Spirit Airlines 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

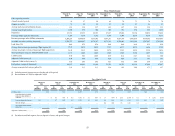

Labor costs in 2015 increased by $64.2 million, or 20.5%, compared to 2014, due mainly to a 27.9% increase in our pilot

and flight attendant workforce required to operate the 14 new aircraft deliveries in 2015, offset slightly by a decrease in bonus

expense due to a failure to achieve bonus targets in 2015. On a per-ASM basis, labor costs decreased primarily due to scale

benefits from overall growth and lower bonus expense on both a dollar and per ASM basis, offset slightly by rising health care

costs which rose more than our capacity growth during the year.

During 2015, aircraft rent increased $15.7 million, or 8.0%, compared to 2014. This increase was primarily driven by a

full year's rent of the seven leased aircraft delivered throughout 2014. We did not take delivery of any leased aircraft during

2015. On a per-ASM basis, aircraft rent expense decreased due to a change in composition of our aircraft fleet between leased

aircraft (for which rent expense is recorded under aircraft rent) and purchased aircraft (for which depreciation expense is

recorded under depreciation and amortization). Since the prior year period, we have purchased and taken delivery of 14 aircraft,

which increased capacity but had no effect on aircraft rent expense, as these assets were purchased and are being depreciated

over their useful life. Had the respective aircraft been leased, the change in rent expense, on both a dollar and per-ASM basis,

would have been greater than the increase currently experienced in depreciation and amortization as a result of these purchases.

Landing fees and other rents for 2015 increased by $26.0 million, or 24.7%, compared to 2014 driven by increased flight

volume. On a per-ASM basis, landing fees and other rents decreased slightly, year over year, primarily due to scale benefits

from increased volume at our airports.

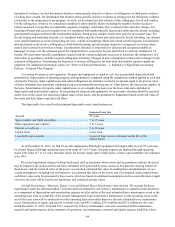

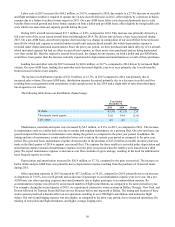

The increase in distribution expense of $11.8 million, or 15.7%, in 2015 compared to 2014 was primarily due to

increased sales volume. On a per-ASM basis, distribution expense decreased primarily due to a decrease in credit card fees

resulting from a renegotiation with our primary credit card processor in late 2014 and a slight shift of sales from third-party

travel agents to our website.

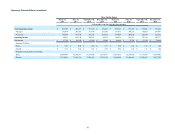

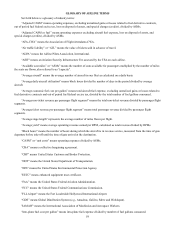

The following table shows our distribution channel usage:

Year Ended

December 31,

2015 2014 Change

Website . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63.5% 61.1% 2.4

Third-party travel agents . . . . . . . . . . . . . . . . . . . . . . . . . . 32.0 34.4 (2.4)

Call center . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.5 4.5 —

Maintenance, materials and repair costs increased by $6.5 million, or 8.8%, in 2015, as compared to 2014 . The increase

in maintenance costs on a dollar basis was due to routine and ongoing maintenance on a growing fleet. On a per-unit basis, our

growth outpaced the increase in maintenance costs during the period, as compared to the prior year period. In addition, the

timing and mix of maintenance events resulted in lower cost events in the current year period as compared to the prior year

period. On a per-unit basis, maintenance expense decreased due to the purchase of $13.0 million in rotable inventory that was

made in the third quarter of 2014 to support our aircraft fleet. The expense for these rotables is recorded under depreciation and

amortization expense instead of maintenance expense as in the prior year period when the rotables were leased from a third

party. We expect maintenance expense to increase as our fleet continues to grow and age, resulting in the need for additional or

more frequent repairs over time.

Depreciation and amortization increased by $26.9 million, or 57.3%, compared to the prior year period. The increase on

both a dollar and per-ASM basis was primarily due to depreciation expense resulting from the purchase of 14 aircraft made

during 2015.

Other operating expenses in 2015 increased by $57.2 million, or 38.2%, compared to 2014, primarily due to an increase

in departures of 25.6%, our overall growth and an increase in passenger re-accommodation expense year over year. On a per-

ASM basis, our other operating expenses increased primarily due to higher passenger re-accommodation expense. Re-

accommodation expense was driven by an increased number of flight cancellations, as compared to the same period last year.

For example, during the second quarter of 2015, we experienced consecutive storm systems in Dallas, Chicago, New York, and

Detroit followed by Tropical Storm Bill that sat over Houston before moving north to Dallas. The timing and location of these

storm systems produced a domino effect on our operations resulting in over 500 flight cancellations and numerous flight

delays. Our travel and lodging expense was also higher, as compared to the prior year period, due to increased operations, the

training of new pilots and flight attendants, and higher average lodging rates.