Spirit Airlines 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

69

As of December 31, 2015, the Company had 18 aircraft capitalized within flight equipment with depreciable lives of 25

years and 61 aircraft financed through operating leases with lease terms from 3 to 15 years. All spare engines are financed

through operating leases with lease terms from 7 to 12 years.

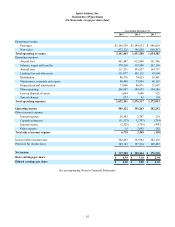

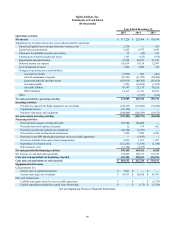

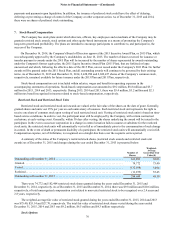

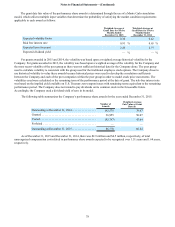

The following table illustrates the components of depreciation and amortization expense:

Year Ended December 31,

2015 2014 2013

(in thousands)

Depreciation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 30,797 $ 11,169 $ 8,340

Amortization of heavy maintenance . . . . . . . . . . . . . . . . . . . . . . . . . . . 43,111 35,802 23,607

Total depreciation and amortization. . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 73,908 $ 46,971 $ 31,947

The Company capitalizes certain internal and external costs associated with the acquisition and development of internal-

use software for new products, and enhancements to existing products, that have reached the application development stage and

meet recoverability tests. Capitalized costs include external direct costs of materials and services utilized in developing or

obtaining internal-use software, and labor cost for employees who are directly associated with, and devote time, to internal-use

software projects. Capitalized computer software, included as a component of ground and other equipment in the

accompanying balance sheets, net of accumulated depreciation, was $8.8 million and $7.4 million at December 31, 2015 and

2014, respectively.

Amortization of capitalized software costs is charged to depreciation on a straight-line method basis. Amortization of

capitalized software costs was $3.1 million, $3.5 million and $3.7 million for the years ended 2015, 2014 and 2013,

respectively. The Company placed in service internal-use software of $4.3 million, $2.7 million and $7.0 million, during the

years ended 2015, 2014 and 2013, respectively.

Measurement of Asset Impairments

The Company records impairment charges on long-lived assets used in operations when events and circumstances

indicate that the assets may be impaired, the undiscounted cash flows estimated to be generated by those assets are less than the

carrying amount of those assets, and the net book value of the assets exceeds their estimated fair value. In making these

determinations, the Company uses certain assumptions, including, but not limited to: (i) estimated fair value of the assets; and

(ii) estimated, undiscounted future cash flows expected to be generated by these assets, which are based on additional

assumptions such as asset utilization, length of service the asset will be used in the Company’s operations, and estimated

salvage values.

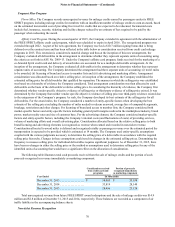

Passenger Revenue Recognition

Tickets sold are initially deferred as “air traffic liability.” Passenger revenue is recognized at time of departure when

transportation is provided. All tickets sold by the Company are nonrefundable. An unused ticket expires at the date of scheduled

travel and is recognized as revenue at the date of scheduled travel.

Customers may elect to change their itinerary prior to the date of departure. A service charge is assessed and recognized

on the date the change is initiated and is deducted from the face value of the original purchase price of the ticket, and the

original ticket becomes invalid. The amount remaining after deducting the service charge is called a credit shell which expires

60 days from the date the credit shell is created and can be used towards the purchase of a new ticket and the Company’s other

service offerings. The amount of credits expected to expire is recognized as revenue upon issuance of the credit and is

estimated based on historical experience. Estimating the amount of credits that will go unused involves some level of

subjectivity and judgment.

The Company is also required to collect certain taxes and fees from customers on behalf of government agencies and

airports and remit to the applicable governmental entity or airport on a periodic basis. These taxes and fees include U.S. federal

transportation taxes, federal security charges, airport passenger facility charges and international arrival and departure taxes.

These items are collected from customers at the time they purchase their tickets, but are not included in passenger revenue. The

Company records a liability upon collection from the customer and relieves the liability when payments are remitted to the

applicable governmental agency or airport.