Spirit Airlines 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

hierarchy of evidence, we first determined whether vendor-specific objective evidence of selling price or third-party evidence

of selling price existed. We determined that neither vendor-specific objective evidence of selling price nor third-party evidence

existed due to the uniqueness of our program. As such, we developed our best estimate of the selling price for all deliverables.

For the selling price of travel, we considered a number of entity-specific factors including the number of miles needed to

redeem an award, average fare of comparable segments, breakage, restrictions, fees to redeem miles and other charges. For

licensing of brand and access to member lists, we considered both market-specific factors and entity-specific factors, including

general profit margins realized in the marketplace/industry, brand power, market royalty rates and size of customer base. For

the advertising and marketing element, we considered market-specific factors and entity-specific factors including, our internal

costs (and fluctuations of costs) of providing services, volume of marketing efforts and overall advertising plan. Consideration

allocated based on the relative selling price to both brand licensing and advertising elements is recognized as revenue when

earned and recorded in non-ticket revenue. Consideration allocated to award miles is deferred and recognized ratably as

passenger revenue over the estimated period the transportation is expected to be provided which is currently estimated at 14

months. We used entity-specific assumptions coupled with the various judgments necessary to determine the selling price of a

deliverable in accordance with the required selling price hierarchy. Changes in these assumptions could result in changes in the

estimated selling prices. Determining the frequency to reassess selling price for individual deliverables requires significant

judgment. For additional information, please see “Notes to Financial Statements—1. Summary of Significant Accounting

Policies—Frequent Flier Program”.

Accounting for property and equipment. Property and equipment is stated at cost, less accumulated depreciation and

amortization. Depreciation of operating property and equipment is computed using the straight-line method applied to each unit

of property. Property under capital leases and related obligations are initially recorded at an amount equal to the present value

of future minimum lease payments computed using our incremental borrowing rate or, when known, the interest rate implicit in

the lease. Amortization of property under capital leases is on a straight-line basis over the lease term and is included in

depreciation and amortization expense. In accounting for property and equipment, we must make estimates about the expected

useful lives of the assets, the expected residual values of the assets, and the potential for impairment based on the fair value of

the assets and their future expected cash flows.

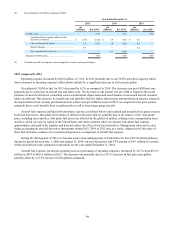

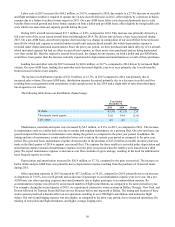

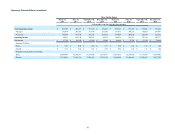

The depreciable lives used for the principal depreciable asset classifications are:

Estimated Useful Life

Aircraft . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25 years

Spare rotables and flight assemblies . . . . . . . . . . . . . . . . . . . . . . 7 to 15 years

Other equipment and vehicles . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 to 7 years

Internal use software . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 to 10 years

Capital lease. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Lease term

Leasehold improvements. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Lesser of lease term or estimated useful life of the

improvement

As of December 31, 2015, we had 18 aircraft capitalized within flight equipment with depreciable lives of 25 years and

61 aircraft financed through operating leases with terms of 3 to 15 years. All spare engines are financed through operating

leases with terms of 7 to 12 years. Residual values for aircraft, major spare rotable parts, avionics and assemblies are estimated

to be 10%.

We record impairment charges on long-lived assets used in operations when events and circumstances indicate the assets

may be impaired, the undiscounted cash flows estimated to be generated by those assets are less than the carrying amount of

those assets, and the net book value of the assets exceeds their estimated fair value. In making these determinations, we use

certain assumptions, including, but not limited to: (i) estimated fair value of the assets; and (ii) estimated, undiscounted future

cash flows expected to be generated by these assets, which are based on additional assumptions such as asset utilization, length

of service the asset will be used in our operations, and estimated salvage values.

Aircraft Maintenance, Materials, Repair Costs and Related Heavy Maintenance Amortization. We account for heavy

maintenance under the deferral method. Under the deferral method the cost of heavy maintenance is capitalized and amortized

as a component of depreciation and amortization expense over the earlier of the next estimated heavy maintenance event or the

remaining lease term or useful life of the aircraft. Management expects that heavy maintenance events occurring closer to the

end of the lease term will be amortized over the remaining lease term rather than over the next estimated heavy maintenance

event. Amortization of engine and aircraft overhaul costs was $43.1 million, $35.8 million and $23.6 million for the years

ended December 31, 2015, 2014 and 2013, respectively. If heavy maintenance costs were amortized within maintenance,

material and repairs expense in the statement of operations, our maintenance, material and repairs expense would have been