Spirit Airlines 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

In September 2015, we executed a lease agreement with Wayne County Airport Authority (the Authority), which owns

and operates Detroit Metropolitan Wayne County Airport (DTW). Under the lease agreement, we lease a 10-acre site, adjacent

to the airfield at DTW, in order to construct, operate and maintain an approximately 126,000 square foot hangar facility. The

lease agreement has a 30-year term with two 10-year extension options. Upon termination of the lease, title of the project,

which will be fully depreciated, will automatically pass to the Authority. We estimate we will complete the project during the

third quarter of 2016. Future commitment amounts for the project are included within operating lease obligations in the table

above.

Off-Balance Sheet Arrangements

We have significant obligations for aircraft and spare engines as 61 of our 79 aircraft and all of our 11 spare engines are

financed under operating leases and therefore are not reflected on our balance sheets. These leases expire between 2016 and

2027. Aircraft rent payments were $217.0 million and $198.7 million for 2015 and 2014, respectively. Our aircraft lease

payments for 56 of our aircraft are fixed-rate obligations. Five of our leases provide for variable rent payments, which fluctuate

based on changes in LIBOR (London Interbank Offered Rate).

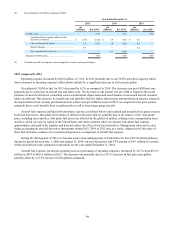

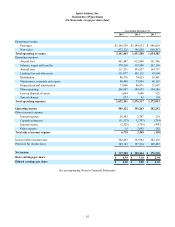

Our contractual purchase commitments consist primarily of aircraft and engine acquisitions through manufacturer and

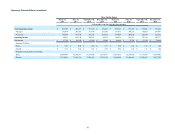

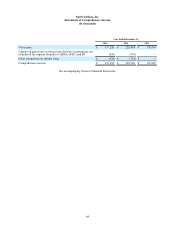

aircraft leasing companies. As of December 31, 2015, our firm aircraft orders consisted of the following:

Airbus Third-Party

Lessor

A320ceo A320neo A321ceo A321neo A320neo (1) Total

2016 3 9 5 17

2017 8 10 18

2018 2 6 5 13

2019 3 10 13

2020 13 13

2021 18 18

13 40 24 10 5 92

(1) We have been notified by our third-party lessor that the delivery of one or more of these A320neos may be delayed

until 2017. We do not believe this delay in delivery date to be significant.

We also have four spare engine orders for V2500 SelectOne engines with IAE and nine spare engine orders for

PurePower PW 1100G-JM engines with Pratt & Whitney. Spare engines are scheduled for delivery from 2017 through 2023.

As of December 31, 2015, we had lines of credit related to corporate credit cards of $18.6 million from which we had

drawn $7.3 million.

As of December 31, 2015, we had lines of credit with counterparties for both physical fuel delivery and derivatives in the

amount of $38.0 million. As of December 31, 2015, we had drawn $6.9 million on these lines of credit. We are required to post

collateral for any excess above the lines of credit if the derivatives are in a net liability position and make periodic payments in

order to maintain an adequate undrawn portion for physical fuel delivery. As of December 31, 2015, we did not hold any

derivatives with requirements to post collateral.

As of December 31, 2015, we have $5.6 million in uncollateralized surety bonds and a $25.1 million unsecured standby

letter of credit facility, representing an off balance-sheet commitment, of which $13.0 million had been drawn upon for issued

letters of credit.