Spirit Airlines 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

80

such aircraft. The equipment notes will be secured by a security interest in such aircraft. Interest on the issued and outstanding

equipment notes are payable semiannually on April 1 and October 1 of each year, commencing on April 1, 2016, and principal

on such equipment notes is scheduled for payment on April 1 and October 1 of certain years, commencing on October 1, 2016.

Issued and outstanding Series A and Series B equipment notes mature in April 2028 and April 2024, respectively, and accrue

interest at a rate of 4.100% per annum and 4.450% per annum, respectively.

As of December 31, 2015, $120.8 million of the proceeds from the sale of the 2015-1 EETCs had been used to purchase

equipment notes in connection with the financing of three Airbus A321 aircraft. The remaining $455.8 million of escrowed

proceeds held by the pass-through trusts will be used to purchase equipment notes as the remaining 12 new aircraft are delivered.

Equipment notes that are issued are reported as debt on the Company's condensed balance sheets.

The Company evaluated whether the pass-through trusts formed are variable interest entities (VIEs) required to be

consolidated by the Company under applicable accounting guidance. The Company determined that the pass-through trusts are

VIEs and that it does not have a variable interest in the pass-through trusts. Based on this analysis, the Company determined that

it is not required to consolidate these pass-through trusts.

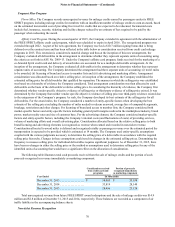

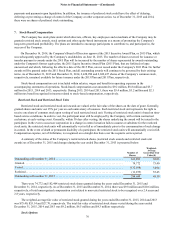

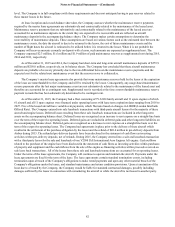

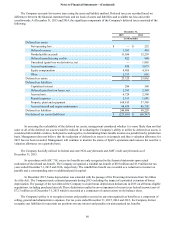

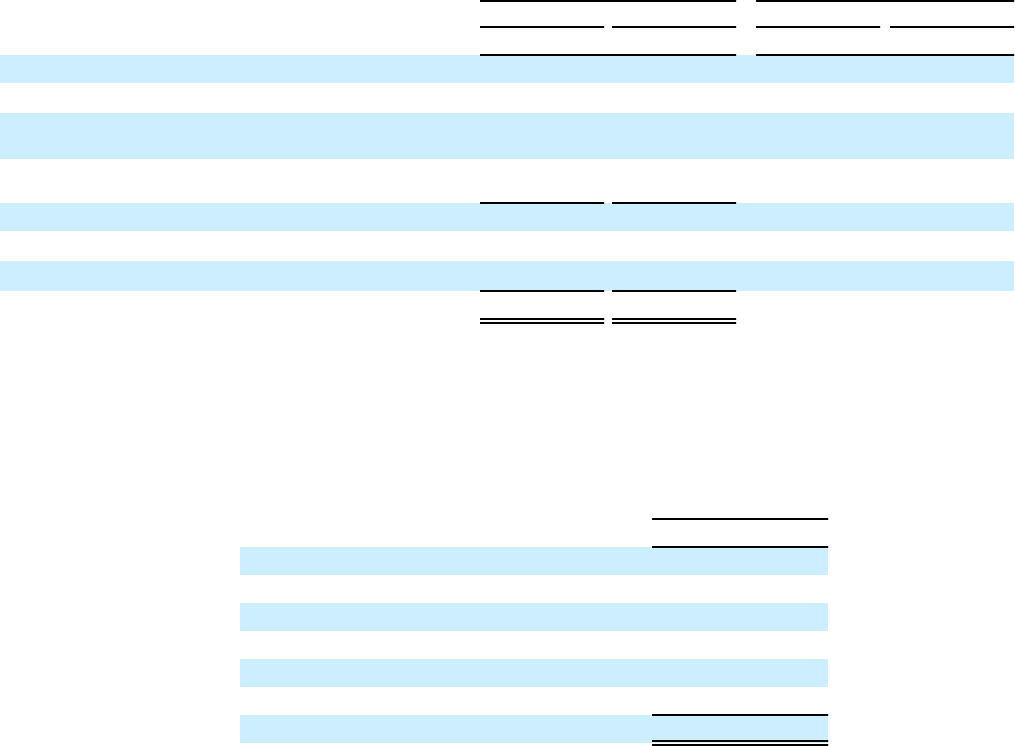

Long-term debt is comprised of the following:

As of December 31, Year Ended December 31,

2015 2014 2015 2014

(in millions) (weighted-average interest rates)

Senior Term Loans due through 2027 $ 484.2 $ 132.0 4.10% 4.26%

Junior Term Loans due through 2022 54.3 16.0 6.90% 6.94%

Class A enhanced equipment trust certificates due

through 2028 95.8 — 4.03% N/A

Class B enhanced equipment trust certificates due

through 2024 25.0 — 4.37% N/A

Long-term debt $ 659.3 $ 148.0

Less current maturities 49.6 10.4

Less unamortized discount, net 13.0 2.4

Total $ 596.7 $ 135.2

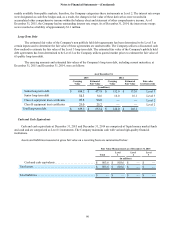

During the year ended December 31, 2015, the Company made scheduled principal payments of $25.4 million on its

outstanding debt obligations. During the year ended December 31, 2014, the Company did not make any debt payments.

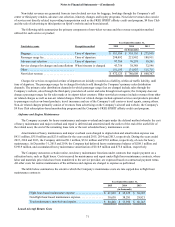

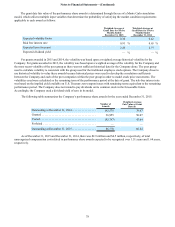

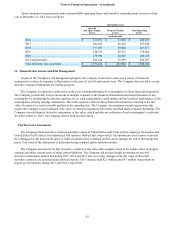

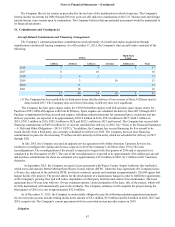

At December 31, 2015, long-term debt principal payments for the next five years and thereafter are as follows:

December 31, 2015

(in millions)

2016 $ 51.5

2017 49.0

2018 53.0

2019 54.2

2020 54.9

2021 and thereafter 396.7

Total debt principal payments $ 659.3

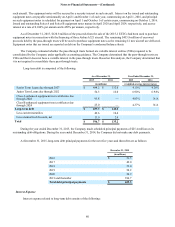

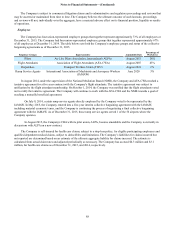

Interest Expense

Interest expense related to long-term debt consists of the following: