company's credit card processors, based upon advance ticket

sales and $9 Fare Club memberships as of December 31, 2015 and 2014, was $250.2 million and $217.1 million, respectively.

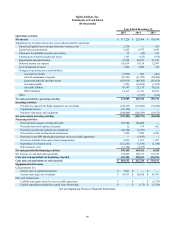

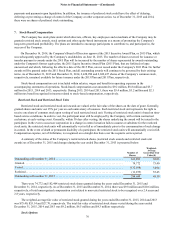

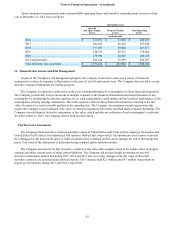

5. Accrued Liabilities

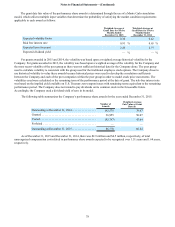

Accrued liabilities included in other current liabilities as of December 31, 2015 and 2014 consist of the following:

As of December 31,

2015 2014

(in thousands)

Federal excise and other passenger taxes and fees payable $ 38,254 $ 42,628

Salaries and wages 34,123 34,209

Airport obligations 30,849 21,726

Aircraft and facility lease obligations 24,014 10,089

Aircraft maintenance 21,688 16,127

Interest payable 12,355 1,708

Fuel 7,084 9,508

Other 14,362 16,926

Other current liabilities $ 182,729 $ 152,921

6. Common Stock and Preferred Stock