Spirit Airlines 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

91

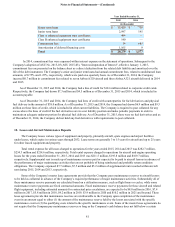

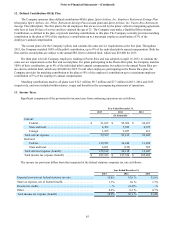

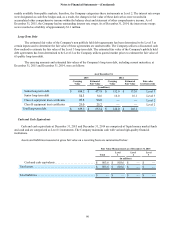

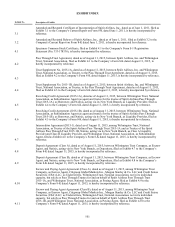

Fair Value Measurements as of December 31, 2014

Total Level

1Level

2Level

3

(in millions)

Cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 632.8 $ 632.8 $ — $ —

Jet fuel options. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.8 — — 4.8

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 637.6 $ 632.8 $ — $ 4.8

Interest rate swaps $ 1.1 $ — $ 1.1 $ —

Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.1 $ — $ 1.1 $ —

The Company had no transfers of assets or liabilities between any of the above levels during the years ended

December 31, 2015 or 2014.

The Company's Valuation Group is made up of individuals from the Company's Treasury and Corporate Accounting

departments. The Valuation Group is responsible for the Company's valuation policies, procedures and execution thereof. The

Company's Valuation Group reports to the Company's Chief Financial Officer and seeks approval for certain derivative

transactions from the Audit Committee. The Valuation Group compares the results of the Company's internally developed

valuation methods with counterparty reports at each balance sheet date and assesses the Company's valuation methods for

accuracy and identifies any needs for modification.

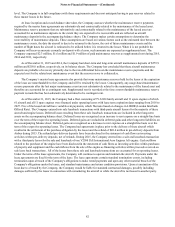

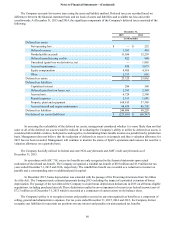

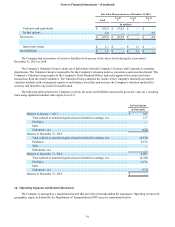

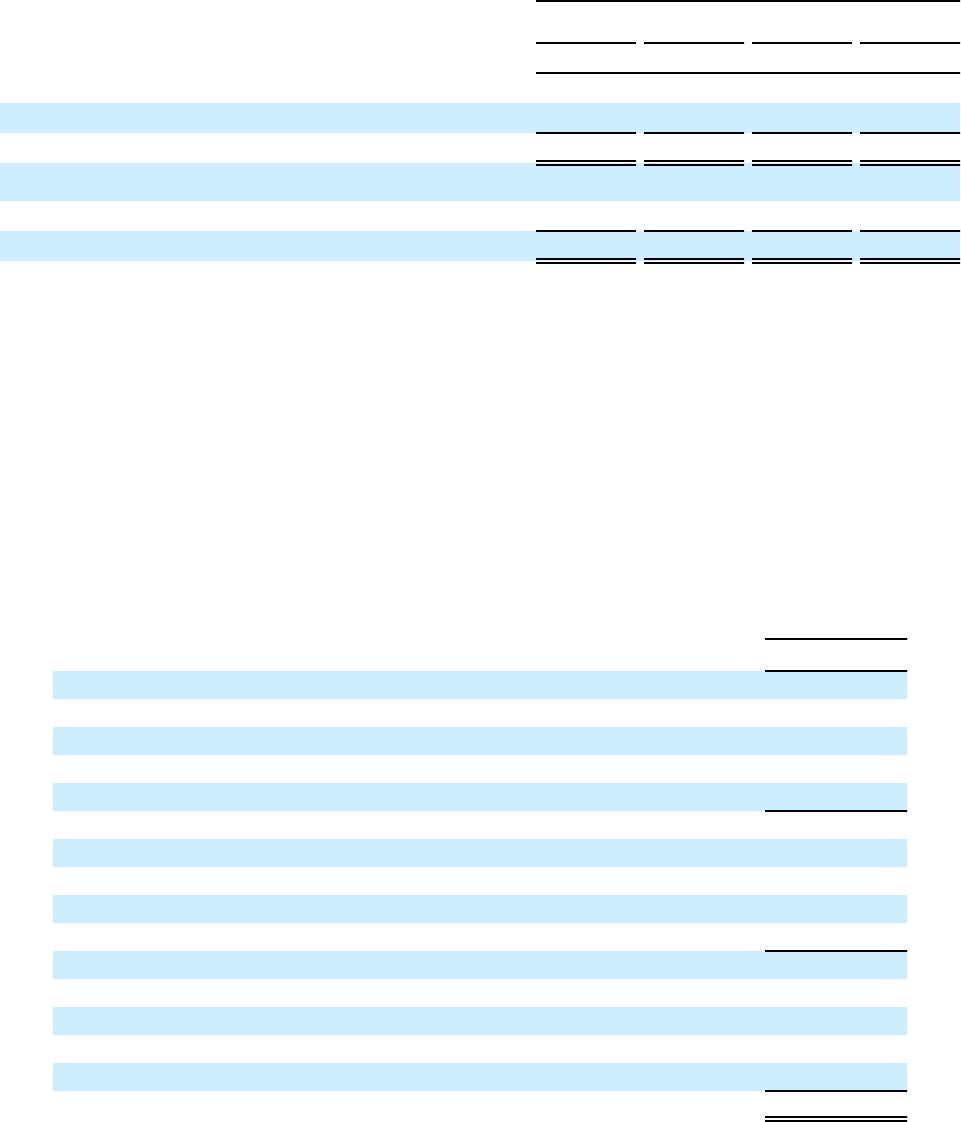

The following table presents the Company’s activity for assets and liabilities measured at gross fair value on a recurring

basis using significant unobservable inputs (Level 3):

Jet Fuel Options

(in thousands)

Balance at January 1, 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 265

Total realized or unrealized gains (losses) included in earnings, net . . . . . . . . . . . . . 157

Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —

Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —

Settlements, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (422)

Balance at December 31, 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —

Total realized or unrealized gains (losses) included in earnings, net . . . . . . . . . . . . . (4,876)

Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,679

Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —

Settlements, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —

Balance at December 31, 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,803

Total realized or unrealized gains (losses) included in earnings, net . . . . . . . . . . . . . (6,700)

Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,474

Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —

Settlements, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (577)

Balance at December 31, 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ —

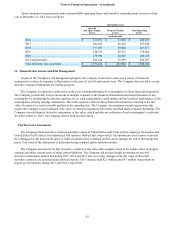

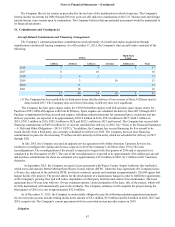

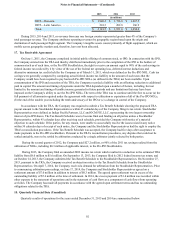

16. Operating Segments and Related Disclosures

The Company is managed as a single business unit that provides air transportation for passengers. Operating revenues by

geographic region as defined by the Department of Transportation (DOT) area are summarized below: