Spirit Airlines 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

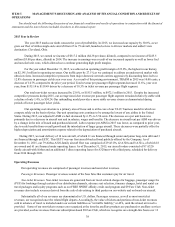

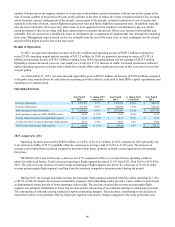

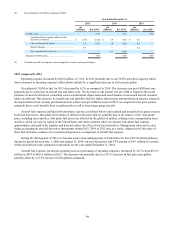

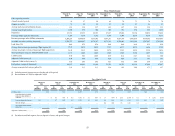

(2) Reconciliation of CASM to Adjusted CASM:

Year Ended December 31,

2015 2014 2013

(in

millions) Per ASM (in

millions) Per ASM (in

millions) Per ASM

CASM (cents)............................................................. 7.68 9.65 9.90

Unrealized losses (gains) related to fuel

derivative contracts............................................ $ (3.9) (0.02) $ 3.9 0.02 $ 0.3 —

Loss on disposal of assets.................................. 1.6 0.01 3.0 0.02 0.5 —

Special charges.................................................. 0.7 — — — 0.2 —

Out of period fuel excise tax ............................. — — 9.3 0.06 — —

Adjusted CASM (cents) ............................................. 7.69 9.55 9.89

(3) Excludes aircraft fuel expense, loss on disposal of assets, and special charges.

2015 compared to 2014

Operating expense increased by $56.0 million, or 3.6%, in 2015 primarily due to our 30.0% growth in capacity which

drove increases in operating expenses offset almost entirely by a significant decrease in fuel cost per gallon.

Our adjusted CASM ex fuel for 2015 decreased by 6.5% as compared to 2014. The decrease on a per-ASM basis was

primarily due to a decrease in aircraft rent and labor costs. The decrease in our aircraft rent per ASM is related to the recent

purchase of aircraft with lower ownership costs recorded under depreciation and amortization versus leased aircraft recorded

under aircraft rent. This decrease in aircraft rent was partially offset by higher depreciation and amortization expense related to

the depreciation of our recently purchased aircraft. Labor costs per ASM are lower in 2015, as compared to the prior period,

primarily due to scale benefits from overall growth as well as from larger gauge aircraft.

Aircraft fuel expenses includes both into-plane expense (as defined below) and realized and unrealized net gains or losses

from fuel derivatives. Into-plane fuel expense is defined as the price that we generally pay at the airport, or the “into-plane”

price, including taxes and fees. Into-plane fuel prices are affected by the global oil market, refining costs, transportation taxes

and fees, which can vary by region in the United States and other countries where we operate. Into-plane fuel expense

approximates cash paid to the supplier and does not reflect the effect of our fuel derivatives. Management chose not to elect

hedge accounting on any fuel derivative instruments during 2015, 2014 or 2013 and, as a result, changes in the fair value of

these fuel derivative contracts are recorded each period as a component of aircraft fuel expense.

During the third quarter of 2014, we became aware of an underpayment of Federal Excise Tax (FET) for fuel purchases

during the period between July 1, 2009 and August 31, 2014. An out of period jet fuel FET amount of $9.3 million is recorded

within aircraft fuel in the statement of operations for the year ended December 31, 2014.

Aircraft fuel expense, our largest operating cost as a percentage of operating expenses, decreased by 24.7% from $612.9

million in 2014 to $461.4 million in 2015. The decrease was primarily due to a 39.1% decrease in fuel prices per gallon,

partially offset by a 27.2% increase in fuel gallons consumed.