Spirit Airlines 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

87

The Company files its tax returns as prescribed by the tax laws of the jurisdictions in which it operates. The Company's

federal income tax returns for 2006 through 2014 tax years are still subject to examination in the U.S. Various state and foreign

jurisdiction tax years remain open to examination. The Company believes that any potential assessment would be immaterial to

its financial statements.

14. Commitments and Contingencies

Aircraft-Related Commitments and Financing Arrangements

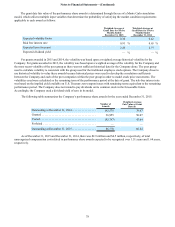

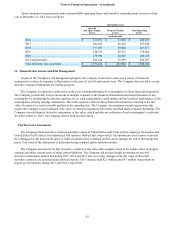

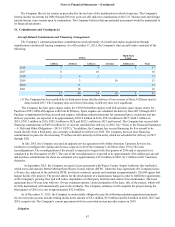

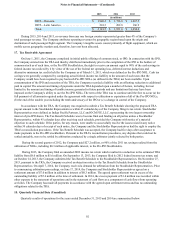

The Company’s contractual purchase commitments consist primarily of aircraft and engine acquisitions through

manufacturers and aircraft leasing companies. As of December 31, 2015, the Company's firm aircraft orders consisted of the

following:

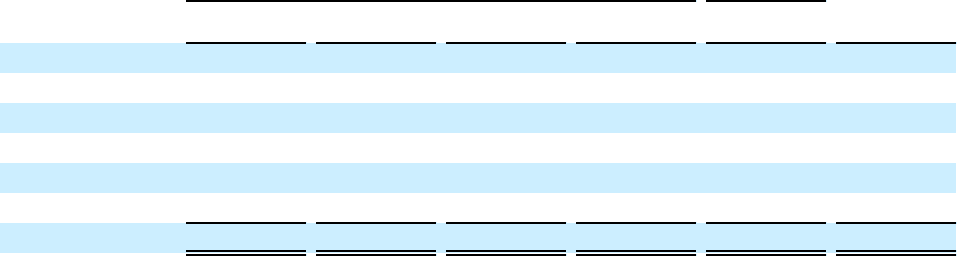

Airbus Third-Party

Lessor

A320ceo A320neo A321ceo A321neo A320neo (1) Total

2016 3 9 5 17

2017 8 10 18

2018 2 6 5 13

2019 3 10 13

2020 13 13

2021 18 18

13 40 24 10 5 92

(1) The Company has been notified by its third-party lessor that the delivery of one or more of these A320neos may be

delayed until 2017. The Company does not believe this delay in delivery date to be significant.

The Company has four spare engine orders for V2500 SelectOne engines with IAE and nine spare engine orders for

PurePower PW 1100G-JM engines with Pratt & Whitney. Spare engines are scheduled for delivery from 2017 through 2023.

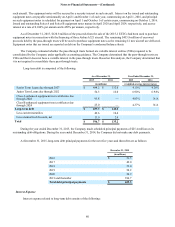

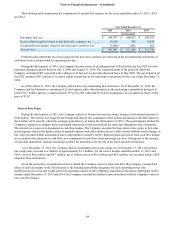

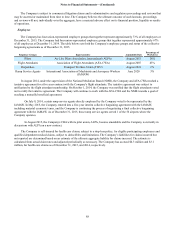

Purchase commitments for these aircraft and engines, including estimated amounts for contractual price escalations and pre-

delivery payments, are expected to be approximately $592.9 million in 2016, $767.4 million in 2017, $620.5 million in

2018, $703.3 million in 2019, $705.5 million in 2020 and $812.1 million in 2021 and beyond. The Company has secured debt

financing commitments of $455.8 million for 12 aircraft, scheduled for delivery in 2016. See “Notes to the Financial Statements

—9. Debt and Other Obligations—2015-1 EETCs.” In addition, the Company has secured financing for five aircraft to be

leased directly from a third party, also currently scheduled for delivery in 2016. The Company does not have financing

commitments in place for the remaining 75 Airbus aircraft currently on firm order, which are scheduled for delivery in 2017

through 2021.

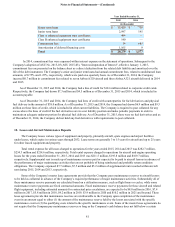

In July 2015, the Company executed an upgrade service agreement with Airbus Americas Customer Services Inc.

(Airbus) to reconfigure the seating and increase capacity in 40 of the Company’s A320ceos from 178 to 182 seats

(reconfiguration). The reconfiguration of the aircraft is expected to begin in the first quarter of 2016 and is expected to be

completed in the first quarter of 2017. The cost of the reconfiguration is expected to be approximately $0.6 million per aircraft

and purchase commitments for these are estimated to be approximately $15.0 million in 2016, $1.7 million in 2017 and none

thereafter.

In September 2015, the Company executed a lease agreement with Wayne County Airport Authority (the Authority),

which owns and operates Detroit Metropolitan Wayne County Airport (DTW). Under the lease agreement, the Company leases

a 10-acre site, adjacent to the airfield at DTW, in order to construct, operate and maintain an approximately 126,000 square foot

hangar facility (the project). The project allows for the development of a maintenance hangar in order to fulfill the requirements

of the Company's growing fleet and will reduce dependence on third-party facilities and contract line maintenance. The lease

agreement has a 30-year term with two 10-year extension options. Upon termination of the lease, title of the project, which will

be fully depreciated, will automatically pass to the Authority. The Company estimates it will complete the project during the

third quarter of 2016 at a cost of approximately $32.0 million.

As of December 31, 2015, the Company is contractually obligated to pay the following minimum guaranteed payments

for its reservation system and advertising media in the amount of $5.1 million, $3.9 million and $2.6 million in 2016, 2017 and

2018, respectively. The Company's current agreement with its reservation system provider expires in 2018.

Litigation