Spirit Airlines 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.43

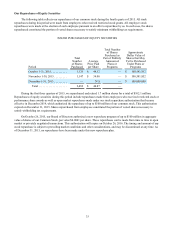

scheduled maintenance obligations across our current fleet around the same time. These more significant maintenance activities

will result in out-of-service periods during which our aircraft will be dedicated to maintenance activities and unavailable to fly

revenue service. When accounting for maintenance expense under the deferral method, heavy maintenance is amortized over

the shorter of either the remaining lease term or the next estimated heavy maintenance event. As a result, deferred maintenance

events occurring closer to the end of the lease term will generally have shorter amortization periods than those occurring earlier

in the lease term. This will create higher depreciation and amortization expense specific to any aircraft related to heavy

maintenance during the final years of the lease as compared to earlier periods. Please see “— Critical Accounting Policies and

Estimates-Aircraft Maintenance, Materials, Repair Costs and Related Heavy Maintenance Amortization.”

Maintenance Reserve Obligations. The terms of some of our aircraft lease agreements require us to post deposits for

future maintenance, also known as maintenance reserves, to the lessor in advance of and as collateral for the performance of

major maintenance events, resulting in our recording significant prepaid deposits on our balance sheet. As a result, the cash

costs of scheduled major maintenance events are paid in advance of the recognition of the maintenance event in our results of

operations. Please see “—Critical Accounting Policies and Estimates—Aircraft Maintenance, Materials, Repair Costs and

Related Heavy Maintenance Amortization” and “—Maintenance Reserves.”

Critical Accounting Policies and Estimates

The following discussion and analysis of our financial condition and results of operations is based on our financial

statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The

preparation of these financial statements requires us to make estimates and judgments that affect the reported amount of assets

and liabilities, revenues and expenses and related disclosure of contingent assets and liabilities at the date of our financial

statements. For a detailed discussion of our significant accounting policies, please see “Notes to Financial Statements—1.

Summary of Significant Accounting Policies.”

Critical accounting policies are defined as those policies that reflect significant judgments or estimates about matters both

inherently uncertain and material to our financial condition or results of operations.

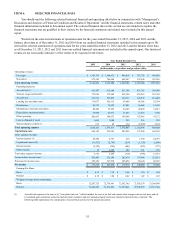

Revenue Recognition. Revenues from tickets sold are initially deferred as ATL. Passenger revenues are recognized when

transportation is provided. An unused non-refundable ticket expires at the date of scheduled travel and is recognized as

revenue for the expired ticket value at the date of scheduled travel.

Our most significant non-ticket revenues include revenues generated from air travel-related services paid for baggage,

passenger usage fees, advance seat selection, itinerary changes, and loyalty programs. The majority of our non-ticket revenues

are recognized once the related flight departs. Some of our non-ticket revenues, such as those related to itinerary changes, are

recognized at the time products are purchased or services are provided. These revenues also include commissions from the

sales of hotel rooms, trip insurance and rental cars recognized at the time the service is rendered. Non-ticket revenues also

include revenues from our subscription-based $9 Fare Club, recognized on a straight-line basis over 12 months.

Customers may elect to change their itinerary prior to the date of departure. A service charge is assessed and recognized

on the date the change is initiated and is deducted from the face value of the original purchase price of the ticket, and the

original ticket becomes invalid. The amount remaining after deducting the service charge is called a credit shell which expires

60 days from the date the credit shell is created and can be used towards the purchase of a new ticket and our other service

offerings. The amount of credits expected to expire unused is recognized as revenue upon issuance of the credit and is

estimated based on historical experience. Estimating the amount of credits that will go unused involves some level of

subjectivity and judgment.

Frequent Flier Program. We accrue for mileage credits earned through travel, including mileage credits for members

with an insufficient number of mileage credits to earn an award, under our FREE SPIRIT program based on the estimated

incremental cost of providing free travel for credits that are expected to be redeemed. Incremental costs include fuel, insurance,

security, ticketing and facility charges reduced by an estimate of amounts required to be paid by the passenger when redeeming

the award.

Under our affinity card program, funds received for the marketing of a co-branded Spirit credit card and delivery of

award miles are accounted for as a multiple-deliverable arrangement. At the inception of the arrangement, we evaluated all

deliverables in the arrangement to determine whether they represent separate units of accounting. We determined the

arrangement had three separate units of accounting: (i) travel miles to be awarded, (ii) licensing of brand and access to member

lists and (iii) advertising and marketing efforts. At inception of the arrangement, we established the estimated selling price for

all deliverables that qualified for separation, as arrangement consideration should be allocated based on relative selling price.

The manner in which the selling price was established was based on the applicable hierarchy of evidence. Total arrangement

consideration was then allocated to each deliverable on the basis of the deliverable's relative selling price. In considering the