Spirit Airlines 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

83

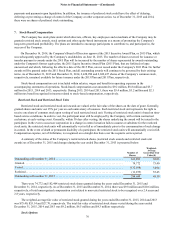

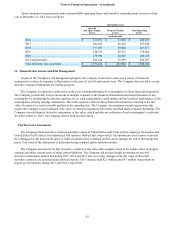

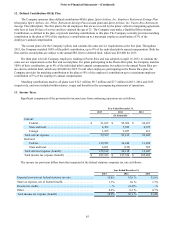

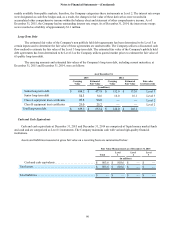

Future minimum lease payments under noncancellable operating leases with initial or remaining terms in excess of one

year at December 31, 2015 were as follows:

Operating Leases

Aircraft

and Spare Engine

Leases Property Facility

Leases Total Operating

Leases

(in thousands)

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 213,491 $ 27,340 $ 240,831

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 201,485 26,364 227,849

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 177,697 29,820 207,517

2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 150,333 28,733 179,066

2020 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 139,992 20,546 160,538

2021 and thereafter . . . . . . . . . . . . . . . . . . . . . . 494,104 70,199 564,303

Total minimum lease payments . . . . . . . . . . . . $ 1,377,102 $ 203,002 $ 1,580,104

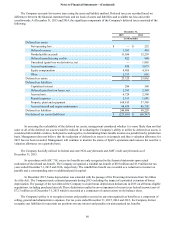

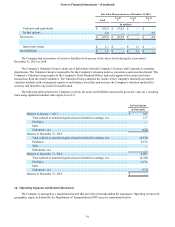

11. Financial Instruments and Risk Management

As part of the Company’s risk management program, the Company from time to time uses a variety of financial

instruments to reduce its exposure to fluctuations in the price of jet fuel and interest rates. The Company does not hold or issue

derivative financial instruments for trading purposes.

The Company is exposed to credit losses in the event of nonperformance by counterparties to these financial instruments.

The Company periodically reviews and seeks to mitigate exposure to the financial deterioration and nonperformance of any

counterparty by monitoring the absolute exposure levels, each counterparty's credit ratings and the historical performance of the

counterparties relating to hedge transactions. The credit exposure related to these financial instruments is limited to the fair

value of contracts in a net receivable position at the reporting date. The Company also maintains security agreements that

require the Company to post collateral if the value of selected instruments falls below specified mark-to-market thresholds. The

Company records financial derivative instruments at fair value, which includes an evaluation of each counterparty's credit risk.

As of December 31, 2015, the Company did not hold any derivatives.

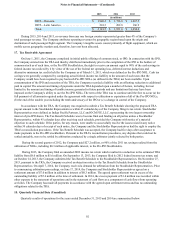

Fuel Derivative Instruments

The Company's fuel derivative contracts generally consist of United States Gulf Coast jet fuel swaps (jet fuel swaps) and

United States Gulf Coast jet fuel options (jet fuel options). Both jet fuel swaps and jet fuel options are used at times to protect

the refining price risk between the price of crude oil and the price of refined jet fuel, and to manage the risk of increasing fuel

prices. Fair value of the instruments is determined using standard option valuation models.

The Company accounts for its fuel derivative contracts at fair value and recognizes them in the balance sheet in prepaid

expenses and other current assets or other current liabilities. The Company did not elect hedge accounting on any fuel

derivative instruments entered into during 2015, 2014 and 2013 and, as a result, changes in the fair value of these fuel

derivative contracts are recorded in aircraft fuel expense. The Company paid $2.5 million and $9.7 million in premiums to

acquire jet fuel options, during 2015 and 2014, respectively.