Spirit Airlines 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

79

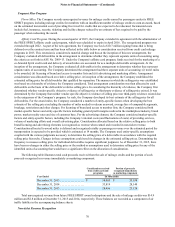

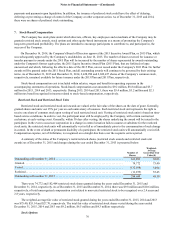

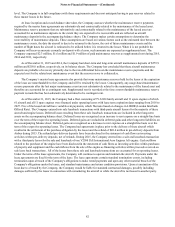

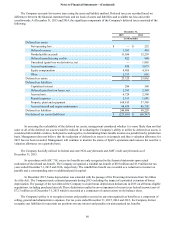

8. Net Income per Share

The following table sets forth the computation of basic and diluted earnings per common share:

Year Ended December 31,

2015 2014 2013

(in thousands, except per share amounts)

Numerator:

Net income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 317,220 $ 225,464 $ 176,918

Denominator:

Weighted-average shares outstanding, basic. . . . . . . . . . . . . . 72,208 72,739 72,593

Effect of dilutive stock awards . . . . . . . . . . . . . . . . . . . . . . . . 218 555 406

Adjusted weighted-average shares outstanding, diluted . . . . . 72,426 73,294 72,999

Net Income per Share:

Basic earnings per common share. . . . . . . . . . . . . . . . . . . . . . $ 4.39 $ 3.10 $ 2.44

Diluted earnings per common share . . . . . . . . . . . . . . . . . . . . $ 4.38 $ 3.08 $ 2.42

Anti-dilutive weighted-average shares . . . . . . . . . . . . . . . . . . 52 29 1

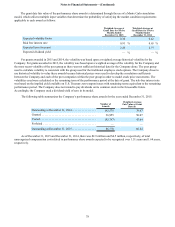

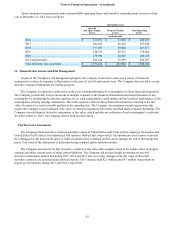

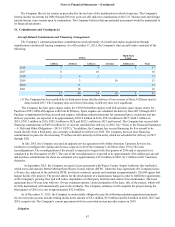

9. Debt and Other Obligations

Long-term debt

As of December 31, 2015, the Company held non public and public debt instruments. The Company's indebtedness

includes the 2014 Framework Agreement, the 2015 Facility Agreements and the 2015-1 EETCs described below.

Framework Agreement

During 2014, the Company entered into a Framework Agreement, with a bank syndicate, which as of December 31,

2015, provided $379 million of debt financing for seven Airbus A320 aircraft and three Airbus A321 aircraft. Each loan extended

under the Framework Agreement was funded on or about the delivery date of each aircraft and is secured by a first-priority

security interest in the individual aircraft. Each loan amortizes on a mortgage-style basis, which requires quarterly payments,

with senior loans having a 12-year term and junior loans having a 7-year term. Loans bear interest payable quarterly on a fixed-

rate basis. As of December 31, 2015, the Company has taken delivery of all Airbus A320 and Airbus A321 aircraft financed

through the Framework Agreement.

Facility Agreements

During 2015, the Company entered into two Facility Agreements, which as of December 31, 2015, provided $185

million of debt financing for five Airbus A320 aircraft. Each loan extended under the Facility Agreements was funded on or near

the delivery date of each aircraft and was secured by a first-priority security interest on the individual aircraft. Each loan

amortizes on a mortgage-style basis, which requires quarterly payments, with senior loans having a 12-year term and junior

loans having a 7-year term. Loans bear interest payable quarterly on a fixed-rate basis. As of December 31, 2015, the Company

has taken delivery of all Airbus A320 aircraft financed through the Facility Agreements.

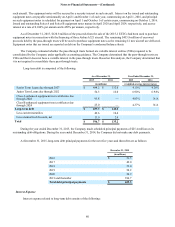

2015-1 EETCs

In August 2015, the Company created two separate pass-through trusts, which issued approximately $576.6 million

aggregate face amount of Series 2015-1 Class A and Class B EETCs with a blended interest rate of 4.15% per annum in

connection with the financing of 12 new Airbus A321 aircraft and 3 new Airbus A320 aircraft. Each class of certificates

represents a fractional undivided interest in the respective pass-through trusts and is not an obligation of the Company. The

proceeds from the issuance of these certificates were initially held in escrow by a depositary and, upon satisfaction of certain

terms and conditions, will be released and used to purchase equipment notes to be issued by the Company with respect to each