Spirit Airlines 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Financial Statements—(Continued)

72

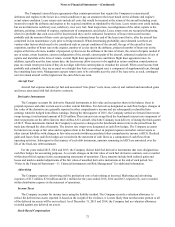

The Company's aircraft lease agreements often contain provisions that require the Company to return aircraft

airframes and engines to the lessor in a certain condition or pay an amount to the lessor based on the airframe and engine's

actual return condition. Lease return costs include all costs that would be incurred at the return of the aircraft including costs

incurred to repair the airframe and engines to the required condition as stipulated by the lease. Lease return costs could include,

but are not limited to redelivery cost, redelivery crew cost, fuel, final inspections, reconfiguration of the cabin, repairs to the

airframe, painting, overhaul of engines, replacement of components, and checks. Lease return costs are recognized beginning

when it is probable that such costs will be incurred and they can be estimated. Incurrence of lease return costs becomes

probable and the amount of those costs can typically be estimated near the end of the lease term (that is, after the aircraft has

completed its last maintenance cycle prior to being returned). When determining probability and estimated cost there are

various other factors which need to be considered such as current condition of the aircraft, the age of the aircraft at lease

expiration, number of hours run on the engines, number of cycles run on the airframe, projected number of hours run on the

engine at the time of return, number of projected cycles run on the airframe at the time of return, the extent of repairs needed if

any at return, return locations, current configuration of the aircraft, current paint of the aircraft, estimated escalation of cost of

repairs and materials at the time of return, current flight hour agreement rates and future flight hour agreement rates. In

addition, typically near the lease return date, the lessors may allow reserves to be applied as return condition consideration or

pass on certain return provisions if they do not align with their current plans to remarket the aircraft. When costs become both

probable and estimable, they are accrued on a straight-line basis as contingent rent, a component of supplemental rent, through

the remaining lease term. Management expects return costs to be estimable near the end of the lease term, as such, contingent

rent for related aircraft will be higher near the end of the lease term.

Aircraft Fuel

Aircraft fuel expense includes jet fuel and associated “into-plane” costs, taxes, and oil, and realized and unrealized gains

and losses associated with fuel derivative contracts.

Derivative Instruments

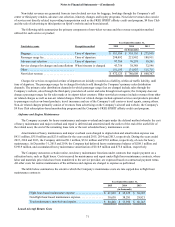

The Company accounts for derivative financial instruments at fair value and recognizes them in the balance sheet in

prepaid expenses and other current assets or other current liabilities. For derivatives designated as cash flow hedges, changes in

fair value of the derivative are generally reported in other comprehensive income and are subsequently reclassified into

earnings when the hedged item affects earnings. During the third quarter of 2015, the Company settled six forward interest rate

swaps having a total notional amount of $120 million. These interest rate swaps fixed the benchmark interest rate component of

interest payments on the debt related to three Airbus A321 aircraft, which the Company took delivery of during the third quarter

of 2015. These instruments limited the Company's exposure to changes in the benchmark interest rate in the period from the

trade date through the date of maturity. The interest rate swaps were designated as cash flow hedges. The Company accounts

for interest rate swaps at fair value and recognizes them in the balance sheet in prepaid expenses and other current assets or

other current liabilities with changes in fair value recorded within accumulated other comprehensive income (AOCI). Realized

gains and losses from cash flow hedges are recorded in the statement of cash flows as a component of cash flows from

operating activities. Subsequent to the issuance of each debt instrument, amounts remaining in AOCI are amortized over the

life of the fixed-rate debt instrument.

For the years ended 2015, 2014 and 2013, the Company did not hold fuel derivative instruments that were designated as

cash flow hedges for accounting purposes. As a result, changes in the fair value of such fuel derivative contracts were recorded

within aircraft fuel expense in the accompanying statements of operations. These amounts include both realized gains and

losses and mark-to-market adjustments of the fair value of unsettled derivative instruments at the end of each period. See

“Notes to the Financial Statements—11. Financial Instruments and Risk Management” for additional information.

Advertising

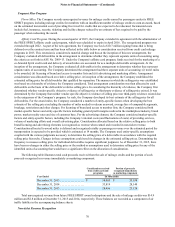

The Company expenses advertising and the production costs of advertising as incurred. Marketing and advertising

expenses of $3.5 million, $3.0 million and $2.1 million for the years ended 2015, 2014 and 2013, respectively, were recorded

within distribution expense in the statement of operations.

Income Taxes

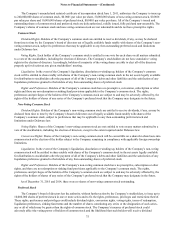

The Company accounts for income taxes using the liability method. The Company records a valuation allowance to

reduce the deferred tax assets reported if, based on the weight of the evidence, it is more likely than not that some portion or all

of the deferred tax assets will be not realized. As of December 31, 2015 and 2014, the Company had no valuation allowance

recorded against any deferred tax assets.

Stock-Based Compensation