Spirit Airlines 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the fiscal year ended December 31, 2015

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the transition period from to

Commission File No. 001-35186

Spirit Airlines, Inc.

(Exact name of registrant as specified in its charter)

Delaware 38-1747023

(State or other jurisdiction of

incorporation or organization) (I.R.S. Employer

Identification No.)

2800 Executive Way

Miramar, Florida 33025

(Address of principal executive offices) (Zip Code)

(954) 447-7920

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class Name of Each Exchange on Which Registered

Voting Common Stock, $0.0001 par value

Non-Voting Common Stock, $0.0001 par value

NASDAQ Global Select Market

None

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes No

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required

to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required

to submit and post such files). Yes No

Table of contents

-

Page 1

... No.) 2800 Executive Way Miramar, Florida (Address of principal executive offices) 33025 (Zip Code) (954) 447-7920 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Voting Common Stock, $0.0001 par value Non... -

Page 2

... computed by reference to the last sale price of the common stock on the NASDAQ Global Select Market on June 30, 2015, the last trading day of the registrant's most recently completed second fiscal quarter. Shares held by each executive officer, director and by certain persons that own 10 percent or... -

Page 3

... Stockholder Matters and Issuer Purchases of Equity Securities...Item 6. Selected Financial Data ...Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations ...Item 7A. Quantitative and Qualitative Disclosures About Market Risk ...Item 8. Financial Statements and... -

Page 4

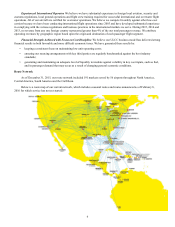

... who pay for their own travel, and our business model is designed to deliver what we believe our customers want: low fares. We aggressively use low fares to address an underserved market, which helps us to increase passenger volume, load factors and non-ticket revenue on the flights we operate. We... -

Page 5

... to identify, select and pay for only the products and services they want to use. In implementing our unbundled strategy, we have grown average non-ticket revenue per passenger flight segment from approximately $5 in 2006 to $54 in 2015 by charging for checked and carry-on baggage; passing through... -

Page 6

... regulations and business practices in the international markets we serve. During 2015, 2014 and 2013, no revenue from any one foreign country represented greater than 4% of the our total passenger revenue. We attribute operating revenues by geographic region based upon the origin and destination... -

Page 7

... reports as well as near term forecasting. Competition The airline industry is highly competitive. The principal competitive factors in the airline industry are fare pricing, total price, flight schedules, aircraft type, passenger amenities, number of routes served from a city, customer service... -

Page 8

...capital requirements inherent in heavy aircraft maintenance. We have entered into a long-term flight hour agreement for our current fleet and future deliveries with IAE and Pratt & Whitney for our engine overhaul services and with Lufthansa Technik on an hour-by-hour basis for component services. We... -

Page 9

... forth our employee groups and status of the collective bargaining agreements. Employee Groups Representative Amendable Date Pilots Flight Attendants Dispatchers Ramp Service Agents Air Line Pilots Association, International (ALPA) Association of Flight Attendants (AFA-CWA) Transport Workers Union... -

Page 10

... with passengers through advertising, the reservation process, at the airport and on board the aircraft. Additional consumer rules proposed in 2014 that would require airlines to disclose through all points of sale the fees for certain basic ancillary services associated with the air transportation... -

Page 11

.... We currently operate international service to Aruba, Colombia, Costa Rica, Dominican Republic, El Salvador, Guatemala, Haiti, Honduras, Jamaica, Mexico, Nicaragua, Panama, Peru and St. Maarten, as well as Puerto Rico and the U.S. Virgin Islands. If we decide to increase our routes to additional... -

Page 12

...and local laws and regulations at locations where we operate and the regulations of various local authorities that operate the airports we serve. Future Regulations The U.S. and foreign governments may consider and adopt new laws, regulations, interpretations and policies regarding a wide variety of... -

Page 13

... for services such as baggage and advance seat selection. This unbundling and other cost reducing measures could enable competitor airlines to reduce fares on routes that we serve. In 2015, the availability of low priced fares coupled with an increase in domestic capacity led to dramatic changes in... -

Page 14

... the level of passenger traffic or maintaining the level of fares or revenues related to ancillary services required to sustain profitable operations in new and existing markets and could impede our growth strategy, which could harm our operating results. Due to our relatively small size, we... -

Page 15

... Restrictions on or increased taxes applicable to charges for ancillary products and services paid by airline passengers and burdensome consumer protection regulations or laws could harm our business, results of operations and financial condition. During 2015, 2014 and 2013, we generated non-ticket... -

Page 16

... Haiti, can cause flight cancellations or significant delays. For example, during the second quarter of 2015, we experienced consecutive storm systems in Dallas, Chicago, New York and Detroit followed by Tropical Storm Bill that sat over Houston before moving north to Dallas. The timing and location... -

Page 17

... business, results of operations and financial condition. We face competition from air travel substitutes. In addition to airline competition from traditional network airlines, other low-cost airlines and regional airlines, we also face competition from air travel substitutes. On our domestic routes... -

Page 18

... increase cost of the healthcare benefits provided to our U.S. employees. In addition, the failure to comply materially with such existing and new laws, rules and regulations could adversely affect our business, results of operations and financial conditions. We have a significant amount of aircraft... -

Page 19

... our aircraft lessors to fund reserves in cash in advance for scheduled maintenance, and a portion of our cash is therefore unavailable until after we have completed the scheduled maintenance in accordance with the terms of the operating leases. Based on the age of our fleet and our growth strategy... -

Page 20

... laws, regulations, taxes and increased airport rates and charges have been proposed from time to time that could significantly increase the cost of airline operations or reduce the demand for air travel. If adopted, these measures could have the effect of raising ticket prices, reducing revenue... -

Page 21

..., would have increase disclosure regarding fees for airline ticket sales, impose federal taxes on charges for carry-on and checked baggage, authorize the DOT's Aviation Consumer Protection Division to oversee lost and stolen baggage claims, and require data collection and the public release of... -

Page 22

... aircraft, increasing the frequency of flights and size of aircraft used in markets we currently serve, and expanding the number of markets we serve where our low cost structure would likely be successful. Effectively implementing our growth strategy is critical for our business to achieve economies... -

Page 23

... costs in an effort to minimize those risks. Our business employs systems and websites that allow for the secure storage and transmission of proprietary or confidential information regarding our customers, employees, suppliers and others, including personal identification information, credit card... -

Page 24

... to address an underserved market. Please see "-Restrictions on or increased taxes applicable to charges for ancillary products and services paid by airline passengers and burdensome consumer protection regulations or laws could harm our business, results of operations and financial condition." Our... -

Page 25

... safe or reliable than other transportation alternatives, or could cause us to perform time consuming and costly inspections on our aircraft or engines which could have a material adverse effect on our business, results of operations and financial condition. Negative publicity regarding our customer... -

Page 26

... fleet are better positioned than we are to manage such events. Reduction in demand for air transportation, or governmental reduction or limitation of operating capacity, in the domestic U.S., Caribbean or Latin American markets could harm our business, results of operations and financial condition... -

Page 27

... to maintain our company culture, our business, results of operations and financial condition could be harmed. Our business is labor intensive. We require large numbers of pilots, flight attendants, maintenance technicians and other personnel. The airline industry has from time to time experienced... -

Page 28

...competitors, the airline industry or the economy in general; strategic actions by us or our competitors, such as acquisitions or restructurings; increased price competition; media reports and publications about the safety of our aircraft or the aircraft type we operate; new regulatory pronouncements... -

Page 29

... our business and do not intend to pay cash dividends in the foreseeable future. Any future determination to pay dividends will be at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements, restrictions contained in current or... -

Page 30

...31, 2015, we operated a fleet of 79 aircraft as detailed in the following table: Average Age (years) 9.6 2.6 2.8 5.2 Number of Aircraft 29 42 8 79 Number Owned - 12 6 18 Number Leased 29 30 2 61 Aircraft Type A319 A320 A321 Seats 145 178 218 - 228 As of December 31, 2015, our firm aircraft orders... -

Page 31

... The project allows for the development of a maintenance hangar in order to fulfill the requirements of our growing fleet and will reduce dependence on third-party facilities and contract line maintenance. The lease agreement has a 30-year term with two 10-year extension options. Upon termination of... -

Page 32

... stock. Any future determination as to the declaration and payment of dividends, if any, will be at the discretion of our board of directors and will depend on then existing conditions, including our financial condition, operating results, contractual restrictions, capital requirements, business... -

Page 33

... PURCHASES OF EQUITY SECURITIES Period October 1-31, 2015 ...November 1-30, 2015 ...December 1-31, 2015 ...Total ... Total Number of Shares Purchased 1,335 1,147 - 2,482 Average Price Paid per Share $ $ $ 44.52 34.00 N/A 40.87 Total Number of Shares Purchased as Part of Publicly Announced Plans... -

Page 34

... of all dividends. The May 26, 2011 stock price used for our stock is the initial public offering price. Stock price performance, presented for the period from May 26, 2011 to December 31, 2015, is not necessarily indicative of future results. 5/26/2011 Spirit ...NYSE ARCA Airline Index. NASDAQ... -

Page 35

... 1,318,388 $ 689,650 381,536 1,071,186 2014 2013 2012 2011 (in thousands, except share and per share data) Aircraft fuel expense is the sum of (i) "into-plane fuel cost," which includes the cost of jet fuel and certain other charges such as fuel taxes and oil, (ii) realized gains and losses related... -

Page 36

... moving our Detroit, Michigan maintenance operations to Fort Lauderdale, Florida; (ii) termination costs in connection with the IPO during the three months ended June 30, 2011 comprised of amounts paid to Indigo Partners, LLC to terminate its professional services agreement with us and fees paid to... -

Page 37

... 31, 2015 2014 2013 2012 2011 Operating Statistics (unaudited) (A) Average aircraft ...Aircraft at end of period...Airports served in the period (B) ...Average daily Aircraft utilization (hours) . . Average stage length (miles) ...Block hours ...Departures ...Passenger flight segments (thousands... -

Page 38

... generated from air travel-related charges for baggage, passenger usage fee (PUF) for bookings through certain of our distribution channels, advance seat selection, itinerary changes, hotel and rental car travel packages and loyalty programs such as our FREE SPIRIT affinity credit card program and... -

Page 39

... supply service expenses, passenger re-accommodation expense, the cost of passenger liability and aircraft hull insurance, all other insurance policies except for employee related insurance, travel and training expenses for crews and ground personnel, professional fees, personal property taxes and... -

Page 40

... required under the agreement with respect to utilization or expiration of all of the Pre-IPO NOLs, (b) the end of the taxable year including the tenth anniversary of the IPO or (c) a change in control of the Company. In accordance with the TRA, we were required to submit a Tax Benefit Schedule... -

Page 41

..., flight schedules, aircraft type, passenger amenities, number of routes served from a city, customer service, safety record, reputation, code-sharing relationships, frequent flier programs and redemption opportunities. Price competition occurs on a market-by-market basis through price discounts... -

Page 42

... we purchased all of our aircraft fuel under a single fuel service contract. The cost and future availability of jet fuel cannot be predicted with any degree of certainty. Labor. The airline industry is heavily unionized. The wages, benefits and work rules of unionized airline industry employees are... -

Page 43

.... Incremental costs include fuel, insurance, security, ticketing and facility charges reduced by an estimate of amounts required to be paid by the passenger when redeeming the award. Under our affinity card program, funds received for the marketing of a co-branded Spirit credit card and delivery of... -

Page 44

..., fees to redeem miles and other charges. For licensing of brand and access to member lists, we considered both market-specific factors and entity-specific factors, including general profit margins realized in the marketplace/industry, brand power, market royalty rates and size of customer base... -

Page 45

... factors such as the estimated time between the maintenance events, the cost of future maintenance events and the number of flight hours the aircraft is estimated to be utilized before it is returned to the lessor. When it is not probable we will recover amounts currently on deposit with a lessor... -

Page 46

... current paint of the aircraft, estimated escalation of cost of repairs and materials at the time of return, current flight hour agreement rates and future flight hour agreement rates. In addition, typically near the lease return date, the lessors may allow reserves to be applied as return condition... -

Page 47

.... The year-over-year increase in average non-ticket revenue per passenger flight segment was primarily driven by a higher volume of passengers electing to purchase seat assignments, largely due to a software update completed in 2014 that enables us to sell seat assignments through more channels as... -

Page 48

... or the "into-plane" price, including taxes and fees. Into-plane fuel prices are affected by the global oil market, refining costs, transportation taxes and fees, which can vary by region in the United States and other countries where we operate. Into-plane fuel expense approximates cash paid to the... -

Page 49

... 31, 2015 and December 31, 2014, respectively. We track economic fuel expense, which we believe is the best measure of the effect fuel prices are currently having on our business, because it most closely approximates the net cash outflow associated with purchasing fuel used for our operations during... -

Page 50

... higher passenger re-accommodation expense. Reaccommodation expense was driven by an increased number of flight cancellations, as compared to the same period last year. For example, during the second quarter of 2015, we experienced consecutive storm systems in Dallas, Chicago, New York, and Detroit... -

Page 51

... of increased operations, as evidenced by a 15.6% increase in block hours. We did not pay or receive cash from any fuel derivatives that settled during the twelve months ended December 31, 2014. Total net loss recognized for derivatives that settled during the twelve months ended December 31, 2013... -

Page 52

... flight attendant workforce required to operate the eleven new aircraft deliveries in 2014 and the implementation of new crew duty and rest rules (FAR 117) beginning in January of 2014, which resulted in the hiring of additional pilots to fly our schedule. On a per-ASM basis, labor costs increased... -

Page 53

...specifically creditable against current income tax in the State of Florida, as allowed under state law, and recorded within other expense in the statements of operations. Income Taxes In 2015, our effective tax rate was 36.9% compared to 36.1% in 2014 and 37.4% in 2013. While we expect our tax rate... -

Page 54

... 30, 2014 December 31, 2014 March 31, 2015 June 30, 2015 September 30, 2015 December 31, 2015 (in thousands, except share and per share amounts) Total operating revenue Passenger ...Non-ticket ...Operating income ...Net income ...Earnings Per Share: Basic...Diluted ...Weighted average shares... -

Page 55

... Ended March 31, 2014 Other operating statistics Aircraft at end of period ...Airports served (1)...Average daily Aircraft utilization (hours) ...Average stage length (miles)...Departures Passenger flight segments (thousands) ...Revenue passenger miles (RPMs) (thousands) Available seat miles (ASMs... -

Page 56

... purchase of four Airbus A320s and one spare engine sale leaseback transaction during 2014 and an increase in paid PDPs as compared to 2013, driven by the timing of aircraft deliveries. Net Cash Provided By Financing Activities. During 2015, financing activities provided $399.1 million. We received... -

Page 57

...a result of excess tax benefits related to share-based payments and received cash as a result of exercised stock options. We spent $4.7 million in debt issuance costs to secure the financing on 4 aircraft delivered in 2014 and 11 aircraft delivered in 2015. During 2013, financing activities provided... -

Page 58

... LIBOR (London Interbank Offered Rate). Our contractual purchase commitments consist primarily of aircraft and engine acquisitions through manufacturer and aircraft leasing companies. As of December 31, 2015, our firm aircraft orders consisted of the following: Airbus A320ceo A320neo A321ceo A321neo... -

Page 59

... the value of tickets sold in advance of travel. "ALPA" means the Airline Pilots Association, International. "ASIF" means an Aviation Security Infrastructure Fee assessed by the TSA on each airline. "Available seat miles" or "ASMs" means the number of seats available for passengers multiplied by the... -

Page 60

... taxes and oil. "Load factor" means the percentage of aircraft seats actually occupied on a flight (RPMs divided by ASMs). "NMB" means the National Mediation Board. "Total operating revenue per ASM," "TRASM" or "unit revenue" means operating revenue divided by ASMs. "OTA" means Online Travel Agent... -

Page 61

... Instruments and Positions We are subject to certain market risks, including commodity prices (specifically aircraft fuel) and interest rates. We purchase the majority of our jet fuel at prevailing market prices and seek to manage market risk through execution of our hedging strategy and other... -

Page 62

... DATA Page 63 64 65 66 67 68 94 Financial Statements: Statements of Operations ...Statements of Comprehensive Income...Balance Sheets ...Statements of Cash Flows ...Statements of Shareholders' Equity ...Notes to Financial Statements...Report of Independent Registered Public Accounting Firm ... 62 -

Page 63

Spirit Airlines, Inc. Statements of Operations (In thousands, except per share data) Year Ended December 31, 2015 2014 2013 Operating revenues: Passenger Non-ticket Total operating revenues Operating expenses: Aircraft fuel Salaries, wages and benefits Aircraft rent Landing fees and other rents ... -

Page 64

Spirit Airlines, Inc. Statements of Comprehensive Income (In thousands) Year Ended December 31, 2015 2014 2013 Net income Unrealized gain (loss) on interest rate derivative instruments, net of deferred tax expense (benefit) of ($500), ($423) and $0 Other comprehensive income (loss) Comprehensive ... -

Page 65

... (In thousands, except share data) December 31, 2015 Assets Current assets: Cash and cash equivalents Accounts receivable, net Aircraft maintenance deposits Prepaid income taxes Prepaid expenses and other current assets Total current assets Property and equipment: Flight equipment Ground and other... -

Page 66

...of assets Changes in operating assets and liabilities: Accounts receivable Aircraft maintenance deposits Long-term deposits and other assets Accounts payable Air traffic liability Other liabilities Other Net cash provided by operating activities Investing activities: Pre-delivery deposits for flight... -

Page 67

... recorded under Tax Receivable Agreement ...Share-based compensation ...Repurchase of common stock . . Conversion of non-voting common stock to common stock ...Proceeds from options exercised Excess tax benefits from sharebased compensation Net income Balance at December 31, 2013 $ Share-based... -

Page 68

... of Presentation Spirit Airlines, Inc. (Spirit or the Company) headquartered in Miramar, Florida, is an ultra low-cost, low-fare airline that provides affordable travel opportunities principally throughout the domestic United States, the Caribbean and Latin America. The Company manages operations on... -

Page 69

... and fees include U.S. federal transportation taxes, federal security charges, airport passenger facility charges and international arrival and departure taxes. These items are collected from customers at the time they purchase their tickets, but are not included in passenger revenue. The Company... -

Page 70

..., insurance, security, ticketing and facility charges reduced by an estimate of fees required to be paid by the passenger when redeeming the award. Affinity Card Program. During the second quarter of 2015, the Company extended its agreement with the administrator of the FREE SPIRIT affinity credit... -

Page 71

... method utilized for each service or product: Year Ended December 31, Non-ticket revenue Recognition method 2015 2014 (in thousands) 2013 Baggage ...Passenger usage fee ...Advance seat selection ...Service charges for changes and cancellations Other ...Non-ticket revenue ... Time of departure Time... -

Page 72

... current paint of the aircraft, estimated escalation of cost of repairs and materials at the time of return, current flight hour agreement rates and future flight hour agreement rates. In addition, typically near the lease return date, the lessors may allow reserves to be applied as return condition... -

Page 73

... driven by assumed market growth rates and estimated costs as well as appropriate discount rates. These estimates are consistent with the plans and estimates that management uses to manage the Company's business. The fair value of share option awards is estimated on the date of grant using the Black... -

Page 74

... for issued letters of credit. 4. Credit Card Processing Arrangements The Company has agreements with organizations that process credit card transactions arising from the purchase of air travel, baggage charges and other ancillary services by customers. As it is standard in the airline industry... -

Page 75

...designate in the future. As of December 31, 2015 and 2014, there were no shares of non-voting common stock outstanding. Preferred Stock The Company's board of directors has the authority, without further action by the Company's stockholders, to issue up to 10,000,000 shares of preferred stock in one... -

Page 76

... of delaying, deferring or preventing a change of control of the Company or other corporate action. As of December 31, 2015 and 2014, there were no shares of preferred stock outstanding. 7. Stock-Based Compensation The Company has stock plans under which directors, officers, key employees and... -

Page 77

..., driven by assumed market growth rates, and estimated costs as well as appropriate discount rates. These estimates were consistent with the plans and estimates management used to manage the Company's business. A summary of share option activity as of December 31, 2015 and changes during the year... -

Page 78

... the peer companies within the peer group in order to model stock price movements. The volatilities used were calculated as the remaining term of the performance period at the date of grant. The risk-free interest rate was based on the implied yield available on U.S. Treasury zero-coupon issues with... -

Page 79

... requires quarterly payments, with senior loans having a 12-year term and junior loans having a 7-year term. Loans bear interest payable quarterly on a fixed-rate basis. As of December 31, 2015, the Company has taken delivery of all Airbus A320 aircraft financed through the Facility Agreements. 2015... -

Page 80

... financing of three Airbus A321 aircraft. The remaining $455.8 million of escrowed proceeds held by the pass-through trusts will be used to purchase equipment notes as the remaining 12 new aircraft are delivered. Equipment notes that are issued are reported as debt on the Company's condensed balance... -

Page 81

... the Company incurred $0.7 million in commitment fees related to seven Airbus A320 aircraft and three Airbus A321 aircraft delivered in 2014 and 2015. As of December 31, 2015 and 2014, the Company had a line of credit for $18.6 million related to corporate credit cards. Respectively, the Company had... -

Page 82

... events, the date the aircraft is due to be returned to the lessor, the cost of future maintenance events and the number of flight hours the aircraft is estimated to be utilized before it is returned to the lessor. When it is not probable the Company will recover amounts currently on deposit with... -

Page 83

...transactions. The credit exposure related to these financial instruments is limited to the fair value of contracts in a net receivable position at the reporting date. The Company also maintains security agreements that require the Company to post collateral if the value of selected instruments falls... -

Page 84

... to three Airbus A321 aircraft, which the company took delivery of during the third quarter of 2015. These instruments limited the Company's exposure to changes in the benchmark interest rate in the period from the trade date through the date of maturity. The interest rate swaps were designated... -

Page 85

... Savings Plan (second plan) and Spirit Airlines, Inc. Puerto Rico Retirement Savings Plan (third plan). The first plan is for all employees that are not covered by the pilots' collective bargaining agreement, who have at least 60 days of service and have attained the age of 21. The Company may... -

Page 86

... the status of Spirit's operations and reassess the need for a valuation allowance on a quarterly basis. The Company has fully utilized its federal and state NOL carryforwards and AMT credit carryforwards as of December 31, 2015. In accordance with ASC 718, excess tax benefits are only recognized... -

Page 87

... for the remaining 75 Airbus aircraft currently on firm order, which are scheduled for delivery in 2017 through 2021. In July 2015, the Company executed an upgrade service agreement with Airbus Americas Customer Services Inc. (Airbus) to reconfigure the seating and increase capacity in 40 of the... -

Page 88

... 31, 2014. The table below sets forth the Company's employee groups and status of the collective bargaining agreements as of December 31, 2015. Employee Groups Representative Amendable Date Percentage of Workforce Pilots Flight Attendants Dispatchers Ramp Service Agents Air Line Pilots Association... -

Page 89

... master netting arrangement. The Company determines fair value of jet fuel options utilizing an option pricing model based on inputs that are either readily available in public markets or can be derived from information available in publicly quoted markets. The Company has consistently applied these... -

Page 90

... utilizes a discounted cash flow method to estimate the fair value of the Level 3 long-term debt. The estimated fair value of the Company's publicly held debt agreements has been determined to be Level 2 as the Company utilizes quoted market prices to estimate the fair value of it's public long-term... -

Page 91

...31, 2015 ...$ 265 157 - - (422) - (4,876) 9,679 - - 4,803 (6,700) 2,474 - (577) - 16. Operating Segments and Related Disclosures The Company is managed as a single business unit that provides air transportation for passengers. Operating revenues by geographic region as defined by the Department of... -

Page 92

... and destination of each passenger flight segment. The Company's tangible assets consist primarily of flight equipment, which are mobile across geographic markets and, therefore, have not been allocated. 17. Tax Receivable Agreement On June 1, 2011, the Company completed its initial public offering... -

Page 93

Three Months Ended March 31 2015 Operating revenue ...Operating income ...Net income...Basic earnings per share ...Diluted earnings per share ...2014 Operating revenue ...Operating income ...Net income...Basic earnings per share ...Diluted earnings per share ...$ 437,987 59,953 37,706 0.52 0.51 $ ... -

Page 94

...Spirit Airlines, Inc. as of December 31, 2015 and 2014, and the related statements of operations, comprehensive income, shareholders' equity and cash flows for each of the three years in the period ended December 31, 2015. These financial statements are the responsibility of the Company's management... -

Page 95

...accordance with the standards of the Public Company Accounting Oversight Board (United States), the accompanying balance sheet of Spirit Airlines, Inc. as of December 31, 2015 and 2014, and the related statement of operations, comprehensive income, shareholders' equity and cash flows for each of the... -

Page 96

... because of changes in conditions, or that the degree of compliance with the policies may deteriorate. Management conducted an evaluation of the effectiveness of our internal control over financial reporting based on the 2013 framework established in Internal Control-Integrated Framework issued by... -

Page 97

..., and the Board appointed Robert L. Fornaro as President and Chief Executive Officer. In connection with his appointment, Mr. Fornaro resigned his position as a member of the Board's Compensation Committee and remained a member of the Board. ITEM 11. EXECUTIVE COMPENSATION The information under the... -

Page 98

... Statements and Supplementary Data above are filed as part of this annual report. 2. Financial Statement Schedules: There are no financial statement schedules filed as part of this annual report, since the required information is included in the Financial Statements, including the notes thereto, or... -

Page 99

... 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. SPIRIT AIRLINES, INC. By: /s/ Edward M. Christie Edward M. Christie Senior Vice President and Chief Financial Officer Date: February 17... -

Page 100

... by virtue hereof. Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed by the following persons on behalf of the registrant in the capacities and on the dates indicated Signature Title Date /s/ Robert L. Fornaro Robert L. Fornaro /s/ Edward M. Christie... -

Page 101

... by reference. Revolving Credit Agreement (2015-1A), dated as of August 11, 2015, between Wilmington Trust, National Association, as Subordination Agent (as agent and trustee for the trustee of Spirit Airlines Pass Through Trust 2015-1A), as Borrower, and Natixis, acting via its New York Branch, as... -

Page 102

...as of October 1, 2013 and Side Letter No. 2 dated as of October 1, 2013, filed as Exhibit 10.3 to the Company's Form 10-Q/A dated February 20, 2014, is hereby incorporated by reference. Fleet Hour Agreement, dated of as October 1, 2013, by and between Spirit Airlines, Inc. and IAE International Aero... -

Page 103

... (No. 333-169474), is hereby incorporated by reference. Terms and Conditions for Worldwide Acceptance of the American Express Card by Airlines, dated September 4, 1998, between Spirit Airlines, Inc. and American Express Travel Related Services Company, Inc., as amended January 1, 2003 and August 28... -

Page 104

... Form of Annual Cash Award Grant Notice and Annual Cash Award Agreement for awards under the Spirit Airlines, Inc. 2015 Incentive Award Plan, filed as Exhibit 10.4 to the Company's Form 10-Q dated July 24, 2015, is hereby incorporated by reference. Non-Employee Director Form of Restricted Stock Unit... -

Page 105

... †Certification of the Chief Financial Officer pursuant to Section 302 of the ...Rule 406 under the Securities Act or Rule 24b-2 under the Exchange Act, which portions are omitted and filed separately with the Securities and Exchange Commission. Indicates a management contract or compensatory plan...