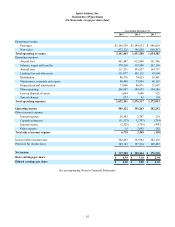

Spirit Airlines 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

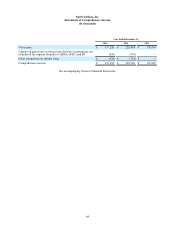

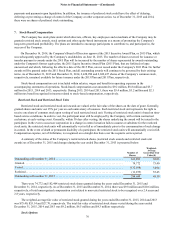

Spirit Airlines, Inc.

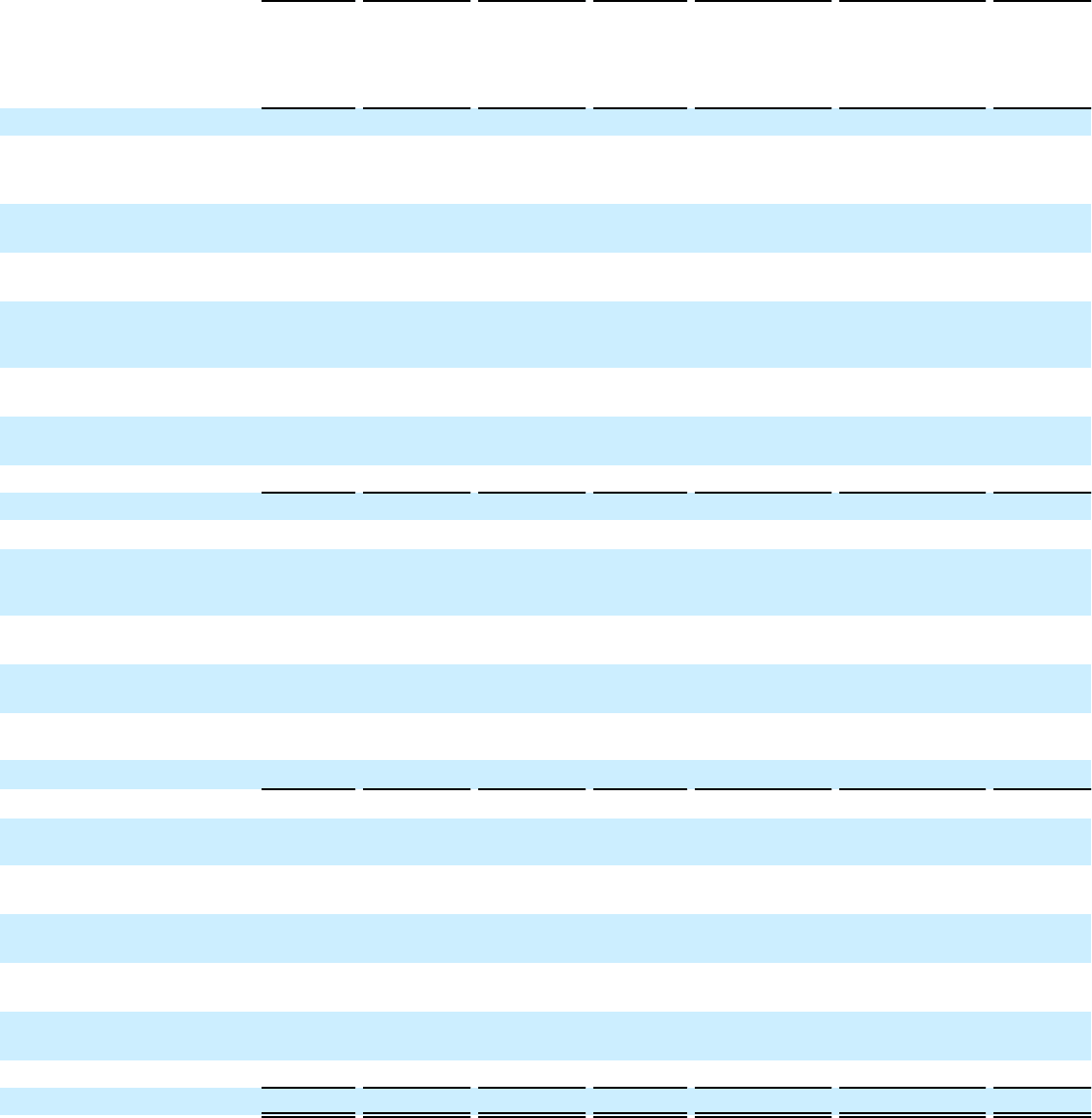

Statements of Shareholders’ Equity

(In thousands)

Common

Stock

Non-

Voting

Common

Stock

Additional

Paid-In

Capital Treasury

Stock

Retained

Earnings

(Accumulated

Deficit)

Accumulated

Other

Comprehensive

Income (Loss) Total

Balance at December 31, 2012 $ 6 $ 1 $ 504,527 $ (1,151) $ 79,152 $ — $ 582,535

Adjustment to liability

recorded under Tax Receivable

Agreement. . . . . . . . . . . . . . . . . — — 2,336 — — — 2,336

Share-based compensation . . . . — — 5,689 — — — 5,689

Repurchase of common stock . . ———(1,140) — — (1,140)

Conversion of non-voting

common stock to common

stock . . . . . . . . . . . . . . . . . . . . . 1 (1) —

Proceeds from options

exercised — — 852 — — — 852

Excess tax benefits from share-

based compensation — — 1,927 — — — 1,927

Net income — — — — 176,918 — 176,918

Balance at December 31, 2013 $ 7 $ — $ 515,331 $ (2,291) $ 256,070 $ — $ 769,117

Share-based compensation . . . . — — 8,797 — — — 8,797

Repurchase of common stock . . — — (1,630) — — (1,630)

Proceeds from options

exercised . . . . . . . . . . . . . . . . . . — — 174 — — — 174

Excess tax benefits from share-

based compensation . . . . . . . . . — — 1,871 — — — 1,871

Unrealized gain (loss) from

cash flow hedges, net of tax (718) (718)

Net income . . . . . . . . . . . . . . . . — — — — 225,464 — 225,464

Balance at December 31, 2014 $ 7 $ — $ 526,173 $ (3,921) $ 481,534 $ (718) $1,003,075

Share-based compensation . . . . — — 9,222 — — — 9,222

Repurchase of common stock — — (112,261) — — (112,261)

Proceeds from options

exercised . . . . . . . . . . . . . . . . . . — — 32 — — — 32

Excess tax benefits from share-

based compensation — — 8,850 — — — 8,850

Unrealized gain (loss) from

cash flow hedges, net of tax (828) (828)

Net income . . . . . . . . . . . . . . . . — — — — 317,220 — 317,220

Balance at December 31, 2015 $ 7 $ — $ 544,277 $(116,182) $ 798,754 $ (1,546) $1,225,310

See accompanying Notes to Financial Statements.