Spirit Airlines 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

78

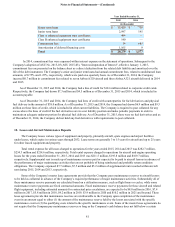

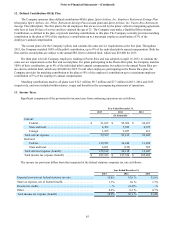

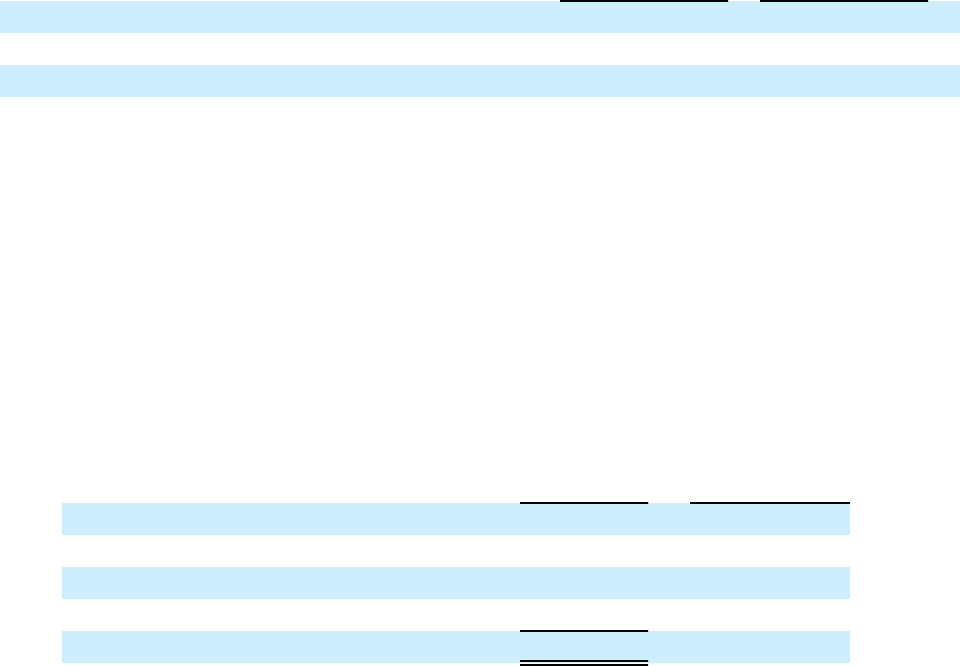

The grant date fair value of the performance share awards is determined through the use of a Monte Carlo simulation

model, which utilizes multiple input variables that determine the probability of satisfying the market condition requirements

applicable to each award as follows:

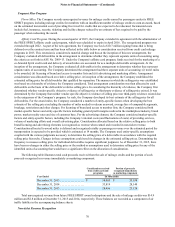

Weighted-Average at

Grant Date for Twelve

Months Ended

December 31, 2015

Weighted-Average at

Grant Date for Twelve

Months Ended

December 31, 2014

Expected volatility factor 0.36 0.42

Risk free interest rate 0.91 % 0.65 %

Expected term (in years) 2.55 2.77

Expected dividend yield — % — %

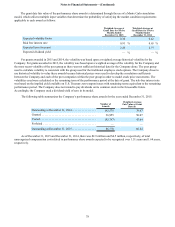

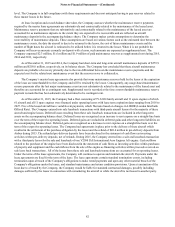

For grants awarded in 2015 and 2014, the volatility was based upon a weighted average historical volatility for the

Company. For grants awarded in 2013, the volatility was based upon a weighted average of the volatility for the Company and

the most recent volatility of the peer group as there was not sufficient historical data for the Company alone. The peer group

used to calculate volatility is consistent with the group used for the traditional employee stock options. The Company chose to

use historical volatility to value these awards because historical prices were used to develop the correlation coefficients

between the Company and each of the peer companies within the peer group in order to model stock price movements. The

volatilities used were calculated as the remaining term of the performance period at the date of grant. The risk-free interest rate

was based on the implied yield available on U.S. Treasury zero-coupon issues with remaining terms equivalent to the remaining

performance period. The Company does not intend to pay dividends on its common stock in the foreseeable future.

Accordingly, the Company used a dividend yield of zero in its model.

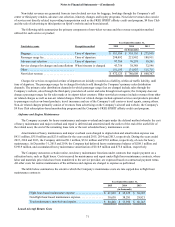

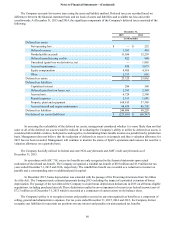

The following table summarizes the Company’s performance share awards for the year ended December 31, 2015:

Number of

Awards

Weighted-Average

Fair Value at Grant

Date ($)

Outstanding at December 31, 2014. . . . . . . . . . . . . . . . . 142,570 39.67

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36,955 50.07

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (92,747) 43.64

Forfeited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — —

Outstanding at December 31, 2015. . . . . . . . . . . . . . . . . 86,778 66.44

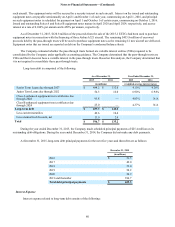

As of December 31, 2015 and December 31, 2014, there was $2.9 million and $4.5 million, respectively, of total

unrecognized compensation cost related to performance share awards expected to be recognized over 1.51 years and 1.64 years,

respectively.