Spirit Airlines 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

71

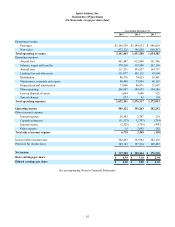

Non-ticket revenues are generated from air travel-related services for baggage, bookings through the Company’s call

center or third-party vendors, advance seat selection, itinerary changes and loyalty programs. Non-ticket revenues also consist

of services not directly related to providing transportation such as the FREE SPIRIT affinity credit card program, $9 Fare Club

and the sale of advertising to third parties on Spirit’s website and on board aircraft.

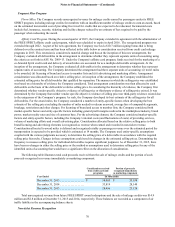

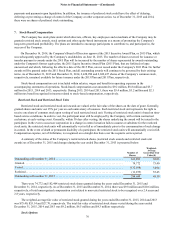

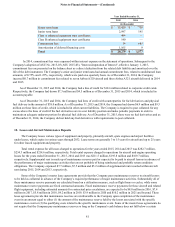

The following table summarizes the primary components of non-ticket revenue and the revenue recognition method

utilized for each service or product:

Year Ended December 31,

Non-ticket revenue Recognition method 2015 2014 2013

(in thousands)

Baggage. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Time of departure $ 381,386 $ 318,103 $ 275,958

Passenger usage fee. . . . . . . . . . . . . . . . . . . . . Time of departure 298,092 221,992 188,911

Advance seat selection . . . . . . . . . . . . . . . . . . Time of departure 97,786 76,270 59,241

Service charges for changes and cancellations When itinerary is changed 43,756 38,388 32,546

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 151,105 131,855 111,711

Non-ticket revenue . . . . . . . . . . . . . . . . . . . . . $ 972,125 $ 786,608 $ 668,367

Charges for services recognized at time of departure are initially recorded as a liability, within air traffic liability, until

time of departure. The passenger usage fee is charged for tickets sold through the Company’s primary sales distribution

channels. The primary sales distribution channels for which passenger usage fees are charged include sales through the

Company’s website, sales through the third-party provided call center and sales through travel agents; the Company does not

charge a passenger usage fee for sales made at its airport ticket counters. Other non-ticket revenues include revenues from other

air related charges as well as non-air related charges. Other air related charges include optional services and products provided

to passengers such as on-board products, travel insurance and use of the Company’s call center or travel agents, among others.

Non-air related charges primarily consist of revenues from advertising on the Company’s aircraft and website, the Company’s

$9 Fare Club subscription-based membership program and the Company’s FREE SPIRIT affinity credit card program.

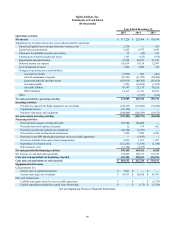

Airframe and Engine Maintenance

The Company accounts for heavy maintenance and major overhaul and repair under the deferral method whereby the cost

of heavy maintenance and major overhaul and repair is deferred and amortized until the earlier of the end of the useful life of

the related asset, the end of the remaining lease term or the next scheduled heavy maintenance event.

Amortization of heavy maintenance and major overhaul costs charged to depreciation and amortization expense was

$43.1 million, $35.8 million and $23.6 million for the years ended 2015, 2014 and 2013, respectively. During the years ended

2015, 2014 and 2013, the Company deferred $9.1 million, $33.6 million and $70.8 million, respectively, of costs for heavy

maintenance. At December 31, 2015 and 2014, the Company had deferred heavy maintenance balance of $208.1 million and

$198.9 million, and accumulated heavy maintenance amortization of $118.9 million and $75.8 million, respectively.

The Company outsources certain routine, non-heavy maintenance functions under contracts that require payment on a

utilization basis, such as flight hours. Costs incurred for maintenance and repair under flight hour maintenance contracts, where

labor and materials price risks have been transferred to the service provider, are expensed based on contractual payment terms.

All other costs for routine maintenance of the airframes and engines are charged to expense as performed.

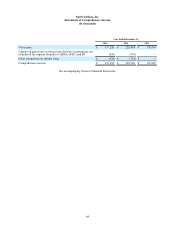

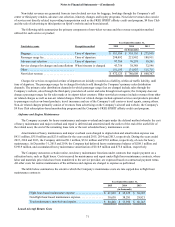

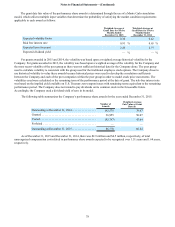

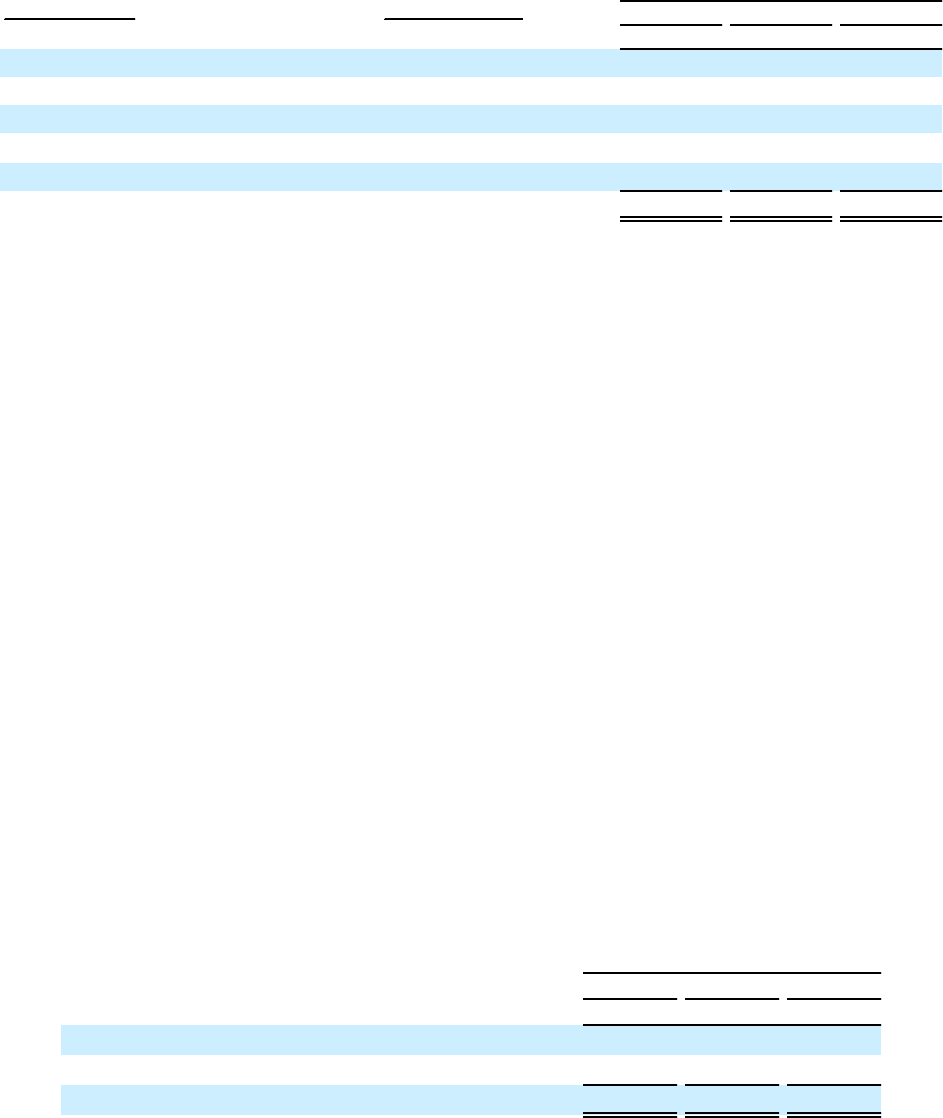

The table below summarizes the extent to which the Company’s maintenance costs are rate capped due to flight hour

maintenance contracts:

Year Ended December 31,

2015 2014 2013

(in thousands)

Flight hour-based maintenance expense . . . . . . . . . . . . . . . . . . . $ 41,818 $ 35,675 $ 30,322

Non-flight hour-based maintenance expense. . . . . . . . . . . . . . . . 38,630 38,281 29,821

Total maintenance, materials and repairs. . . . . . . . . . . . . . . . . . . $ 80,448 $ 73,956 $ 60,143

Leased Aircraft Return Costs