Spirit Airlines 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40

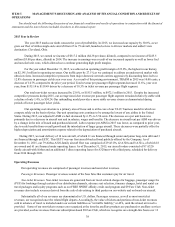

Other Expense (Income)

Interest Expense. Interest expense in 2015 was primarily related to the financing of purchased aircraft. For 2014, interest

expense primarily represented interest related to the financing of purchased aircraft, interest related to the underpayment of

prior year jet fuel FET and interest charged under the Tax Receivable Agreement (TRA). Interest expense in 2013 primarily

related to interest on the TRA. For a detailed discussion of the TRA, see “Notes to the Financial Statements—17. Tax

Receivable Agreement.”

Capitalized Interest. Capitalized interest represents interest cost incurred during the acquisition period of an aircraft

which theoretically could have been avoided had we not made PDPs for that aircraft. The percent of interest expense

capitalized is equal to the amount of interest which could have been avoided. As such, if the amount of PDPs on deposit is less

than the amount of related debt on which interest is incurred, then only a percent of total incurred interest expense qualifies for

capitalization. These amounts are capitalized as part of the cost of the aircraft upon delivery. Capitalization of interest ceases

when the asset is ready for service. Capitalized interest for 2015 primarily related to the interest incurred on long-term debt. For

2014, capitalized interest related to interest incurred on long-term debt, underpayment of prior year jet fuel FET and interest

charged under the TRA. For 2013, capitalized interest related to interest incurred in connection with payments owed under the

TRA.

Interest Income. For 2015, interest income was related to interest earned on funds required to be held in escrow in

accordance with the terms of our EETC. For a detailed discussion of the EETC, see “Notes to the Financial Statements—9.

Debt and Other Obligations.”

Other Expense. For 2014, other expense included $1.4 million related to the tax receivable settlement amount in excess of

the amount previously accrued for. In addition, for 2014, other expense included a charitable contribution of $1.0 million that is

specifically creditable against current income tax in the State of Florida, as allowed under state law.

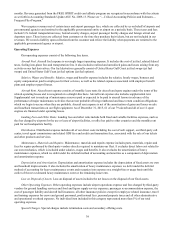

Income Taxes

We account for income taxes using the liability method. We record a valuation allowance to reduce the deferred tax assets

reported if, based on the weight of the evidence, it is more likely than not that some portion or all of the deferred tax assets will

not be realized. Deferred taxes are recorded based on differences between the financial statement basis and tax basis of assets

and liabilities and available tax loss and credit carryforwards. In assessing the realizability of the deferred tax assets, we

consider whether it is more likely than not that some or all of the deferred tax assets will be realized. In evaluating the ability to

utilize our deferred tax assets, we consider all available evidence, both positive and negative, in determining future taxable

income on a jurisdiction by jurisdiction basis.

In connection with our IPO in 2011, we entered into the TRA and thereby distributed immediately prior to the completion

of the IPO to the holders of common stock as of such time, or the Pre-IPO Stockholders, the right to receive an amount equal to

90% of the cash savings in federal income tax realized by it by virtue of the use of the federal net operating loss, deferred

interest deductions and alternative minimum tax credits held by us as of March 31, 2011, which was defined as the Pre-IPO

NOL. Cash tax savings were generally computed by comparing actual federal income tax liability to the amount of such taxes

that we would have been required to pay had such Pre-IPO NOLs (as defined in the TRA) not been available. Upon

consummation of the IPO and execution of the TRA, we recorded a liability with an offsetting reduction to additional paid in

capital. The amount and timing of payments under the TRA depended upon a number of factors, including, but not limited to,

the amount and timing of taxable income generated in future periods and any limitations that may have been imposed on our

ability to use the Pre-IPO NOLs. The term of the TRA was to continue until the first to occur (a) the full payment of all

amounts required under the agreement with respect to utilization or expiration of all of the Pre-IPO NOLs, (b) the end of the

taxable year including the tenth anniversary of the IPO or (c) a change in control of the Company.

In accordance with the TRA, we were required to submit a Tax Benefit Schedule showing the proposed TRA payout

amount to the Stockholder Representatives within 45 calendar days of filing our tax return. Stockholder Representatives were

defined as Indigo Pacific Partners, LLC and OCM FIE, LLC, representing the two largest ownership interest of pre-IPO shares.

The Tax Benefit Schedule was to become final and binding on all parties unless a Stockholder Representative, within 45

calendar days after receiving such schedule, provided us with notice of a material objection to such schedule. If the parties, for

any reason, were unable to successfully resolve the issues raised in any notice within 30 calendar days of receipt of such notice,

we and the Stockholder Representatives had the right to employ the reconciliation procedures as set forth in the TRA. If the Tax

Benefit Schedule was accepted, we then had five days after acceptance to make payments to the Pre-IPO stockholders.

Pursuant to the TRA's reconciliation procedures, any disputes that could not be settled amicably, were to be settled by

arbitration conducted by a single arbitrator jointly selected by both parties.