Spirit Airlines 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

2014 compared to 2013

Operating expense increased by $204.2 million, or 14.9%, in 2014 primarily due to our 17.9% growth in capacity as well

as higher amortization of heavy maintenance events on our aircraft.

Our adjusted CASM ex fuel for 2014 decreased by 0.5% as compared to 2013. The decrease was primarily due to lower

passenger re-accommodation expense year over year, due to better operational performance during 2014, as compared to 2013.

In addition, on a per-ASM basis, distribution expense decreased, primarily due to a $2.9 million settlement gain received in

2014, and aircraft rent expense decreased due to reduced rent expense related to 14 A319 aircraft for which lease extensions

with reduced rates were negotiated with the lessor at the end of the second quarter of 2013, providing for a full year of benefit

in 2014 versus 7 months of benefit in 2013. These decreases were partially offset by an increase in depreciation and

amortization expense, landing fees and other rents expense, salaries, wages and benefits expense, and maintenance, materials

and repairs expense per ASM.

Aircraft fuel expense increased by 11.1% from $551.7 million in 2013 to $612.9 million in 2014. The increase was

primarily due to a 16.6% increase in fuel gallons consumed as well as an additional $9.3 million recorded in the third quarter of

2014 for unpaid jet fuel FET related to prior years, partially offset by a 6.9% decrease in fuel prices per gallon.

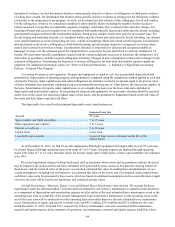

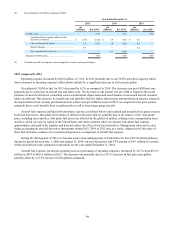

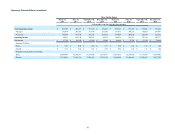

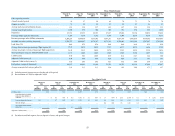

The elements of the changes in aircraft fuel expense are illustrated in the following table:

Year Ended December 31,

2014 2013

(in thousands, except per

gallon amounts) Percent

Change

Fuel gallons consumed 200,498 171,931 16.6 %

Into-plane fuel cost per gallon $ 3.03 $ 3.16 (4.1)%

Into-plane fuel expense $ 608,033 $ 542,523 12.1 %

Realized losses (gains) related to fuel derivative contracts, net 995 8,958 NM

Unrealized losses (gains) related to fuel derivative contracts, net 3,881 265 NM

Aircraft fuel expense (per statement of operations) $ 612,909 $ 551,746 11.1 %

The into-plane fuel cost per gallon decrease of 4.1% was primarily a result of a decrease in jet fuel prices partially offset

by an additional $9.3 million for prior year unpaid jet fuel FET recorded in the third quarter of 2014.

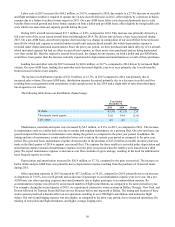

The elements of the changes in economic fuel expense are illustrated in the following table:

Year Ended December 31,

2014 2013

(in thousands, except per

gallon amounts) Percent

Change

Into-plane fuel expense $ 608,033 $ 542,523 12.1 %

Realized (gains) and losses related to fuel derivative contracts, net 995 8,958 NM

Out of period fuel federal excise tax (9,278) — NM

Economic fuel expense $ 599,750 $ 551,481 8.8 %

Fuel gallons consumed 200,498 171,931 16.6 %

Economic fuel cost per gallon $ 2.99 $ 3.21 (6.9)%

Fuel gallons consumed increased 16.6% as a result of increased operations, as evidenced by a 15.6% increase in block

hours.

We did not pay or receive cash from any fuel derivatives that settled during the twelve months ended December 31, 2014.

Total net loss recognized for derivatives that settled during the twelve months ended December 31, 2013 was $9.0 million. This

amount represents the net cash paid for the settlement of derivatives. We paid $1.0 million in premiums for fuel options which

expired during the twelve months ended December 31, 2014. We did not have any fuel options expire during the twelve months

ended December 31, 2013. We had $3.9 million in unrealized gains and losses related to our outstanding fuel derivatives during