Spirit Airlines 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

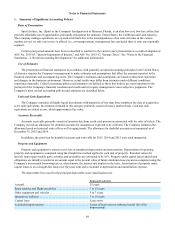

Notes to Financial Statements

1. Summary of Significant Accounting Policies

Basis of Presentation

Spirit Airlines, Inc. (Spirit or the Company) headquartered in Miramar, Florida, is an ultra low-cost, low-fare airline that

provides affordable travel opportunities principally throughout the domestic United States, the Caribbean and Latin America.

The Company manages operations on a system-wide basis due to the interdependence of its route structure in the various

markets served. As only one service is offered (i.e., air transportation), management has concluded there is only one reportable

segment.

Certain prior period amounts have been reclassified to conform to the current year's presentation as a result of adoption of

ASU No. 2015-03, "Interest-Imputation of Interest," and ASU No. 2015-17, "Income Taxes." See “Notes to the Financial

Statements—2. Recent Accounting Developments” for additional information.

Use of Estimates

The preparation of financial statements in accordance with generally accepted accounting principles in the United States

of America requires the Company's management to make estimates and assumptions that affect the amounts reported in the

financial statements and accompanying notes. The Company's estimates and assumptions are based on historical experience

and changes in the business environment. However, actual results may differ from estimates under different conditions,

sometimes materially. Critical accounting policies and estimates are defined as those that both (i) are most important to the

portrayal of the Company's financial condition and results and (ii) require management's most subjective judgments. The

Company's most critical accounting policies and estimates are described below.

Cash and Cash Equivalents

The Company considers all highly liquid investments with maturities of less than three months at the date of acquisition

to be cash equivalents. Investments included in this category primarily consist of money market funds. Cash and cash

equivalents are stated at cost, which approximates fair value.

Accounts Receivable

Accounts receivable primarily consist of amounts due from credit card processors associated with the sales of tickets. The

Company records an allowance for doubtful accounts for amounts not expected to be collected. The Company estimates the

allowance based on historical write offs as well as aging trends. The allowance for doubtful accounts was immaterial as of

December 31, 2015 and 2014.

In addition, the provision for doubtful accounts and write-offs for 2015, 2014 and 2013 were each immaterial.

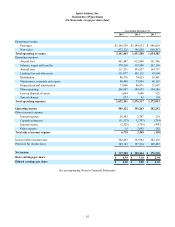

Property and Equipment

Property and equipment is stated at cost, less accumulated depreciation and amortization. Depreciation of operating

property and equipment is computed using the straight-line method applied to each unit of property. Residual values for

aircraft, major spare rotable parts, avionics and assemblies are estimated to be 10%. Property under capital leases and related

obligations are initially recorded at an amount equal to the present value of future minimum lease payments computed using the

Company's incremental borrowing rate or, when known, the interest rate implicit in the lease. Amortization of property under

capital leases is on a straight-line basis over the lease term and is included in depreciation and amortization expense.

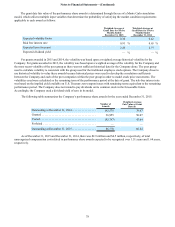

The depreciable lives used for the principal depreciable asset classifications are:

Estimated Useful Life

Aircraft . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25 years

Spare rotables and flight assemblies . . . . . . . . . . . . . . . . . . . . . . 7 to 15 years

Other equipment and vehicles . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 to 7 years

Internal use software . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 to 10 years

Capital lease . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Lease term

Leasehold improvements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Lesser of lease term or estimated useful life of the

improvement